Polylactic Acid Market to Reach $4,568 Million by 2033, Growing at 18.1% CAGR from 2023

Polylactic Acid Market size is expected to be worth around USD 4568 Million by 2033, from USD 866 Million in 2023, growing at a CAGR of 18.10%

The Polylactic Acid (PLA) market is witnessing significant growth, driven by increasing environmental awareness and demand for sustainable materials. PLA, an eco-friendly bioplastic derived from renewable resources such as corn starch and sugarcane, offers biodegradability, making it an attractive alternative to conventional plastics. The market is projected to expand from USD 866 million in 2023 to USD 4,568 million by 2033, at a CAGR of 18.10%. Key applications of PLA include packaging, textiles, agriculture, and consumer goods, where its sustainability and performance benefits are increasingly valued. Technological innovations and government incentives further propel market growth, with significant investments directed toward PLA production capabilities and advancements.

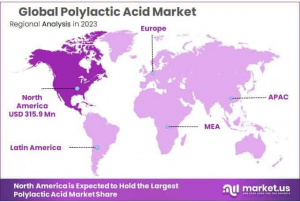

North America and Europe are leading regions in PLA adoption, driven by stringent regulations and consumer preferences for environmentally friendly products. Meanwhile, the Asia Pacific region offers substantial growth opportunities due to its industrial expansion and focus on sustainable practices. The market is supported by major players like NatureWorks LLC, TotalEnergies Corbion, and BASF SE, who are expanding production capacities and investing in R&D to enhance PLA properties. However, the high production cost compared to traditional plastics poses a restraint, challenging market penetration in cost-sensitive regions.

👉 Request a free sample PDF report for valuable insights: https://market.us/report/polylactic-acid-market/request-sample/

Key Takeaways

• Market Expansion: The global PLA market is expected to grow from USD 866 million in 2023 to USD 4,568 million by 2033, with an 18.10% CAGR.

• Standard PLA Dominance: Standard PLA held a 54.3% market share in 2023, driven by widespread use in packaging and disposable products.

• Films & Sheets Lead: Films & Sheets applications led the market in 2023, capturing a 35.6% share, especially in food and agricultural packaging.

• Thermoforming grade Polylactic Acid (PLA) held a dominant market position, capturing more than a 27.8% share.

• Corn Starch held a dominant market position in the Polylactic Acid (PLA) sector, capturing more than a 56.8% share.

• Packaging held a dominant market position in the Polylactic Acid (PLA) market, capturing more than a 44.5% share.

• North America Leadership: North America led the global PLA market in 2023, holding a 36.5% share, valued at USD 315.9 million.

Experts Review

Government incentives play a crucial role in advancing the PLA market, with programs like the USDA's Biopreferred Program and Europe's Horizon Europe providing substantial funding for research and innovation. These initiatives aim to enhance the efficiency and adoption of sustainable bioplastics. Technological innovations, such as improved PLA composites by Novamont and Mitsubishi Chemical, address performance limitations, expanding PLA applications to demanding sectors like automotive. Investment opportunities abound, particularly in emerging markets like Asia Pacific. However, risks include cost competitiveness and scalability challenges.

Consumer awareness is increasing, driven by environmental concerns, but widespread adoption still faces hurdles due to higher costs than conventional plastics. From a regulatory perspective, supportive policies like the European Union's Single-Use Plastics Directive are driving demand for biodegradable alternatives. While technological impact is positive, boosting production capabilities and product offerings, regulatory frameworks provide necessary market incentives, fostering a shift toward eco-friendly materials. Continuous R&D efforts are essential to address current cost restraints and enhance material properties, ensuring PLA's competitiveness in the global market.

Report Segmentation

The PLA market is segmented by type, grade, raw material, application, and end-use. By type, the market includes Racemic PLLA, PDLA, Regular PLLA, PDLLA, and PLA blends. Among these, Regular PLLA is widely utilized due to its favorable properties for general applications. By grade, the market spans Thermoforming, Injection Molding, Extrusion, Blow Molding, and others, with Thermoforming grade holding a significant share due to its versatility in packaging. Raw materials include Corn Starch, Sugarcane, Cassava, among others, with Corn Starch leading due to its availability and cost-effectiveness.

Application-wise, the market covers Films & Sheets, Bottles, Rigid Thermoforms, and Others. Films & Sheets form the largest segment, driven by demand for sustainable packaging. In terms of end-use, Packaging dominates due to global demand for biodegradable solutions. Agriculture follows, utilizing PLA for eco-friendly mulch films and planting containers. Consumer Goods and Textiles also represent key segments, leveraging PLA's environmental benefits. This segmentation reflects the diverse and expanding applications of PLA, highlighting significant growth prospects across various industries as demand for sustainable materials rises.

Key Market Segments

By Type

• Racemic PLLA (Poly-l-lactic acid)

• PDLA (Poly-d-lactic acid)

• Regular PLLA (Poly-l-lactic acid)

• PDLLA (Poly-dl-lactic acid)

• PLA Blends

By Grade

• Thermoforming

• Injection Molding

• Extrusion

• Blow Molding

• Others

By Raw Material

• Corn starch

• Sugarcane

• Cassava

• Others

By Application

• Films & Sheets

• Bottles

• Rigid Thermoforms

• Others

By End-use

• Packaging

• Agriculture

• Consumer Goods

• Textiles

• Others

👉 Buy Now to access the full report: https://market.us/purchase-report/?report_id=125746

Drivers, Restraints, Challenges, and Opportunities

• Drivers: The primary drivers for the PLA market include increasing demand for sustainable packaging solutions, bolstered by environmental awareness and supporting government policies. Technological advancements are also propelling growth by enhancing PLA’s cost-effectiveness and performance.

• Restraints: A major restraint is the higher production cost compared to conventional plastics, affecting PLA's competitiveness in price-sensitive markets. The need for specialized technology and economies of scale further exacerbates this issue.

• Challenges: Challenges include overcoming cost barriers, expanding market penetration, and achieving mass production efficiencies. Addressing these challenges is crucial for PLA to compete with traditional plastics.

• Opportunities: Significant opportunities exist in the Asia Pacific region, where industrial growth and favorable economic policies support PLA market expansion. Increasing consumer preference for eco-friendly products opens new avenues in packaging, textiles, and agriculture.

Key Player Analysis

Key players like NatureWorks LLC, TotalEnergies Corbion, and BASF SE are pivotal to the PLA market’s expansion. These companies are leaders in bioplastic production, leveraging technological advancements to improve PLA’s sustainability and competitiveness. NatureWorks LLC is known for its significant investments in expanding production capacity, particularly focusing on high-performance biopolymers.

TotalEnergies Corbion emphasizes collaborative ventures to enhance production technologies, while BASF SE’s innovative product lines cater to diverse applications across multiple sectors. These industry leaders are supported by smaller firms like Danimer Scientific and Futerro, who concentrate on specialized biodegradable solutions. Together, they spearhead the PLA market’s growth by focusing on R&D, strategic partnerships, and expanding global reach.

Market Key Players

• BASF SE

• COFCO

• Danimer Scientific

• Dow Chemicals

• Futerro

• COFCO

• JIANGSU SUPLA BIOPLASTICS CO., LTD.

• Jiangxi Keyuan Biopharm Co.,Ltd.

• Mitsubishi Chemical America, Inc.

• NatureWorks LLC

• Shanghai Tong-jie-liang

• Biomaterials Co.,LTD.

• TotalEnergies

• Corbion

• Teijin Ltd

• UNITIKA LTD.

• Zhejiang Hisun Biomaterials Co., Ltd.

Recent Developments

Recent developments in the PLA market include significant investments in production capacity and technology. BASF has been active in advancing PLA products, focusing on improving performance attributes for various applications, emphasizing sustainability. In 2023, COFCO scaled up its PLA production capabilities, responding to growing market demand for biodegradable materials. TotalEnergies and BASF formed a joint venture to enhance PLA production technology, with a substantial investment aimed at boosting capacity and sustainability. Another notable advancement is the expansion of NatureWorks LLC’s production facility in Thailand, projected to increase output by 25% within two years. These developments reflect the industry’s commitment to addressing sustainability while meeting increasing global demand for eco-friendly alternatives.

Conclusion

The Polylactic Acid market is poised for significant growth, driven by environmental awareness and demand for sustainable solutions across major industries. Supported by government incentives and technological innovations, PLA is becoming increasingly attractive despite cost competitiveness challenges. Key industry players are actively improving production efficiencies and expanding capabilities, ensuring PLA's future market dominance. As consumer awareness continues to rise and regulatory support strengthens, PLA is well-positioned to replace traditional plastics in many applications, particularly in regions focused on sustainability. Continued focus on R&D and investment will be crucial for overcoming challenges and leveraging emerging opportunities, securing PLA’s role as a sustainable material of choice.

Lawrence John

Prudour

+91 91308 55334

Lawrence@prudour.com

Visit us on social media:

Facebook

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.