Disruptive Technology for the Mining Industry, Thermal Fragmentation, Nippon Dragon Resources Inc.

Exploiting the toughest geology; surgically removing wasted gold ounces in pillars and structures without blasting, changing the economics of mining.

Nippon Dragon Resources Inc. (OTCQB:RCCMF)

Full copy of the Mining MarketWatch Journal Review may be viewed at http://miningmarketwatch.net/nip.htm online.

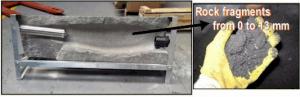

The Thermal Fragmentation process uses powerful burners, powered by diesel fuel and compressed air, to fragment hard rock. A small (125 mm) pilot hole can be enlarged to just over 1 m in ~8 minutes, making it ideal for targeting gold-bearing quartz veins, resulting in dramatically less dilution, increased productivity, lower costs, increased safety, and less impact on environment.

Nippon’s current market capitalization is ~$14 million Canadian (~138M shares outstanding X ~10 cents (~190M fully diluted, with majority of warrants proximal 12 cents)). Its market cap is minuscule relative to the potential and the current share price presents an opportunity for shareholders to reap large returns as recent vetting of Nippon’s technology have yielded highly favorable results -- we expect Thermal Fragmentation to be formally adopted via strategic agreement by at least one, likely more, major miner(s) this 2017. Nippon has exceptional risk-reward characteristics; Mining MarketWatch Journal sees a sizable assent in share price near-term. Intellectual property fee revenue potential alone has the possibility for significant share price revaluation; Nippon is apt to respond in multiples near-term as the inherent value and accomplishments are appreciated by the market.

Nippon Dragon Resources currently has Thermal Fragmentation units ('Dragons') in the field and distributors in Canada, Japan, South Africa, USA, and Australia. Its business model is based on intellectual property (IP) fees and rental, however expected upcoming long-term large contracts will likely be strictly IP fees for using the process with clients buying their own equipment. Nippon is positioned to charge upwards of ~US$25,000/month per unit in IP fees, a deal for the client whose savings compared to old technology would be many multiples. The cost of using a dragon to extract 1 tonne of ore would be a fraction (e.g. drop to under $100/t), enabling the converting of marginal or non-profitable mining to efficient mining.

Monthly income is projected to increase exponentially:

Nippon Dragon Resources is making the rounds of select miners and having its Thermal Fragmentation technology tested/demoed. Mining MarketWatch Journal encountered, in passing, a few engineers of some majors that attended Thermal Fragmentation testing at their mine site in North America recently, the reviews of the technology were spectacular, and the names of the majors these engineers work for would impress you. You will not hear of the names of these companies doing the vetting because Nippon is prohibited from talking about any of them as they insist on non-disclosure agreements. The precision (within 2 cm) with which Nippon’s technology can extract makes it particularly advantageous for mineralized corridors under 2 meters -- over 80% of known precious metals resources available in the world are in mineralized structures under 2 meters. Anecdotally, Mining MarketWatch Journal notes that last year the COO of a major South African miner said in its quarterly review of production that it was experimenting with Thermal Fragmentation, they didn't mention Nippon Dragon Resources, but we know there is no other company in the world that makes Thermal Fragmentation -- he also said the testing was going well. Interesting enough, Nippon still has a dragon unit in operation in South Africa. Some of the mines in South Africa have ridiculously high grades of gold (e.g. >100 g/t), the drawback is the veins are narrow underground, however ideal for Nippon’s thermal fragmentation. In such a scenario possible efficiencies may result in several hundreds of thousands of dollars per year per unit in the field -- this will have a major positive impact on their bottom-line. Not only would the South African mine benefit from improved economics, the actual miners themselves would benefit from increased safety, and new jobs in next-generation technology that will increase minelife. Independent mining equipment analysts have estimated that when adoption accelerates there could be demand for 5,000 - 10,000 Dragon units globally. Cost savings are too lucrative to ignore and mining MarketWatch Journal believes a major contract/strategic agreement is imminent, requiring numerous dragon units, each generating IP fees for Nippon. This will create a tailwind for further steepening of the adoption curve and the share price of Nippon Dragon Resources Inc.

Nippon is currently contract mining in Arizona, and advancing its flagship 100%-owned Rocmec 1 Gold Property toward a near-term mining scenario. Full copy of the Mining MarketWatch Journal Review may be viewed at http://miningmarketwatch.net/nip.htm online.

This release may contain forward-looking statements regarding future events that involve risk and uncertainties. Readers are cautioned that these forward-looking statements are only predictions and may differ materially from actual events or results. Articles, excerpts, commentary and reviews herein are for information purposes and are not solicitations to buy or sell any of the securities mentioned.

James O'Rourke

Mining MarketWatch Journal

8666209945

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.