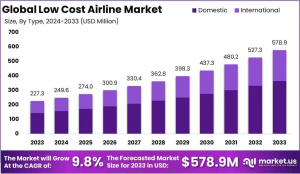

Low-Cost Airline Market Share to Reach USD 578.9 Million by 2033, with a CAGR of 9.8%

Low-Cost Airline Market is projected to reach USD 578.9 Million by 2033, growing at a CAGR of 9.8% from 2024 to 2033.

The Global Low-Cost Airline Market is projected to reach USD 578.9 million by 2033, up from USD 227.3 million in 2023, growing at a CAGR of 9.8% from 2024 to 2033.

A low-cost airline (LCA) refers to a carrier that offers lower fares and fewer amenities than traditional full-service airlines, while maintaining profitability through cost-cutting measures and operational efficiencies. These carriers often charge for additional services such as checked baggage, food, and seat selection, allowing them to keep base ticket prices competitive. By optimizing their fleets, streamlining operations, and focusing on high-density routes, low-cost airlines can drive higher utilization rates and maximize revenues. This model has disrupted the traditional airline industry, leading to increased competition and lower overall travel costs for consumers.

The low-cost airline market represents a rapidly growing segment of the global aviation industry. Characterized by budget-friendly travel options, it has gained significant traction in both domestic and international markets. This market is defined by increased passenger volumes, a greater emphasis on operational efficiency, and evolving customer preferences for affordable travel. Airlines adopting the low-cost model have capitalized on rising disposable incomes, an expanding middle class in emerging markets, and growing demand for both leisure and business travel.

Request Your Sample Report Today for In-Depth Insights and Analysis at https://market.us/report/low-cost-airline-market/request-sample/

Key growth drivers include rising fuel prices, increasing demand for air travel, and a shift in consumer behavior towards value-driven options. Additionally, strategic expansions into underserved routes, coupled with advancements in aircraft technology, have provided ample opportunities for further market penetration. Low-cost airlines are also poised to benefit from the continued post-pandemic recovery in global travel, with opportunities for innovation in ancillary services and digital enhancements to meet evolving customer expectations.

**Key Takeaways**

~~ The global low-cost airline market is expected to grow significantly, increasing from USD 227.3 million in 2023 to USD 578.9 million by 2033, with a compound annual growth rate (CAGR) of 9.8% from 2024 to 2033.

~~ In 2023, the Domestic Segment led the market with a 63% share, driven by the post-pandemic recovery and a rising demand for cost-effective, short-haul travel.

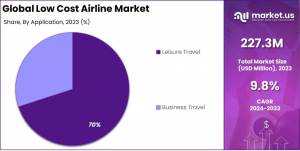

~~ Leisure travel accounted for 70% of the market share in 2023, reflecting strong consumer preference for affordable vacations and spontaneous travel experiences.

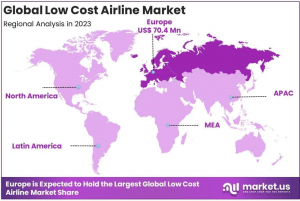

~~ Europe represented 31% of the market share in 2023, supported by well-developed infrastructure, competitive pricing, and a wide network of low-cost routes.

**Market Segmentation**

In 2023, the Domestic segment dominated the Low-Cost Airline Market with a 63% market share, driven by the rapid recovery of domestic travel post-pandemic and growing demand for affordable short-haul flights. Key factors include improved regional connectivity, government infrastructure investments, and aggressive budget airline expansions into secondary cities. Low-cost carriers also attracted travelers with competitive pricing and frequent promotions. While the International segment is growing, fueled by relaxed visa policies and demand for budget-friendly vacations, it remains smaller due to regulatory complexities and higher operational costs.

In 2023, the Leisure Travel segment dominated the Low-Cost Airline Market, holding over 70% of the market share, driven by increased demand for affordable vacations, higher disposable incomes, and a preference for spontaneous travel. Factors like domestic tourism growth, weekend getaways, and attractive deals to popular destinations further boosted this segment. Meanwhile, the Business Travel segment accounted for the remaining share, growing at a slower pace due to remote work and cost-cutting measures. Although low-cost carriers are targeting business travelers with flexible, budget-friendly options, this segment’s recovery is expected to be gradual as in-person interactions become more common in the coming years.

**Key Market Segments**

By Type

~~ Domestic

~~ International

By Application

~~ Leisure Travel

~~ Business Travel

**Driving factors**

Increasing Demand for Affordable Air Travel

The growing global middle class, particularly in emerging economies, is significantly driving the demand for low-cost air travel. With disposable incomes rising, more consumers are opting for budget airlines to fulfill their travel needs. This shift is accelerating the market growth as budget airlines offer essential routes at competitive prices. The affordability factor, combined with the expanding range of destinations, is increasing the frequency of travel among cost-conscious passengers, fueling the overall growth of the market.

"Order the Complete Report Today to Receive Up to 30% Off at https://market.us/purchase-report/?report_id=27577

**Restraining Factors**

Rising Fuel Costs Impacting Profit Margins

One of the primary restraints affecting the global low-cost airline market is the volatility in fuel prices. Since fuel constitutes a significant portion of operational costs, fluctuating fuel prices can undermine the profitability of budget airlines. Despite efforts to mitigate these costs through hedging and fuel-efficient aircraft, any substantial increase in oil prices directly impacts operating expenses, forcing low-cost carriers to raise ticket prices or absorb losses, ultimately affecting market dynamics and growth.

**Growth Opportunity**

Expansion into Emerging Markets

Low-cost airlines are increasingly targeting emerging markets, where the demand for affordable air travel is rapidly growing. As economies in regions like Southeast Asia, Latin America, and Africa expand, more consumers are looking for cost-effective travel options. This opens up significant growth opportunities for low-cost carriers to establish routes and tap into a largely underserved market. By capitalizing on this shift, airlines can secure new revenue streams and expand their market footprint globally.

**Latest Trends**

Digital Transformation and Enhanced Customer Experience

As consumer expectations rise, low-cost airlines are increasingly leveraging digital technologies to enhance customer experience while maintaining low operational costs. Innovations like mobile check-ins, contactless payments, and personalized offers based on passenger data are becoming integral to the industry. This trend not only increases operational efficiency but also drives customer loyalty, as travelers seek convenience and tailored experiences. As more airlines adopt these digital advancements, the market will continue to evolve in line with customer preferences.

**Regional Analysis**

Lead Region: Europe with Largest Market Share in Low-Cost Airline Market (31% in 2023)

Europe leads the low-cost airline market with a 31% share in 2023, valued at USD 70.4 million. The region’s strong market presence is driven by competitive pricing and high demand for affordable travel. North America follows, with gradual adoption of low-cost models, while Asia Pacific shows the highest growth potential, fueled by rising disposable incomes and expanding middle class.

In the Middle East & Africa, the low-cost sector is emerging, especially in countries like the UAE and Saudi Arabia, while Latin America sees steady growth, particularly in Brazil and Mexico. Overall, Europe remains the dominant region, with Asia Pacific poised for rapid expansion.

!! Request Your Sample PDF to Explore the Report Format !!

**Key Players Analysis**

The Global Low-Cost Airline Market in 2024 will continue to be driven by a competitive landscape, with key players maintaining a stronghold in both regional and international markets. AirAsia Group Berhad, Norwegian Air Shuttle, and easyJet plc are expected to dominate Southeast Asia, Europe, and North America, capitalizing on their established low-cost models and extensive route networks. Ryanair Holdings, with its efficient operations, will maintain its leadership in Europe, while Alaska Air Group and JetBlue Airways are positioned for growth in the U.S. market. Airlines like Qantas and WestJet will leverage their strong regional presence. The rise of Go Airlines, GOL, and SpiceJet also suggests expanding opportunities in emerging markets, with other players contributing to diverse offerings in an increasingly price-sensitive global market.

Top Key Players in the Market

~~ AirAsia Group Berhad

~~ Norwegian Air Shuttle ASA

~~ easyJet plc

~~ Ryanair Holdings plc

~~ Alaska Air Group Inc.

~~ WestJet Airlines Ltd.

~~ Qantas Airways

~~ Go Airlines Ltd.

~~ GOL Linhas Aéreas Inteligentes S.A.

~~ SpiceJet Limited

~~ Dubai Aviation Corporation

~~ JetBlue Airways Corporation

~~ Other Key Players

**Recent Developments**

~~ In 2024, JetBlue Airways Corporation: JetBlue abandoned its $3.8 billion acquisition of Spirit Airlines after the U.S. District Court blocked the deal due to antitrust concerns.

~~ In October 2024, Frontier Airlines: Frontier announced 22 new routes set to launch in December, expanding its network with budget-friendly fares starting at $19.

~~ In 2024, Wizz Air: Wizz Air revealed plans to launch long-haul routes in 2025, starting with flights from London Gatwick to Jeddah and Milan to Abu Dhabi, maintaining its low-cost model.

~~ In August 2024, SpiceJet: SpiceJet reported a 26% increase in net profit for Q1 FY2025, achieving INR 150 Crore in profit for the second consecutive profitable quarter.

**Conclusion**

The Global Low-Cost Airline Market is projected to grow from USD 227.3 million in 2023 to USD 578.9 million by 2033, expanding at a CAGR of 9.8%. This growth is fueled by rising demand for affordable air travel, especially in emerging markets, and the increasing preference for leisure travel. Low-cost carriers are benefiting from operational efficiencies, competitive pricing, and digital advancements to enhance customer experience. Key drivers include a growing middle class, a post-pandemic travel rebound, and expanding routes. However, challenges like rising fuel costs and regulatory complexities persist. Europe leads the market, while Asia Pacific shows the highest growth potential. Major players like Ryanair, AirAsia, and easyJet dominate, with opportunities for new entrants in emerging regions.

Lawrence John

Prudour

+91 91308 55334

email us here

Visit us on social media:

Facebook

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.