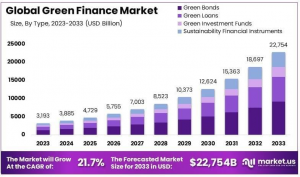

Green Finance Market Projected to Skyrocket to $22,754 Billion by 2033, Expanding at a CAGR of 21.7%

Global green finance market projected to skyrocket from USD 3,192.61 billion in 2023 to USD 22,754 billion by 2033, with a CAGR of 21.7%.

The Green Finance market is witnessing a significant upswing, primarily fueled by heightened global awareness and the imperative shift towards sustainable and low-carbon economic practices. Analysts emphasize the pivotal role of green finance in supporting renewable energy initiatives, sustainable agriculture, and carbon reduction projects. This sector not only offers potential for high returns but also contributes significantly to environmental sustainability.

In terms of investment, the U.S. Department of Energy’s Loan Programs Office stands out with over USD 40 billion committed to renewable energy and emerging technologies like carbon capture and hydrogen. This investment is crucial in propelling the U.S. towards a cleaner energy future. Similarly, the European Union’s Green Deal is a major catalyst in the region, with the InvestEU program aiming to mobilize at least €1 trillion by 2030 to finance its ambitious objectives, necessitating an estimated annual investment of €260 billion.

𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 𝐁𝐞𝐟𝐨𝐫𝐞 𝐏𝐮𝐫𝐜𝐡𝐚𝐬𝐢𝐧𝐠 𝐑𝐞𝐩𝐨𝐫𝐭: https://market.us/report/green-finance-market/request-sample/

The corporate sector is also a key player in driving green finance, with 2021 seeing a record issuance of green bonds valued at USD 500 billion. These instruments not only enhance environmental performance but also help reduce CO2 emissions and improve ecological ratings. Furthermore, the renewable energy sector, particularly utility-scale solar and battery storage projects, is experiencing robust tax equity financing, with demand consistently exceeding supply. In 2021, renewable sources contributed to 23% of U.S. electricity generation, a figure that is expected to rise with ongoing investments.

Overall, the Green Finance market is poised for robust growth, supported by substantial investments from both public and private sectors, underpinning its essential role in the global transition to a sustainable economy.

𝐊𝐞𝐲 𝐓𝐚𝐤𝐞𝐚𝐰𝐚𝐲𝐬

- The global Green Finance Market is projected to grow from USD 3,192.61 billion in 2023 to USD 22,754 billion by 2033, registering a CAGR of 21.7% during the forecast period from 2024 to 2033.

- In 2023, Green Bonds accounted for 40% of the market, primarily due to their effectiveness in capitalizing on sustainable projects.

- The Renewable Energy sector led with a 45% share in 2023, highlighting its pivotal role in the transition to sustainable energy sources.

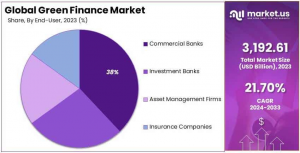

- Commercial Banks held 38% of the market in 2023, reflecting their integral position in financing green initiatives.

- Europe dominated the Green Finance Market with a 35% market share in 2023, driven by robust regulatory frameworks and strong financial markets.

- In 2021, corporate green bond issuances reached a record high of USD 500 billion, indicating a substantial surge in demand for sustainable finance instruments.

Key Market Segments

By Type

-Green Bonds

-Green Loans

-Green Investment Funds

-Sustainability-Linked Financial Instruments

By Industry Vertical

-Renewable Energy

-Sustainable Agriculture

-Green Real Estate

-Environmental Technology

By End-User

-Commercial Banks

-Investment Banks

-Asset Management Firms

-Insurance Companies

𝐎𝐫𝐝𝐞𝐫 𝐭𝐡𝐞 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐓𝐨𝐝𝐚𝐲 𝐭𝐨 𝐑𝐞𝐜𝐞𝐢𝐯𝐞 𝐔𝐩 𝐭𝐨 30% 𝐎𝐅𝐅: https://market.us/purchase-report/?report_id=126016

Type Analysis

Green bonds stand out as the leading financial instrument in the green finance market, accounting for 40% of its composition. Their dominance is primarily due to their effectiveness in raising substantial capital for environmental and sustainable projects, making them highly attractive to investors seeking clear environmental impacts. Following green bonds, green loans and green investment funds also play crucial roles. Green loans offer specific funding for companies implementing sustainable practices, whereas green investment funds pool resources from multiple investors to support a diverse array of green initiatives. Additionally, sustainability-linked financial instruments are emerging as innovative options that incentivize companies to meet specific sustainability targets. The proliferation of green bonds is further supported by their reputation for providing stable returns and lower risks, making them appealing to a wide range of investors. Enhanced standards and increased transparency regarding the allocation of proceeds are expected to further boost investor confidence and promote growth in this segment.

Industry Vertical Analysis

The renewable energy sector commands the largest share within the green finance market, holding a 45% stake. This dominance is driven by the critical need for sustainable energy solutions that contribute to global carbon reduction efforts. Significant investments are being channeled into technologies like solar and wind energy, which facilitate the shift away from fossil fuels while offering significant economic benefits. Other vital sectors include sustainable agriculture, which focuses on the efficient use of natural resources, and green real estate, dedicated to environmentally friendly building practices. Environmental technology also plays a supporting role by providing essential technologies for waste management and water purification, aiding efficiency across all sectors. The prominence of renewable energy is likely to continue, bolstered by technological advancements and governmental support through various subsidies and incentives, underscoring its pivotal role in the green finance landscape.

End-User Analysis

Commercial banks are the primary end-users of green finance, holding a dominant market share of 38%. Their significant influence is attributed to their extensive networks and substantial capital resources, which are essential for financing green initiatives. Commercial banks excel in bridging the gap between investors seeking green opportunities and companies requiring funds for sustainable projects. Investment banks and asset management firms also contribute to the market by developing and managing green financial products like green bonds and sustainable asset funds. Meanwhile, insurance companies are increasingly supporting green projects through underwriting and promoting sustainability-focused insurance products. The role of commercial banks is crucial in expanding green finance, as they are key to funding the necessary innovations and infrastructure for a sustainable future.

Top Key Players

-JP Morgan Chase & Co.

-Bank of America Corporation

-CitiGroup Inc.

-UBS Group AG

-BlackRock, Inc.

-BNP Paribas

-Morgan Stanley

-ING Group

-Credit Agricole Group

-HSBC Holdings plc

-Goldman Sachs Group, Inc.

-State Street Corporation

-Other Key Players

Conclusion

In conclusion, the green finance market is characterized by significant growth and diversification across its various segments. Green bonds lead with a 40% share due to their effectiveness in mobilizing capital for sustainable projects, while renewable energy dominates the industry verticals with a 45% share, reflecting its essential role in the global shift towards sustainable energy sources. Commercial banks are the primary end-users, holding a 38% market share, pivotal in facilitating green investments through their extensive networks and financial resources.

This robust expansion in green finance is supported by increasing global awareness of environmental issues and a strong investor demand for opportunities that combine financial returns with positive environmental impact. The ongoing development of standards and incentives is expected to continue driving the market forward, underpinning its crucial role in fostering a sustainable economic future.

Lawrence John

Prudour

+91 91308 55334

email us here

Visit us on social media:

Facebook

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.