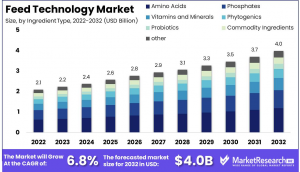

Feed Technology Market Revenue Estimated at USD 4.0 Billion in 2032, Growing at a CAGR of 6.8%

Feed technology Market size is expected to be worth around USD 4.0 Bn by 2032 from USD 2.1 Bn in 2022, growing at a CAGR of 6.8% from 2023 to 2032.

The Feed Technology Market is burgeoning due to increased global demands for high-quality meat and dairy products driven by population growth. The market, which stood at USD 2.1 billion in 2022, is expected to nearly double, reaching USD 4.0 billion by 2032. This growth reflects a compound annual growth rate (CAGR) of 6.8% over the forecast period.

Key innovations are being fostered within this industry, including enhanced feed formulas, additives, and precision feeding devices. These innovations are critical for optimizing livestock productivity and ensuring the efficient use of resources, which have become essential as the world grapples with increased demands for animal protein.

The sector is characterized by a diverse range of product offerings, such as feed additives, precision feeding equipment, and feed management software. These technologies not only benefit traditional agriculture but are also transforming aquaculture, poultry, and even pet food industries. The industry's success largely hinges on its ability to ethically balance nutritional efficacy with environmental sustainability. The push towards precision systems is a testament to the sector's commitment to minimizing waste and enhancing the welfare and productivity of livestock, marking a significant stride towards eco-friendly and responsible animal agriculture practices.

➤ 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐑𝐞𝐪𝐮𝐞𝐬𝐭: 𝐔𝐧𝐥𝐨𝐜𝐤 𝐕𝐚𝐥𝐮𝐚𝐛𝐥𝐞 𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬 𝐟𝐨𝐫 𝐘𝐨𝐮𝐫 𝐁𝐮𝐬𝐢𝐧𝐞𝐬𝐬: https://marketresearch.biz/report/feed-technology-market/request-sample/

Experts Review

Government incentives play a significant role in propelling feed technology forward, often through subsidies aimed at fostering research and adoption of new technologies. Cutting-edge innovations like precision feeding and new feed additives have transformative potential, enhancing both efficiency and sustainability. Technological advancements, including data analytics and automation, have major impacts, enabling precise control over feed quality and livestock nutrition.

Investment opportunities are ripe in regions with growing livestock sectors, although risks such as fluctuating ingredient prices and complex regulatory environments present challenges. The regulatory environment is crucial, as it influences market dynamics, with varying statutory requirements across different regions.

Consumer awareness is rising, with more emphasis on ethical production practices. This shift pushes the industry to develop safer, sustainable feed solutions. The regulatory environment plays a supportive role but also requires businesses to adapt to evolving standards. Overall, technological impacts significantly influenced by consumer demand are advancing feed technology by fostering a commitment to sustainable practices and innovative solutions.

Report Segmentation

The Feed Technology Market is segmented primarily by ingredient type and application. The ingredient types include amino acids, phosphates, vitamins and minerals, phytogenics, probiotics, and commodity ingredients. Among these, amino acids are dominant due to their essential role in animal growth and nutrition.

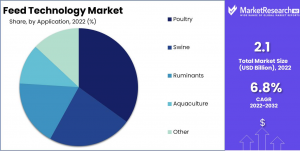

The application segment is divided primarily into poultry, swine, ruminants, aquaculture, and other animals. Poultry remains the largest segment, driven by high global consumption of poultry products and the need for efficient feeding methods to support growing demand. Emerging economies stimulate demand within this segment, reinforcing poultry feed’s prominence in enhancing animal productivity and fulfilling consumer needs.

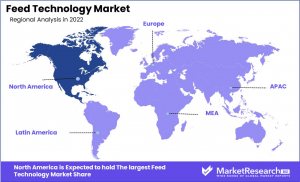

Geographically, the market is widespread, with notable growth in North America, supported by advancements in feed technology and a robust livestock industry, and in Asia-Pacific regions, driven by rising meat consumption and economic growth. Each region presents unique market dynamics shaped by local regulatory conditions, economic development, and consumer preferences.

Understanding these segments is crucial for industry players to tailor their strategies and capitalize on region-specific opportunities, addressing local consumer demands, regulatory landscapes, and resource availability, ultimately steering the market’s growth trajectory.

Key Market Segments

By Ingredient Type

• Amino Acids

• Phosphates

• Vitamins and Minerals

• Phytogenics

• Probiotics

• Commodity Ingredients

• Other Types

By Application

• Poultry

• Swine

• Ruminants

• Aquaculture

• Other Applications

➤ 𝐁𝐮𝐲 𝐍𝐨𝐰 𝐭𝐡𝐢𝐬 𝐏𝐫𝐞𝐦𝐢𝐮𝐦 𝐑𝐞𝐩𝐨𝐫𝐭 𝐭𝐨 𝐆𝐫𝐨𝐰 𝐲𝐨𝐮𝐫 𝐁𝐮𝐬𝐢𝐧𝐞𝐬𝐬: https://marketresearch.biz/purchase-report/?report_id=37396

Drivers, Restraints, Challenges and Opportunities

Key drivers for the Feed Technology Market include increasing demand for animal-derived products like meat, milk, and eggs. This is amplified by technological advancements that enhance feed processing and formulation, ensuring high nutritional value and minimizing harmful additives. A focus on animal health and nutrition underscores the rising use of quality feed additives to boost animal wellbeing.

Conversely, the market faces restraints such as fluctuating feed ingredient costs driven by variable global supply chains and environmental concerns associated with intensive livestock production. Compliance with environmental regulations compels manufacturers to adopt sustainable practices, which can incur additional costs and operational changes.

Challenges include navigating complex regulatory environments and the need for continuous innovation to improve feed efficiency and productivity. However, significant opportunities arise from developing cost-effective feed formulations and precision feeding technologies that cater to specific animal needs, thus improving productivity.

The integration of alternative protein sources and sustainable feeding practices also represents a substantial opportunity, particularly in regions striving for agricultural sustainability and reduced reliance on traditional protein sources. These drivers and challenges shape the competitive landscape, pushing for advancements that benefit not only manufacturers but also the global community demanding responsible animal agriculture.

Key Player Analysis

The Feed Technology Market is competitive, with major players like Cargill, ADM, and Evonik leading the industry. Cargill dominates with its extensive portfolio of animal nutrition products and services aimed at boosting livestock health and performance. ADM is closely, renowned for its comprehensive range of feed ingredients, additives, and processing technologies that cater to diverse market needs.

Evonik stands out for its pioneering work with amino acids and other functional feed ingredients, which are critical for enhancing feed efficiency and animal health. Its focus on innovation and sustainability sets it apart in the industry.

Other significant players include Nutreco, Alltech, and Charoen Pokphand Group, each contributing unique solutions and technologies designed to address various facets of feed production and livestock nutrition. These companies continually invest in R&D, aiming to maintain competitive advantage by meeting the ever-evolving demands for quality and sustainable animal nutrition.

• Archer Daniels Midland Company

• Cargill, Incorporated

• Evonik

• Nutreco

• Alltech

• Charoen Pokphand Group

• Land O'Lakes, Inc

• New Hope Group

• Sumitomo Chemical

• ForFarmers

• DSM Nutritional Products

• Other Key Players

Recent Developments

Recent developments in the Feed Technology Market highlight the sector's forward momentum. In 2021, Alltech unveiled a new range of feed additives focused on enhancing livestock health and productivity. These products reflect the industry's push towards efficiency and targeted animal health solutions.

In 2022, Cargill's acquisition of Kemin Industries for $94 billion marked a major milestone, significantly bolstering its animal nutrition portfolio and reinforcing its position in the global market. This strategic move allows Cargill to expand its offerings and better meet the needs of its customers worldwide.

In 2023, InnovaFeed announced its plans to establish a new insect protein production facility in France. This facility is intended to produce innovative ingredients for animal feed, emphasizing the industry's shift toward sustainable protein alternatives. Such expansions and acquisitions illustrate the dynamic nature of the feed technology industry and its commitment to innovative and sustainable practices.

Conclusion

The Feed Technology Market is poised for substantial growth, buoyed by rising global demands for animal-derived products and significant technological advancements. As the industry progresses, key players are expanding their portfolios and investing in sustainable practices to meet consumer demands. The focus on innovative formulations and precision feeding technologies offers promising growth prospects, particularly in regions experiencing economic and population growth. Success in this market will depend on navigating regulatory landscapes, managing cost volatility, and embracing sustainability. Ultimately, the feed technology industry plays a crucial role in supporting global food security and responsible agricultural practices.

Lawrence John

Prudour

+91 91308 55334

Lawrence@prudour.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.