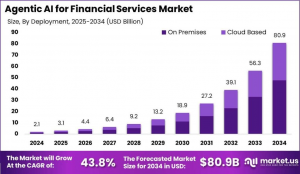

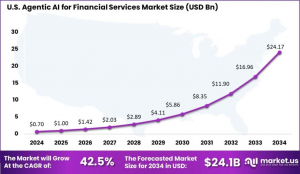

Agentic AI For Financial Services Market Huge Growth Boost Revenue By USD 80.9 Billion

In 2024, North America led the market, securing a significant share of 41.4%, which equates to a revenue of around USD 0.8 billion...

This growth is largely driven by financial institutions integrating agentic AI technologies to optimize operations, reduce errors, and personalize customer interactions. Such technologies are crucial for managing data-intensive tasks like compliance checks and financial transactions, pushing towards deeper process autonomy and efficiency.

🔴 𝐃𝐢𝐫𝐞𝐜𝐭 𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐨𝐟 𝐭𝐡𝐢𝐬 𝐏𝐫𝐞𝐦𝐢𝐮𝐦 𝐑𝐞𝐩𝐨𝐫𝐭 @ https://market.us/report/agentic-ai-for-financial-services-market/free-sample/

In 2024, North America dominated the market, capturing over 41.4% of the share, attributed to its robust tech infrastructure and a supportive regulatory environment. The region's leadership is further supported by significant investments in AI from both private and public sectors, creating a conducive environment for AI innovation in financial services.

The solutions segment leads with over 67.2% market share due to offering comprehensive tools like data integration, predictive analytics, and automation of routine tasks.

Key Takeaways

Projected 2034 Market Value: USD 80.9 Billion.

2024 Dominant Region: North America with 41.4% market share.

Key Solutions: Data integration and predictive analytics dominate offerings.

🔴 𝐇𝐮𝐫𝐫𝐲 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭 𝐅𝐨𝐫 𝐋𝐢𝐦𝐢𝐭𝐞𝐝 𝐏𝐞𝐫𝐢𝐨𝐝 𝐎𝐧𝐥𝐲 @ https://market.us/purchase-report/?report_id=138890

Experts Review

Experts highlight agentic AI's potential to transform financial services by automating complex processes and enhancing operational efficiency. The technology reduces reliance on human intervention, allowing institutions to allocate resources towards more strategic initiatives. However, ethical and governance challenges, particularly around accountability and transparency, remain significant concerns requiring robust frameworks.

Investments in AI research and development are pivotal, with initiatives like "Project Stargate" illustrating the scale of commitment from major tech companies. These efforts drive rapid advancements in AI capabilities, further stimulating demand in the financial sector for innovative solutions that enhance customer service and operational efficiency.

🔴 𝐓𝐨 𝐆𝐚𝐢𝐧 𝐠𝐫𝐞𝐚𝐭𝐞𝐫 𝐢𝐧𝐬𝐢𝐠𝐡𝐭𝐬, 𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐚 𝐬𝐚𝐦𝐩𝐥𝐞 𝐫𝐞𝐩𝐨𝐫𝐭 @ https://market.us/report/agentic-ai-for-financial-services-market/free-sample/

Report Segmentation

The report segments the market by offering, deployment, technology, and application. Solutions, including data integration and automation, lead the offering segment, while deployment splits into cloud-based and on-premises, with the latter favored for its security advantages in handling sensitive financial data.

Technologically, machine learning, deep learning, and NLP are at the forefront, facilitating personalized advisory, fraud detection, and automated trading systems. Applications span customer service automation, risk management, and portfolio management, reflecting a comprehensive approach to enhancing service delivery and client satisfaction in financial services.

🔴 𝐆𝐞𝐭 𝐭𝐡𝐞 𝐅𝐮𝐥𝐥 𝐑𝐞𝐩𝐨𝐫𝐭 𝐚𝐭 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭 (𝐋𝐢𝐦𝐢𝐭𝐞𝐝 𝐏𝐞𝐫𝐢𝐨𝐝 𝐎𝐧𝐥𝐲) @ https://market.us/purchase-report/?report_id=138890

Drivers, Challenges, and Opportunities

The primary driver for adopting agentic AI in financial services is the enhancement of operational efficiency and cost reduction. By automating complex tasks like fraud detection and compliance, AI systems free human resources for strategic roles, reducing costs and improving accuracy.

The industry's challenges include ethical and governance issues, particularly maintaining accountability and transparency in AI decision-making. However, opportunities lie in transforming customer interactions by offering personalized and efficient service experiences, ultimately increasing loyalty and satisfaction.

Key Player Analysis

Key players transforming the agentic AI landscape in financial services include tech giants like Microsoft, Alphabet (Google), and Amazon. Microsoft's Azure AI integrates agentic AI capabilities to improve financial services, bolstered by acquisitions like Nuance Communications. Meanwhile, Google's offerings, through Google Cloud, enhance asset management and transaction monitoring using advanced machine learning. Amazon's AWS platform provides AI-powered fraud detection and credit scoring tools, augmented by strategic acquisitions.

These companies focus on innovation and partnerships to expand their capabilities, making substantial impacts on the market by delivering AI-driven solutions that enhance efficiency and security in financial services.

Recent Developments

Recent developments include significant innovations and partnerships within the industry. In January 2025, Citi launched agentic AI-powered virtual financial assistants aimed at improving wealth management and customer engagement. Additionally, IBM introduced an AI solution for real-time compliance monitoring, enhancing fraud detection and regulatory adherence. UiPath expanded its automation platform to incorporate agentic AI, streamlining complex banking operations like invoice processing.

These advancements underscore the ongoing commitment to integrating AI technologies across financial sectors, supporting efficiency, and innovation in dynamic market landscapes.

Conclusion

The Agentic AI for Financial Services Market is poised for substantial growth, driven by the need for enhanced operational efficiency and customer engagement. Despite challenges like ethical and governance concerns, key players continue to innovate, focusing on AI solutions that transform financial services.

With increased investments in AI development, the market is well-positioned to leverage technology for improved decision-making, security, and customer satisfaction. Financial institutions embracing these advancements are set to gain competitive advantages, paving the way for a more efficient, automated, and personalized approach to financial services.

➤ 𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐎𝐭𝐡𝐞𝐫 𝐈𝐧𝐭𝐞𝐫𝐞𝐬𝐭𝐞𝐝 𝐓𝐨𝐩𝐢𝐜𝐬

Cloud Computing in EdTech Market - https://market.us/report/cloud-computing-in-edtech-market/

AI in Renewable Energy Market - https://market.us/report/ai-in-renewable-energy-market/

5G Core Network Market - https://market.us/report/5g-core-network-market/

AI in Smart Buildings and Infrastructure Market - https://market.us/report/ai-in-smart-buildings-and-infrastructure-market/

Satellite Data Service Market - https://market.us/report/satellite-data-service-market/

Plastic Carrier Tape for Semiconductor Market - https://market.us/report/plastic-carrier-tape-for-semiconductor-market/

EdTech for Language Learning Market - https://market.us/report/edtech-for-language-learning-market/

SiC Wafer Defect Inspection System Market - https://market.us/report/sic-wafer-defect-inspection-system-market/

AI-enabled Kitchen Appliances Market - https://market.us/report/ai-enabled-kitchen-appliances-market/

Semiconductor Prime Wafer Market - https://market.us/report/semiconductor-prime-wafer-market/

AI-Powered Receipt Automation Market - https://market.us/report/ai-powered-receipt-automation-market/

Invoice Factoring Market - https://market.us/report/invoice-factoring-market/

Exascale Computing Market - https://market.us/report/exascale-computing-market/

N-type Semiconductor Material Market - https://market.us/report/n-type-semiconductor-material-market/

Smart Receipt Analytics Market - https://market.us/report/smart-receipt-analytics-market/

Lawrence John

Prudour

+91 91308 55334

Lawrence@prudour.com

Visit us on social media:

Facebook

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.