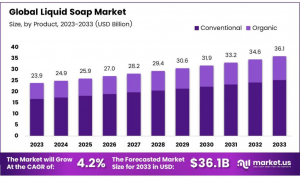

Global Liquid Soap Market to Reach USD 36.1 Billion by 2033, Growing at 4.2% CAGR

Liquid Soap Market size is expected to be worth around USD 36.1 Billion by 2033, from USD 23.9 Billion in 2023, growing at a CAGR of 4.2%.

The Global Liquid Soap Market size is expected to be worth around USD 36.1 Billion by 2033, from USD 23.9 Billion in 2023, growing at a CAGR of 4.2% during the forecast period from 2024 to 2033.

The liquid soap market refers to the segment of the personal care industry that produces and distributes liquid soap products for personal hygiene, household cleaning, and industrial use. These products are formulated with a blend of cleansing agents, moisturizers, and fragrances, catering to diverse consumer and institutional needs.

The liquid soap market has experienced consistent growth driven by increasing hygiene awareness among consumers, a rise in disposable income, and a preference for convenient and effective cleaning solutions. Additionally, the COVID-19 pandemic accelerated the demand for liquid soaps as a key hygiene product.

Governments worldwide have supported this market through initiatives promoting public hygiene and investments in sanitation infrastructure. Regulations related to product safety, labeling, and the use of eco-friendly ingredients have become more stringent, creating both opportunities and challenges for manufacturers. Compliance with these regulations is essential, as consumers increasingly prioritize sustainable and ethically produced products. The combination of public investment and strict regulatory frameworks ensures long-term stability and innovation in the liquid soap market.

The liquid soap market offers ample opportunities for both new entrants and established players to expand their business. Companies can leverage the rising demand for eco-friendly and natural liquid soaps by introducing innovative formulations that cater to environmentally conscious consumers. Additionally, growing online retail channels provide an excellent platform for market penetration and brand visibility. Strategic collaborations with distributors and retailers can help businesses improve supply chain efficiency and market reach.

Emerging markets, particularly in developing economies, present a vast untapped potential for growth due to increasing urbanization and hygiene awareness. By focusing on product diversification, such as antibacterial and sensitive-skin variants, businesses can appeal to specific consumer needs and gain a competitive edge in this dynamic market.

This market analysis demonstrates the transformative potential within the liquid soap industry for businesses aiming to capitalize on evolving consumer trends and regulatory landscapes.

Curious About Market Trends? Request Your Complimentary Sample Report Today: https://market.us/report/liquid-soap-market/free-sample/

Key Takeaway

-- The global liquid soap market is projected to reach USD 36.1 billion by 2033, growing at a CAGR of 4.2% from 2024 to 2033.

-- Conventional liquid soaps held a dominant market share of 72% in 2023, driven by affordability and consumer familiarity.

-- Bath & Body Soaps led the product type segment with a 60% market share in 2023, owing to their widespread use in personal care routines.

-- Hypermarkets & Supermarkets dominated the distribution channel segment in 2023, offering a wide range of products at competitive prices.

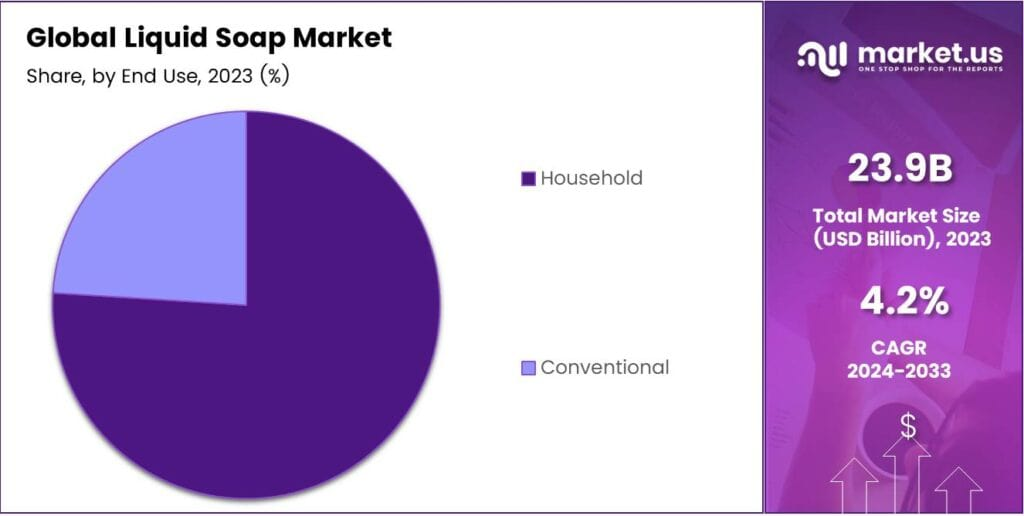

-- The household end-use segment held the largest market share in 2023, driven by the convenience and versatility of liquid soap in daily cleaning and hygiene.

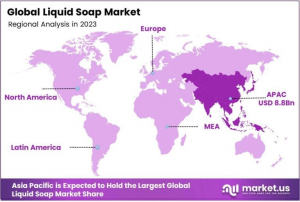

-- Asia Pacific was the dominant region in 2023, accounting for 37% of the global market share, valued at USD 8.8 billion, fueled by population growth and rising hygiene awareness.

Use Cases

➔ Personal Hygiene: Liquid soap is commonly used in bathrooms and kitchens for handwashing, offering an effective way to clean hands and prevent the spread of germs. With rising awareness around hygiene, liquid soap is seen as a more convenient and hygienic alternative to bar soap.

➔ Sensitive Skin Solutions: Many liquid soaps are formulated for sensitive skin, offering moisturizing or hypoallergenic properties. These options cater to individuals with allergies or skin conditions like eczema, providing a gentle cleanse without causing irritation.

➔ Luxury Bath Products: Liquid soaps with premium ingredients such as essential oils, botanical extracts, or natural scents are becoming increasingly popular as part of luxury bath and body care routines. High-end liquid soaps offer a spa-like experience, enhancing self-care and relaxation.

➔ Eco-friendly Packaging: With growing environmental concerns, brands are introducing liquid soaps with sustainable packaging options, such as refillable bottles or biodegradable containers. This market trend appeals to eco-conscious consumers looking to reduce waste and carbon footprints.

➔ Hotel and Hospitality Industry: Liquid soap is widely used in the hospitality sector, including hotels, resorts, and spas. Offering high-quality liquid soap in rooms and public restrooms enhances the guest experience, creating a more luxurious and hygienic atmosphere.

Driving Factors

1. Growing Awareness of Hygiene and Health:

The increasing global focus on hygiene, especially following the COVID-19 pandemic, has resulted in higher demand for liquid soaps. People are more cautious about cleanliness and personal hygiene, with liquid soap being viewed as more hygienic than bar soap due to its pump or dispenser mechanism, reducing the risk of cross-contamination.

2. Rising Preference for Skin-friendly Products:

Consumers are becoming more conscious of the ingredients in the products they use, especially those that come in direct contact with the skin. Liquid soaps with natural ingredients, moisturizing properties, and dermatologically tested formulas are becoming increasingly popular. This shift towards skin-friendly, gentle products is fueling the growth of the liquid soap market.

3. Convenience and Ease of Use:

Liquid soaps are preferred over traditional bar soaps because they offer greater convenience and a mess-free experience. They are easier to use in liquid form, particularly in public or shared spaces like bathrooms and kitchens, where hygienic dispensing is essential. The ease of use, especially with dispensers or pumps, is making liquid soap a more attractive option for households, businesses, and hotels.

4. Availability of Specialized Products:

The market for liquid soap has diversified with the growing availability of specialized products such as antibacterial, hypoallergenic, and eco-friendly variants. These products cater to a broad range of consumer needs, whether it's for sensitive skin, allergies, or environmental concerns. The availability of such niche products is driving increased demand across various segments, from personal care to commercial use.

5. Sustainability and Eco-friendly Packaging:

With rising environmental concerns, consumers are becoming more conscious of the environmental impact of the products they purchase. Brands are responding by offering liquid soaps in eco-friendly packaging, such as recyclable plastic bottles or refill pouches. Additionally, many liquid soap brands are focusing on using biodegradable and cruelty-free ingredients, which appeals to eco-conscious consumers, further boosting market growth.

Report Segmentation

In 2023, Conventional products dominated the Liquid Soap Market with a 72% share. Their continued market leadership is due to their affordability, wide availability, and the fact that consumers are familiar with them and trust their effectiveness.

In the By Product Type segment, Bath & Body Soaps led with a 60% share. This is largely because these soaps are commonly used in everyday personal care routines, making them a staple for many consumers.

In terms of distribution, Hypermarkets & Supermarkets held the largest share of the market. Their dominance is driven by the wide variety of liquid soap options they offer at competitive prices, making them the go-to place for many shoppers.

In the By End Use segment, Household use took the lead, accounting for the largest share. This is because liquid soaps are widely used for daily cleaning and hygiene at home. Consumers prefer them for their convenience, versatility, and effectiveness in tasks like handwashing, bathing, and surface cleaning.

By Product

• Conventional

• Organic

By Product Type

• Bath & Body Soaps

• Dish Wash Soaps

• Laundry Soaps

• Others

By Distribution Channel

• Hypermarkets & Supermarkets

• Convenience Stores

• Online

• Others

By End Use

• Household

• Conventional

Ready to Act on Market Opportunities? Buy Your Report Now and Get 30% off: https://market.us/purchase-report/?report_id=135244

Regional Analysis

The liquid soap market is growing at a steady pace, with Asia Pacific leading the global market, holding a 37% share, valued at USD 8.8 billion. The rapid urbanization, increasing disposable incomes, and heightened consumer awareness about hygiene and personal care are key drivers behind this growth. In countries like China and India, the demand for liquid soap has surged, as consumers are shifting from traditional bar soaps to liquid versions, which are seen as more hygienic and convenient. There is also a noticeable shift toward premium liquid soaps, as more consumers prioritize quality and health-conscious ingredients. The increasing preference for natural, organic, and eco-friendly products has further accelerated the demand for liquid soaps made with plant-based ingredients. As the region’s middle class expands and urban areas continue to grow, the market is expected to continue its upward trajectory, with innovation in product offerings and packaging becoming key trends.

Growth Opportunities

➥ Focus on Organic and Natural Ingredients: Consumers are increasingly prioritizing natural and organic products in their daily routines. Launching liquid soaps that are free from harsh chemicals, and made with ingredients like essential oils, aloe vera, or coconut oil, can meet the demand for safer, skin-friendly options.

➥ Travel-sized and Portable Packaging: Offering travel-sized liquid soaps or convenient packaging options, such as refillable containers, could cater to consumers on the go. These products are particularly appealing to frequent travelers, gym-goers, and those looking for space-saving alternatives in their personal care routines.

➥ Antibacterial and Moisturizing Formulas: Combining multiple benefits in one product can drive market growth. Liquid soaps that not only cleanse but also moisturize or offer antibacterial protection, especially for high-demand areas like healthcare settings or families with children, could become more popular.

➥ Sustainable and Refillable Packaging: The growing eco-consciousness of consumers offers an opportunity to develop liquid soap products with refillable packaging or containers made from recycled materials. This helps reduce plastic waste and attract customers who are looking for sustainable solutions in their daily products.

➥ Collaborations with Wellness and Spa Centers: Partnering with wellness centers, spas, or hotels to provide premium liquid soaps can open a new revenue channel. Offering high-quality, luxury liquid soaps in bulk to these businesses for use in their services or retail can cater to customers seeking high-end, indulgent experiences.

Key Players

Reckitt Benckiser Group plc.

Godrej Consumer Products

NEW AVON LLC.

Procter & Gamble

Kao Chemicals

Bluemoon Bodycare

Unilever

3M

Lion Corporation

GOJO Industries, Inc.

Not Sure? Request a Sample Report and See How Our Insights Can Drive Your Business: https://market.us/report/liquid-soap-market/free-sample/

Trending Factors

Antibacterial Properties: Health-conscious consumers are increasingly opting for antibacterial liquid soaps, especially in the wake of health crises like the COVID-19 pandemic. These soaps promise to kill germs more effectively, appealing to hygiene-focused users.

Natural and Organic Ingredients: There is a significant shift towards liquid soaps made with natural and organic ingredients. Consumers are looking for products free from harsh chemicals, made with components like essential oils, herbal extracts, and organic moisturizers.

Refill Stations: To combat plastic waste, many brands are setting up refill stations in stores where customers can refill their soap containers. This not only reduces plastic consumption but also encourages brand loyalty by offering cost-effective and eco-friendly solutions.

Luxury and Aromatherapy Soaps: The demand for luxury and aromatherapy liquid soaps is rising, with consumers seeking out products that offer therapeutic benefits through essential oils and unique scents. These products provide a spa-like experience in the comfort of one's home.

Innovative Dispensing Systems: Brands are innovating with dispensers that enhance hygiene and convenience. Touchless dispensers that use motion sensors are becoming popular in both households and commercial settings, preventing the spread of germs.

Restraining Factors

1. Rising Raw Material Prices

The production of liquid soap relies on various raw materials, including oils, surfactants, and fragrances. Fluctuations in the prices of these ingredients can significantly impact the cost of manufacturing liquid soap. Rising raw material prices, often due to global supply chain disruptions or trade policies, can lead to higher production costs. In turn, manufacturers may have to increase the price of their products, making them less attractive to price-sensitive customers.

2. Competition from Alternative Products

Liquid soap faces strong competition from alternative cleaning products, such as bar soap and hand sanitizers, which can be more affordable and convenient. Additionally, the growing trend of “no-waste” and eco-friendly products is driving consumers to choose options with minimal packaging, such as refillable soap dispensers. This shift in consumer preferences could limit the growth potential for liquid soap manufacturers, especially if they do not innovate in packaging or ingredients.

Conclusion

In conclusion, the Global Liquid Soap Market is poised for steady growth, with a projected market size of USD 36.1 billion by 2033. Driven by increasing hygiene awareness, rising disposable incomes, and consumer preference for convenient and skin-friendly products, the market offers significant opportunities for both new and established players. As eco-friendly and natural products become more popular, manufacturers can capitalize on these trends by offering sustainable packaging and organic ingredients. However, challenges such as rising raw material prices and competition from alternative products could impact growth. Businesses that innovate in packaging, product formulations, and sustainability are likely to maintain a competitive edge in this evolving market.

Related Report

Cashew Nut Essential Oil Market: https://market.us/report/cashew-nut-essential-oil-market/

Bath Bomb Market: https://market.us/report/bath-bomb-market/

Organic Skin Care Market: https://market.us/report/organic-skin-care-market/

Baby Nail Care Products Market: https://market.us/report/baby-nail-care-products-market/

Hair Perfume Market: https://market.us/report/hair-perfume-market/

Lawrence John

Prudour

+91 91308 55334

Lawrence@prudour.com

Visit us on social media:

Facebook

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.