The Overlooked Elements of Executive Pay: Perquisites, Retirement and Severance

While perquisites, retirement and severance are not ordinarily an annual focus of Compensation Committees, these non-core elements can play a critical role in crafting executive compensation programs that enable companies to achieve their strategic goals and objectives. This issue of the Beacon looks at these non-core elements, outlines important committee considerations and highlights the questions committees should ask when evaluating these non-core elements.

When people think of executive compensation, they naturally think of salaries, annual bonuses, and long-term incentives. While these are the foundational elements of pay that predominantly occupy Compensation Committees’ time and attention. The non-core elements play a material role in retention, motivation and governance.

Perquisites

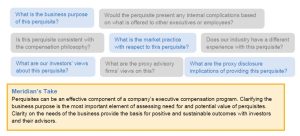

Generally, perquisites are provided to executives to enable them to devote more time to the company’s business, protect its operations and/or address risks related to health or security. Understanding the purposes and roles of perquisites is essential in determining which to offer and how they fit into the company’s executive compensation philosophy and program.

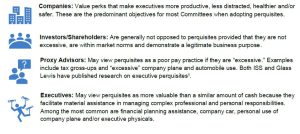

There are several lenses through which to consider perquisites:

Often, Compensation Committees focus on particular high-ticket perquisites, such as personal use of company planes or other pivotal arrangements related to executive health and safety. Committees need to understand their perquisite offerings in the context of the above perspectives.

Key Questions When Considering Perquisites

Retirement

Historical Context

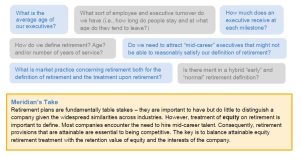

The nature of the employment relationship with executives has changed significantly over the past 30 years. Pension plans and supplemental executive retirement plans have been dramatically reduced and, in many cases, have been eliminated entirely. Instead, compensation has become substantially more performance and stock based. Most companies do maintain defined contribution and “restoration” plans to mitigate the statutory limitations of qualified plans. Somewhat ironically, the shift away from pensions has made the retirement provisions of equity awards particularly important and valuable, given the significant portion of total compensation that is comprised of equity awards.

Retirement Plans

Across nearly all industries retirement plans have become overwhelmingly defined contribution (DC) in nature. Defined benefit (DB) plans have largely been phased out or frozen and replaced by DC plans. The cost of DB plans, the volatility they often introduce into company profitability and a workforce with considerably more mobility across employers over a career are the factors which drove this change. Nonetheless, opportunities to accumulate (and move) retirement assets are highly valued. This means the company contribution elements (e.g., match formulas, discretionary contributions, executive restoration elements and investment choices) are an important aspect of executive remuneration. However, retirement arrangements rarely have the value or retention power to materially impact attraction or retention of executives, as they often can get the same offering elsewhere.

Treatment of Equity upon Retirement

For higher-growth companies, the treatment of equity upon retirement often receives less attention as executives are more focused on intermediate time frames. However, for more established companies the treatment of equity on retirement is of high interest and value. A company should balance:

1. Retaining employees/executives with longer service retirement eligibility; against

2. Attracting mid-career talent with more attainable retirement eligibility.

Most companies define retirement eligibility as some combination of age and service. Once attained, outstanding equity awards are eligible for some degree of beneficial treatment (e.g., pro rata and/or full vesting of equity).

Striking the balance outlined above requires defining:

1. The age(s) and/or service that constitutes retirement (there can be more than one);

2. How much an individual is entitled to receive at these milestones; and

3. Other features:

A. Designed to ensure that, as the executive cohort becomes more senior and seasoned, the retention value of equity is not lost through the executive’s right to resign and claim retirement treatment (e.g., a requirement to provide advance notice of retirement).

B. Designed to provide optionality to the company and avoid doubling up (e.g., not permitting an executive to receive both severance on a termination without cause and retirement treatment of equity).

Increasingly, we see companies in the sticky situation of having an age + service equity vesting provision, which eliminates the retention “glue” equity awards are supposed to provide. This also fails to support planful executive retirements and allows for a “double dip” (an executive terminated without cause, but who has met age and service requirements for retirement, receives both severance and equity vesting).

When considering how much equity should vest upon retirement, it boils down to the Board’s take on what is consistent with the company’s compensation philosophy. The alternatives range from losing all unvested awards upon retirement to full vesting. Most companies we work with now tend to fall somewhere in between those extremes and may provide partial or pro-rata vesting of equity awards upon retirement. Investors prefer continued to accelerated vesting of equity on retirement as it maintains a long-term decision-making focus as executives near retirement.

Key Questions When Considering Equity Award Retirement Provisions

Severance

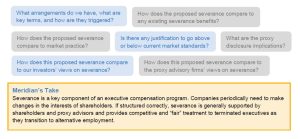

Severance is used to facilitate managerial transitions and/or make individuals indifferent to organizational decisions that may be to their detriment, including a reduction in force and a merger or acquisition. Severance can be provided by individual agreement with each executive or through a severance plan. Most companies have migrated toward generalized plans rather than individual agreements. They are simpler, easier to administer and avoids complex, one-off negotiations with each executive.

Most shareholders and their advisors support severance that is not “excessive” and/or reflects market practice. The proxy advisory firms take a dim view of any severance protection that provides for tax gross ups. This has led to a shift in the market towards a “best net” approach for severance related to changes in control, as this avoids a tax gross-up and enables the individual executives to either have their severance capped or paid out in full, depending on which would provide a greater benefit.

Key Questions When Considering Severance

Conclusion

These non-core elements are an important element of an executive compensation program. They are a particularly critical element of executive compensation at the margin – when attracting and retaining executives during critical times. Getting the non-core elements right can pay off by enabling a company to achieve its strategic goals and objectives.

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.