Embedded Finance Market Set to Reach USD 700.1 Billion by 2033, Led by North America

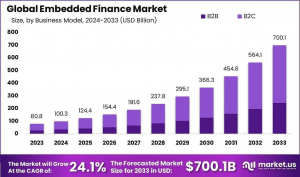

By 2033, the Global Embedded Finance Market set to soar to USD 700.1B, from USD 80.85B in 2023, with a CAGR of 24.10%.

The embedded finance market is undergoing significant expansion, driven by the increasing digitalization of various sectors and the growing consumer preference for seamless transaction experiences. Businesses across industries, especially in e-commerce, retail, and technology services, are integrating financial services such as payments, lending, and insurance directly into their platforms. This integration not only streamlines transactions but also enhances customer engagement and satisfaction by providing a more comprehensive service offering within a single interface.

𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 𝐁𝐞𝐟𝐨𝐫𝐞 𝐏𝐮𝐫𝐜𝐡𝐚𝐬𝐢𝐧𝐠 𝐑𝐞𝐩𝐨𝐫𝐭: https://market.us/report/embedded-finance-market/request-sample/

As the market evolves, significant opportunities are emerging for the expansion of embedded financial services. Innovations in embedded investment tools and sophisticated, transaction-specific insurance products are expected to open new growth avenues. Additionally, there is substantial potential for expansion in developing regions, where traditional banking services are less penetrated, offering a ripe market for embedded finance solutions.

Technological advancements in AI and machine learning are making financial services more intelligent, secure, and capable of adapting to complex regulatory frameworks. This technological progression, coupled with more accommodating regulations, is set to broaden the market's reach, enabling a global scale integration of financial solutions into business ecosystems. The Global Payments Report 2023 highlights that Account-to-Account (A2A) payments are projected to grow at a CAGR of 13.1% through to 2026, reaching a market valuation of approximately USD 850.1 billion, indicating a robust trajectory for this segment of embedded finance.

𝐊𝐞𝐲 𝐓𝐚𝐤𝐞𝐚𝐰𝐚𝐲𝐬

-- The Global Embedded Finance Market is projected to grow from USD 80.85 billion in 2023 to USD 700.1 billion by 2033, with a Compound Annual Growth Rate (CAGR) of 24.1% from 2024 to 2033.

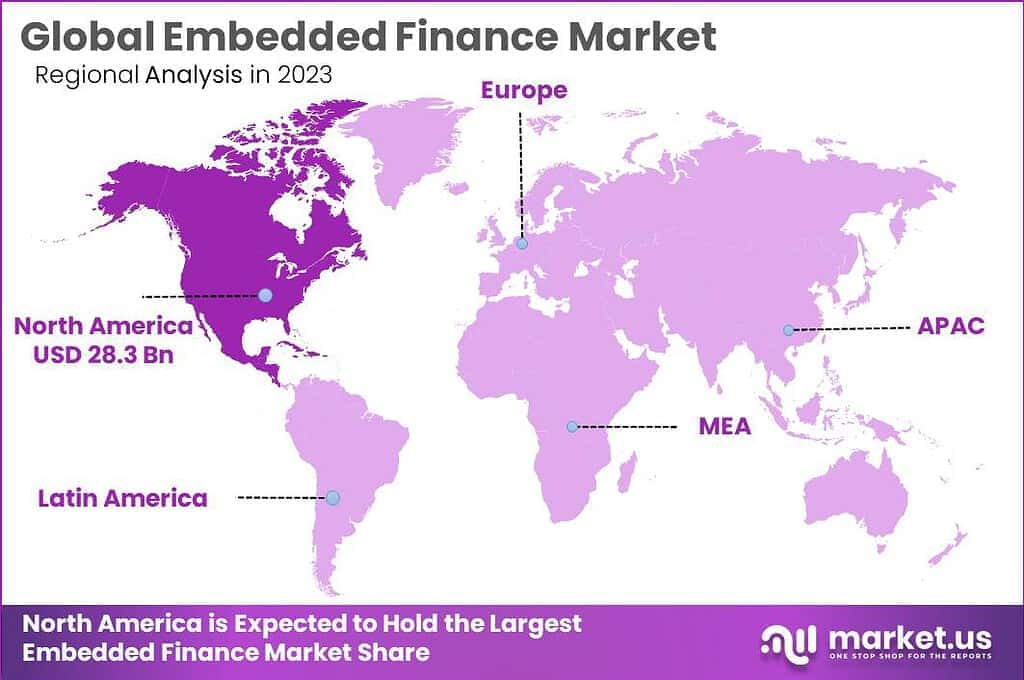

-- In 2023, North America held more than a 35% market share, generating approximately USD 28.3 billion in revenue.

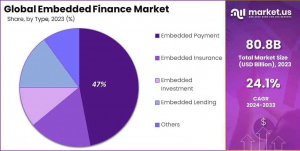

-- The Embedded Payment segment held over a 47% market share in 2023.

-- The Business-to-Consumer (B2C) segment captured more than a 65% share in 2023.

-- The Retail segment accounted for more than a 34% market share in 2023.

-- According to The Global Payments Report 2023, Account-to-Account (A2A) payments are expected to reach a valuation of nearly USD 850.1 billion by 2026, with a CAGR of 13.1%.

Key Market Segments

By Type

--Embedded Payment

--Embedded Insurance

--Embedded Investment

--Embedded Lending

--Others

By Business Model

--B2B

--B2C

By End-Use Industry

--Retail

--Healthcare

--Logistics

--Manufacturing

--Travel & Entertainment

--Others

𝐎𝐫𝐝𝐞𝐫 𝐭𝐡𝐞 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐓𝐨𝐝𝐚𝐲 𝐭𝐨 𝐑𝐞𝐜𝐞𝐢𝐯𝐞 𝐔𝐩 𝐭𝐨 30% 𝐎𝐅𝐅: https://market.us/purchase-report/?report_id=131326

Type Analysis

In 2023, the Embedded Payment segment took a leading position in the embedded finance market with over a 47% share. This dominance is attributed to the seamless integration of payment processing into non-financial platforms, such as retail websites and social media applications. Embedded payments enhance user experience by allowing direct, in-app transactions, thereby reducing the need for consumers to leave their current applications to complete purchases. This functionality is particularly valued in the e-commerce and online service sectors, where quick and secure transactions are crucial. By minimizing purchase friction, embedded payments not only improve customer satisfaction and retention but also drive higher conversion rates and reduce cart abandonment, significantly boosting business revenues.

Business Model Analysis

The Business-to-Consumer (B2C) segment held a dominant position in the embedded finance market in 2023, securing more than a 65% share. This segment benefits from direct interactions with a large consumer base that relies on embedded financial services for daily transactions. The rising consumer expectations for seamless experiences in sectors like online shopping, travel bookings, and entertainment services have pushed businesses to integrate financial services directly into their consumer interfaces. This integration simplifies transaction processes and enhances the likelihood of transaction completion on the platforms themselves. Moreover, the high volume of individual transactions in the B2C segment provides valuable data that businesses use to optimize financial offerings and improve service quality, further solidifying the B2C segment's leadership in the market.

End-Use Industry Analysis

In 2023, the Retail segment maintained a strong presence within the embedded finance market, accounting for more than a 34% share. The ongoing surge in e-commerce has led retailers to increasingly embed payment solutions, financing, and insurance services directly into their platforms, streamlining the purchasing process and enhancing customer experiences. Retailers leverage embedded finance to offer personalized promotions and credit products at the point of sale, which encourages larger purchases and repeat business. This strategy not only boosts customer satisfaction but also fosters loyalty, as customers are drawn back to platforms that offer added convenience. As retailers continue to harness the benefits of embedded finance, this segment is expected to remain a key player in the market, driving the continued growth and integration of financial solutions within the retail sector.

Top Key Players

~Stripe Inc.

~Fortis Payment Systems, LLC

~Finastra International Limited

~Cybrid Technology Inc.

~PAYRIX

~FinBox

~Lendflow

~PayPal Holdings Inc.

~Zopa Bank Limited

~Walnut Insurance Inc.

~Transcard Payments

~Fluenccy Pty Limited

~Other Key Players

Conclusion

In 2023, the Embedded Finance Market saw significant leadership from the Embedded Payment segment, which held a dominant 47% market share, highlighting its integral role in facilitating seamless transactions across non-financial platforms. Similarly, the Business-to-Consumer (B2C) segment captured a commanding 65% share, driven by the direct integration of financial services into consumer platforms across diverse sectors, enhancing transaction completion rates and user satisfaction.

Additionally, the Retail sector maintained a robust position with over a 34% share, leveraging embedded finance to streamline purchasing processes and personalize financial offerings, thereby boosting sales and customer loyalty. Collectively, these segments exemplify the market's dynamic growth and the increasing reliance on embedded financial services to meet consumer demands for convenience and efficiency in transactions.

Lawrence John

Prudour

+91 91308 55334

email us here

Visit us on social media:

Facebook

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.