Automated Microbiology Market Valued at USD 6.8 Billion in 2023, Forecasted to Reach USD 16.2 Billion

The Global Automated Microbiology Market was valued at USD 6.8 Bn in 2023. It is expected to reach USD 16.2 Bn by 2033, with a CAGR of 9.3%

The Global Automated Microbiology Market was valued at USD 6.8 Bn in 2023. It is expected to reach USD 16.2 Bn by 2033, with a CAGR of 9.3% during the forecast period from 2024 to 2033.

The Automated Microbiology Market focuses on technologies designed to automate microbiological testing and analysis, including microbial identification, susceptibility testing, and culture processing. Automation enhances efficiency, accuracy, and throughput while minimizing manual labor and human errors. The demand for rapid diagnostic solutions, coupled with technological advancements, is driving market growth across clinical, industrial, and environmental applications.

Innovations such as MALDI-TOF mass spectrometry have revolutionized microbial identification, reducing identification time from 24-48 hours to just 10-30 minutes. This speed is critical in clinical settings, where rapid diagnosis can significantly improve patient outcomes. Additionally, fully automated laboratory solutions, like the BD Kiestra TLA (Total Laboratory Automation) system, have demonstrated operational efficiencies. The University Hospitals Cleveland Medical Center reported a 20% reduction in staffing needs after adopting this system, highlighting the cost-saving benefits of automation.

The rising prevalence of infectious diseases and the need for advanced diagnostic tools are further accelerating market adoption. Automated microbiology is now widely used in clinical diagnostics, pharmaceutical research, food safety testing, and environmental monitoring. By integrating automation, laboratories can enhance testing speed, maintain result consistency, and improve overall laboratory efficiency, ultimately supporting better public health and safety measures.

Click here to get a Sample report copy @ https://marketresearch.biz/report/automated-microbiology-market/request-sample/

Key Takeaways

•Market Growth: The global automated microbiology market was valued at USD 6.8 billion in 2023 and is projected to reach USD 16.2 billion by 2033, growing at a CAGR of 9.3% from 2024 to 2033.

•By Product: Instruments account for 40% of the market, playing a crucial role in automating microbial analysis and improving laboratory efficiency.

•By Diagnostic Technology: DNA sequencing is utilized in 30% of applications, enabling precise pathogen identification and resistance profiling for improved disease management.

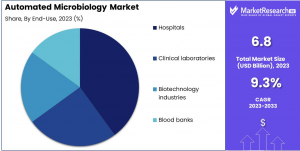

•By End-Use: Hospitals lead the market with a 40% share, reflecting their need for rapid, accurate microbial diagnostics to enhance patient outcomes.

•Regional Dominance: North America holds a 38% market share, supported by its advanced healthcare infrastructure and significant investments in medical technology.

•Growth Opportunity: The integration of AI and machine learning in diagnostic workflows presents new opportunities to improve accuracy and speed in microbial identification, revolutionizing infectious disease management.

Segmentation Analysis

••By Product Analysis: Instruments dominated the Automated Microbiology Market in 2023, holding over 40% market share. Automated culture systems and microbiology analyzers are crucial for high-throughput microbial identification and susceptibility testing, improving accuracy and efficiency in clinical, pharmaceutical, and food safety laboratories. Microbiology analyzers enable rapid, multi-sample processing, making them indispensable in diagnostics. While reagents are essential for assays, their share remains lower due to the capital investment and technological advancements driving the instruments segment forward.

••By Diagnostic Technology Analysis: DNA sequencing led the diagnostic technology segment, accounting for over 30% of the market in 2023. This dominance stems from its high precision and ability to analyze microbial genetics, making it critical in clinical diagnostics and epidemiology. DNA & RNA probe technology aids in pathogen identification, though with a smaller share due to its targeted applications. Detection techniques like PCR and mass spectrometry are essential for microbial quantification. Immunoassays and monoclonal antibodies play key roles in infection monitoring, but their adoption remains lower than genetic-based technologies.

••By End-Use Analysis: Hospitals dominated the end-use segment in 2023, capturing over 40% of the market due to their reliance on automated microbiology systems for rapid infectious disease diagnosis and infection control. Clinical laboratories leverage automation for high-volume diagnostic testing, while biotechnology industries use it for research and quality control. Blood banks also utilize these systems for pathogen screening, ensuring blood safety. However, their market share is smaller compared to hospitals, which require extensive microbial diagnostic capabilities for patient care.

Market Segments

By Product

•Instruments

•Automated culture systems

•Microbiology analyzers

•Reagents

By Diagnostic Technology

•DNA sequencing

•DNA & RNA probe technology

•Detection techniques

•Monoclonal antibodies

•Immunoassays

By End-Use

•Hospitals

•Clinical laboratories

•Biotechnology industries

•Blood banks

To Purchase this Premium Report @ https://marketresearch.biz/purchase-report/?report_id=49149

Market Dynamics

•Driver: The escalating threat of antimicrobial resistance (AMR) necessitates rapid and accurate microbial diagnostics to guide effective treatment strategies. Automated microbiology systems enhance the speed and precision of pathogen identification and susceptibility testing, thereby playing a crucial role in combating AMR. This demand for improved diagnostic capabilities is a significant driver of the automated microbiology market.

•Trend: The integration of advanced technologies, such as Raman spectroscopy, is emerging as a notable trend in automated microbiology. Raman spectroscopy offers rapid, label-free identification of microorganisms by analyzing their unique molecular vibrations. This technique enhances the ability to detect and identify pathogens swiftly, improving diagnostic workflows and patient outcomes.

•Restraint: The misuse and overuse of antimicrobials have led to the emergence of resistant strains, complicating treatment protocols. Automated systems must continuously adapt to detect these evolving pathogens accurately. However, the high cost of implementing and maintaining advanced automated microbiology equipment can be a significant barrier for some healthcare facilities, potentially limiting widespread adoption.

•Opportunity: The increasing prevalence of healthcare-associated infections (HCAIs) presents a substantial opportunity for the automated microbiology market. Automated systems can enhance infection control by providing timely and precise microbial identification, thereby facilitating effective intervention strategies. As healthcare facilities strive to reduce HCAIs, the adoption of automated microbiology technologies is poised to expand, addressing critical public health concerns.

Market Key Players

•Becton Dickinson and Company

•Bio-Rad Laboratories, Inc.

•bioMeriux, Inc.

•QIAGEN GmbH

•Beckman Coulter

•Agilent Technologies, Inc.

•Gene-Probe, Inc.

•Affymetrix, Inc.

•Abbott Laboratories

Regional Analysis

North America led the Automated Microbiology Market in 2023, holding a 38% market share. This dominance is driven by advanced healthcare infrastructure, substantial R&D investments, and a high burden of infectious diseases. The United States and Canada are at the forefront, widely adopting automated microbiology systems in hospitals and laboratories to enhance diagnostic accuracy and efficiency. The presence of major industry players and continuous technological advancements further fuel market expansion.

•Europe holds a significant market share, supported by strong regulatory frameworks, healthcare innovation, and investments in laboratory automation. The region’s commitment to improving diagnostic accuracy and patient outcomes continues to drive adoption.

•Asia Pacific is the fastest-growing region, propelled by rising healthcare investments, increasing cases of infectious diseases, and improved healthcare infrastructure. The large population base and demand for advanced diagnostic solutions contribute to market expansion.

•Middle East & Africa are witnessing gradual growth, driven by investments in healthcare infrastructure and efforts to enhance disease diagnostics. Adoption of automated microbiology systems is rising as healthcare facilities seek improved diagnostic efficiency.

•Latin America is an emerging market, with Brazil and Mexico leading demand. Healthcare infrastructure improvements and a growing focus on advanced diagnostics are driving the adoption of automated microbiology systems across the region.

Emerging Trends of Automated Microbiology:

•Integration of Artificial Intelligence (AI): AI is increasingly utilized to interpret complex microbial data. Machine learning algorithms analyze patterns in microbial growth and resistance, leading to faster and more reliable diagnoses. For instance, AI-enhanced digital nucleic acid amplification tests improve the precision of detecting pathogens, thereby aiding in personalized medicine and real-time epidemic monitoring.

•Total Laboratory Automation (TLA): TLA systems automate the entire diagnostic workflow, from sample inoculation to the final result. These systems enhance productivity and reduce turnaround times. Studies have shown that implementing TLA can significantly improve laboratory efficiency, with some laboratories reporting productivity increases from processing approximately 492 samples per day to about 621 samples daily post-automation.

•Advanced Antimicrobial Susceptibility Testing (AST): Rapid AST methods are being developed to quickly determine the effectiveness of antibiotics against specific pathogens. Automated systems like the BD Phoenix can analyze up to 99 test panels simultaneously, providing results within 6 to 16 hours, which is crucial for timely patient treatment.

•Adoption of Mass Spectrometry Techniques: Techniques such as Matrix-Assisted Laser Desorption Ionization–Time of Flight (MALDI-TOF) mass spectrometry are becoming standard for identifying microorganisms. MALDI-TOF offers rapid and accurate identification, often within minutes, and has been widely adopted in clinical laboratories to enhance diagnostic capabilities.

•Implementation of Digital Imaging and Remote Analysis: High-resolution digital imaging allows for the remote analysis of culture results, facilitating telemicrobiology. This approach enables experts to review and interpret results from different locations, promoting collaboration and improving diagnostic accuracy.

Use Cases of Automated Microbiology:

•Rapid Bloodstream Infection Diagnosis: Automated systems expedite the detection and identification of pathogens in blood samples. For example, integrating the BACTEC blood culture system with the BD Phoenix automated microbiology system allows for direct identification and susceptibility testing of gram-negative rods from positive blood cultures, potentially reducing the time to results by more than 12 hours compared to traditional methods.

•Efficient Urine Sample Processing: Automation streamlines the analysis of urine samples for urinary tract infections. The implementation of total laboratory automation has been shown to reduce the median turnaround time for urine cultures from approximately 73.7 hours to 40.0 hours, enhancing the speed of diagnosis and treatment initiation.

•High-Throughput Antimicrobial Susceptibility Testing: Automated AST systems, such as the Vitek 2, can simultaneously conduct up to 240 tests within a span of 4 to 10 hours. This high-throughput capability allows for the rapid determination of the most effective antibiotics, which is essential in combating resistant infections.

•Food and Water Safety Monitoring: Automated microbiology plays a crucial role in detecting contaminants in food and water supplies. For instance, a computational system utilizing time-lapse coherent imaging and deep learning has been developed to detect and classify live bacteria in water samples, identifying 90% of bacterial colonies within 7 to 10 hours with a precision of 99.2% to 100%.

•Pandemic Response and High-Volume Testing: During health crises, automated systems enable laboratories to manage increased testing demands efficiently. Robotic systems have been employed to automate COVID-19 testing workflows, significantly increasing testing capacity and reducing the risk of exposure for laboratory personnel.

Lawrence John

Prudour

+91 91308 55334

Lawrence@prudour.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.