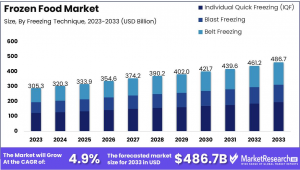

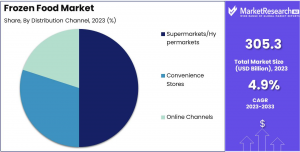

Frozen Food Market to Reach USD 486.7 Billion by 2033, Growing at a 4.9% CAGR from USD 305.3 Billion

Frozen Food Market was valued at USD 305.3 Bn in 2023. It is expected to reach USD 486.7 Bn by 2033, with a CAGR of 4.9%

The Frozen Food Market is a dynamic sector characterized by the production, distribution, and consumption of frozen food products like vegetables, fruits, meats, and ready-to-eat meals. Valued at USD 305.3 billion in 2023, it is projected to grow to USD 486.7 billion by 2033 with a CAGR of 4.9%. Convenience, technological advancements in freezing, and the busy lifestyles of consumers are key drivers. The trend towards healthier eating has expanded options, with many products now catering to health-conscious consumers. Innovations in freezing, like cryogenic methods, enhance nutrient preservation, retaining up to 80% of vitamin C in vegetables, appealing to health-aware buyers.

Retailers are leveraging these advancements by expanding their cold chain logistics and broadening product ranges. The rise of e-commerce further fuels market growth, offering consumers a wider variety of frozen products with convenient access. Overall, the market benefits from a convergence of factors, including the demand for convenient, high-quality food and significant technological innovations.

Key Takeaways

• Market Growth: The Global Frozen Food Market was valued at USD 305.3 Bn in 2023. It is expected to reach USD 486.7 Bn by 2033, with a CAGR of 4.9% during the forecast period from 2024 to 2033.

• By Product Type: Frozen Fruits and Vegetables account for 25% of the market, offering convenience and year-round availability.

• By Freezing Technique: Individual Quick Freezing (IQF) leads with 40%, preserving the quality and nutritional value of food products.

• By Distribution Channel: Supermarkets/Hypermarkets are the major distribution channel, commanding 50% of sales, reflecting their widespread consumer accessibility.

• Regional Dominance: Europe is a significant player with a 35% market share, influenced by consumer preferences for convenience and quality.

• Growth Opportunity: Innovations in freezing technology that enhance texture and taste can spur further growth in the frozen food sector.

👉 Request a free sample PDF report for valuable insights: https://marketresearch.biz/report/frozen-food-market/request-sample/

Experts Review:

Experts highlight substantial government incentives and technological innovations as catalysts in the frozen food market. Various governments support the sector via subsidies for cold storage and logistics improvements, underpinning infrastructure development crucial for market expansion. Technological innovations, especially in freezing techniques, enhance product quality and shelf-life, crucial for consumer trust. Investment opportunities abound due to growing demand, though risks include energy costs and potential market saturation. Consumer awareness regarding the nutritional integrity of frozen foods is rising, positively impacting market perception. Technologically, flash and cryogenic freezing have revolutionized the sector, ensuring better nutrient retention. The regulatory environment is favorable, with stringent quality and safety standards driving compliance and consumer confidence. Overall, the convergence of these factors positions the frozen food market for robust growth, supported by both consumer and technological dynamics.

Report Segmentation:

The frozen food market is segmented by product type, freezing technique, and distribution channel. Product types include frozen fruits and vegetables, snacks, cooked ready meals, desserts, meat, and fish, each appealing to different consumer needs. For instance, frozen fruits and vegetables account for over 25% of the market share, driven by health-conscious consumers. Freezing techniques such as Individual Quick Freezing (IQF) dominate due to quality retention, alongside blast and belt freezing methods suitable for industry-specific needs. Distribution channels are segmented into supermarkets/hypermarkets, convenience stores, and online channels, with supermarkets accounting for over 50% of sales due to extensive product availability and consumer accessibility. Growing online channels also reflect changing consumer purchasing habits driven by convenience.

Key Market Segments

By Product Type

• Frozen Fruits and Vegetables

• Frozen Snacks

• Frozen-cooked Ready Meals

• Frozen Desserts

• Frozen Meat and Fish

• Frozen Pet Food

By Freezing Technique

• Individual Quick Freezing (IQF)

• Blast Freezing

• Belt Freezing

By Distribution Channel

• Supermarkets/Hypermarkets

• Convenience Stores

• Online Channels

👉 Buy Now to access the full report: https://marketresearch.biz/purchase-report/?report_id=1783

Drivers, Restraints, Challenges, and Opportunities:

Key drivers include the increasing demand for convenience amidst busy lifestyles, advancements in freezing technologies, and the rising preference for ready-to-eat meals. However, high energy costs for maintaining cold chains and consumer perceptions of frozen foods being less nutritious pose significant challenges.

Ensuring nutrient retention through technological advancements offers opportunities, as well as harnessing rising health and sustainability trends to appeal to environmentally and health-conscious consumers. Restraints include operational costs and shifting consumer perceptions, while opportunities lie in developing healthier, organic products and improving supply chain efficiencies.

Key Player Analysis:

Major players in the frozen food market, such as Aryzta AG, Nestle, and General Mills Inc., are poised to capitalize on emerging consumer trends through strategic innovations and robust distribution networks. Aryzta AG excels in bakery products by enhancing automation and product consistency. Nestle benefits from its extensive range of nutritious frozen meals appealing to health-conscious consumers. General Mills Inc. and others like Kraft Foods Group Inc. leverage their brand portfolios to cater to evolving consumer preferences. Ajinomoto and Cargill expand through acquisitions, while Unilever and Flower Foods focus on sustainability and innovation, strengthening their market positions.

Market Key Players

• Aryzta AG

• Nestle

• General Mills Inc.

• Kraft Foods Group Inc.

• Ajinomoto Co. Inc.

• Cargill Incorporated

• Europastry S.A.

• Kellogg Company

• Unilever Plc

• Flower Foods

• Allens, Inc.

Recent Developments:

In recent months, key market players have introduced new product lines and expanded existing ones to meet rising consumer demands. For instance, Nestlé launched plant-based frozen meals under its Garden Gourmet brand in May 2024, targeting health-conscious consumers. Conagra Brands expanded its Healthy Choice line in April 2024, focusing on low-calorie frozen dinners, tapping into the diet-conscious segment. These advancements reflect a broader industry trend towards meeting health and sustainability demands, enhancing market growth and adaptation to evolving consumer preferences.

Conclusion:

The frozen food market is poised for significant growth, driven by demand for convenience, health consciousness, and technological advancements. Major market players are continuously innovating to meet changing consumer expectations for high-quality, sustainable products. Challenges remain, notably in consumer perceptions and operational costs, but opportunities in technological innovation and market expansion are driving positive momentum. As lifestyle trends evolve, the frozen food market remains a vital and dynamic segment within the global food industry.

Lawrence John

Prudour

+91 91308 55334

Lawrence@prudour.com

Visit us on social media:

Facebook

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.