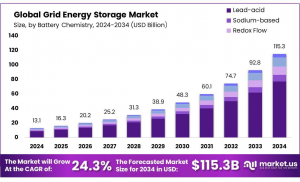

Grid Energy Storage Market Encouraged Growth To USD 115.3 Billion by 2034 at 24.3% CAGR

Grid Energy Storage Market size is expected to be worth around USD 115.3 Bn by 2034, from USD 13.1 Bn in 2024, growing at a CAGR of 24.3%.

Government initiatives, including tax credits, subsidies, and research funding, have been instrumental in spurring growth in the energy storage sector. Countries like the United States, China, and European nations have introduced mandates and financial support to encourage investments from both the public and private sectors. The market is expected to benefit from advancements in battery technologies, particularly solid-state batteries, which offer higher energy density and improved safety compared to traditional lithium-ion batteries.

As the sector evolves, it will leverage next-generation battery materials to enhance performance and longevity. Emerging markets are anticipated to play a key role in driving demand as they seek to integrate more renewable energy into their grids. By 2030, annual deployments of grid-scale storage systems are projected to exceed 100 gigawatt-hours, solidifying their importance in the global energy transition. The integration of AI and machine learning is also making energy storage systems more efficient by optimizing power distribution and load management.

Key Takeaways

• Market size expected to reach USD 115.3 Bn by 2034, growing at a CAGR of 24.3%

• Lithium-ion batteries dominate with a 67.2% market share

• Third-party ownership model leads with a 67.2% share

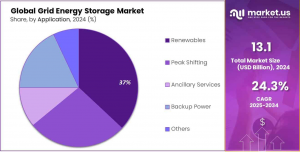

• Renewables application holds a 37.4% market share

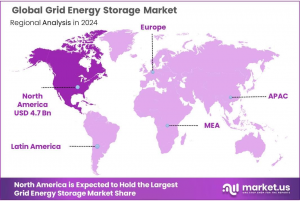

• North America dominates with a 35.9% market share, valued at USD 4.7 billion

➤ 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐑𝐞𝐪𝐮𝐞𝐬𝐭: 𝐔𝐧𝐥𝐨𝐜𝐤 𝐕𝐚𝐥𝐮𝐚𝐛𝐥𝐞 𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬 𝐟𝐨𝐫 𝐘𝐨𝐮𝐫 𝐁𝐮𝐬𝐢𝐧𝐞𝐬𝐬: https://market.us/report/grid-energy-storage-market/request-sample/

Experts Review:

Government incentives and technological innovations are driving the grid energy storage market forward. Many countries are offering tax credits, subsidies, and research funding to accelerate adoption. Technological advancements in battery chemistry, particularly in solid-state batteries, are improving energy density and safety.

Investment opportunities in grid energy storage are abundant, but risks include market volatility and regulatory uncertainties. The sector's growth is closely tied to renewable energy expansion and grid modernization efforts.

Consumer awareness of energy storage benefits is increasing, driving demand for residential and commercial systems. The impact of energy storage technologies on grid stability and renewable integration is significant, enabling a more resilient and sustainable energy infrastructure.

The regulatory environment is evolving to support energy storage deployment, with policies aimed at reducing barriers to entry and creating favorable market conditions. However, regulations vary by region, and navigating this landscape remains a challenge for industry players.

➤ 𝐁𝐮𝐲 𝐍𝐨𝐰 𝐭𝐡𝐢𝐬 𝐏𝐫𝐞𝐦𝐢𝐮𝐦 𝐑𝐞𝐩𝐨𝐫𝐭 𝐭𝐨 𝐆𝐫𝐨𝐰 𝐲𝐨𝐮𝐫 𝐁𝐮𝐬𝐢𝐧𝐞𝐬𝐬: https://market.us/purchase-report/?report_id=141047

Report Segmentation:

The grid energy storage market is segmented by battery chemistry, ownership, application, and region. In terms of battery chemistry, lithium-ion dominates with a 67.2% share, followed by other technologies like lead-acid, sodium-based, and redox flow batteries. Ownership is divided between third-party-owned (67.2% share) and utility-owned systems. Applications include renewables integration (37.4% share), peak shifting, ancillary services, and backup power. Geographically, North America leads with a 35.9% market share, followed by Europe and the Asia-Pacific regions.

By Battery Chemistry

• Lead-acid

• Sodium-based

• Redox Flow

• Lithium-ion

• Others

By Ownership

• Third-party Owned

• Utility Owned

By Application

• Renewables

• Peak Shifting

• Ancillary Services

• Backup Power

• Others

Drivers, Restraints, Challenges, and Opportunities

Drivers include increasing renewable energy integration, government support, and declining battery costs. The need for grid stability and resilience also propels market growth. Restraints involve high initial investment costs and technical challenges in large-scale deployment. Challenges include regulatory hurdles, grid integration complexities, and supply chain constraints for critical materials.

Opportunities abound in emerging markets, technological advancements, and the potential for new revenue streams through ancillary services. The growing electric vehicle market also presents synergies for grid-scale storage solutions. Additionally, the development of long-duration energy storage technologies opens new avenues for market expansion.

Key Player Analysis

Leading companies in the grid energy storage market include Tesla, ABB, LG Chem, and Fluence Energy. These players are focusing on technological innovation, strategic partnerships, and geographical expansion to maintain their competitive edge. Tesla, for instance, leverages its expertise in electric vehicles to develop advanced battery storage solutions. ABB offers comprehensive grid integration services alongside its storage products. LG Chem and Fluence Energy are known for their cutting-edge battery technologies and system integration capabilities. These companies are investing heavily in R&D to improve energy density, reduce costs, and enhance the overall performance of their storage solutions.

• 24M Technologies, Inc.

• ABB Group

• Ambri Incorporated

• BYD Co. Ltd.

• BYD Company Ltd

• Fluence Energy

• FZSONICK SA

• General Electric

• GS Yuasa Corp.

• Hitachi Ltd.

• KORE Power, Inc.

• LG Chem Ltd.

• Lockheed Martin Corporation

• Mitsubishi Electric Corp.

• NGK Insulators Ltd.

• Panasonic Corp.

• Redflow Limited

• Samsung SDI Co. Ltd.

• Sumitomo Electric Industries, Ltd.

• VRB Energy

Recent Developments

In 2024, several significant developments shaped the grid energy storage landscape. Major players secured large-scale contracts for utility-scale projects, particularly in North America and Europe. Technological breakthroughs in solid-state batteries and flow battery chemistries were announced, promising higher energy densities and longer lifespans. Policy initiatives, such as the U.S. Inflation Reduction Act, continued to provide strong support for energy storage deployments. Additionally, innovative business models, including energy-storage-as-a-service, gained traction, making storage solutions more accessible to a broader range of customers.

Conclusion

The Grid Energy Storage Market is on a trajectory of rapid growth, driven by the global shift towards renewable energy and the need for grid stability. As technologies advance and costs decline, energy storage is becoming an integral part of modern power systems. The sector presents significant opportunities for investors, technology providers, and utilities. However, challenges remain in terms of regulatory frameworks and large-scale integration. With continued innovation and supportive policies, grid energy storage is poised to play a crucial role in shaping a sustainable and resilient energy future.

Lawrence John

Prudour

+91 91308 55334

Lawrence@prudour.com

Visit us on social media:

Facebook

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.