Sodium Chlorate Market Valued At Nearly USD 6.0 Billion By 2033 | Growing at a CAGR of 5.2%

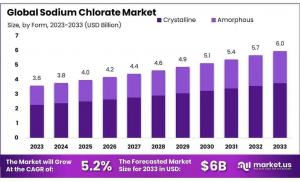

The Sodium Chlorate Market size is expected to be worth around USD 6.0 Bn by 2033, from USD 3.6 Bn in 2023, growing at a CAGR of 5.2% from 2023 to 2033.

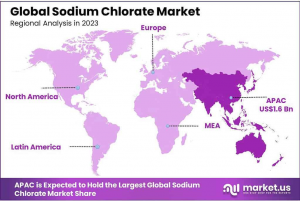

The Asia Pacific region led the global sodium chlorate market in 2023, holding a dominant share of 43.5%.”

NEW YORK, NY, UNITED STATES, January 27, 2025 /EINPresswire.com/ -- The global Sodium Chlorate Market is a dynamic and growing sector, primarily driven by its extensive use in various industrial applications. Sodium chlorate is an inorganic compound with the chemical formula NaClO3. It is a white crystalline powder highly soluble in water and decomposes on heating to release oxygen. The primary use of sodium chlorate is in manufacturing chlorine dioxide, a key bleaching agent used in the pulp and paper industry. Additionally, it serves as an herbicide, particularly effective in non-cultivated areas and for total vegetation control.— Tajammul Pangarkar

The demand for paper and pulp products, including paper packaging materials and hygiene-related products, has steadily increased, particularly in emerging economies. This uptick in demand directly correlates with growth in the sodium chlorate market. However, the market is also witnessing a shift in trends, where environmental concerns are prompting the paper industry to explore eco-friendly bleaching agents that reduce the reliance on chlorine-based chemicals. Despite these shifts, the effectiveness and cost-efficiency of chlorine dioxide produced from sodium chlorate in bleaching make it a staple in the industry for the foreseeable future.

Driving factors for the growth of the sodium chlorate market include the increasing global demand for paper and paperboard products, driven by factors such as urbanization, changes in consumer lifestyles, and the rise of e-commerce. Moreover, the growing agriculture sector contributes to the demand for sodium chlorate as an herbicide. Its effectiveness in controlling unwanted vegetation in non-agricultural settings bolsters its use in forestry and land management applications. Additionally, the chemical industry utilizes sodium chlorate in various applications, including the production of perchlorates and as an oxidizing agent, further diversifying its usage and supporting market growth.

However, the market also faces certain challenges. The production of sodium chlorate is energy-intensive, leading to significant operational costs that can constrain market growth. Moreover, stringent environmental regulations regarding the production and disposal of chemical byproducts and the push for sustainable practices in industrial operations can affect the growth dynamics.

Manufacturers and stakeholders in the sodium chlorate market are increasingly investing in research and development to improve production processes and develop environmentally friendly alternatives that comply with global regulations. Looking ahead, the future growth opportunities for the sodium chlorate market appear promising, particularly with technological advancements and innovation in production techniques. There is potential for the development of new applications of sodium chlorate in various industries, including water treatment and energy storage systems.

The ongoing research into eco-friendly and efficient methods of producing chlorine dioxide could also revitalize the market, ensuring compliance with environmental standards while maintaining cost efficiency. Furthermore, expansion in emerging markets and regions with growing industrial activities offers new avenues for growth and market expansion. The ability of industry players to navigate regulatory landscapes and adapt to shifting market demands will be crucial in capitalizing on these opportunities and sustaining long-term growth in the global sodium chlorate market.

Make confident decisions using our insights and analysis. Request a PDF Sample Report@ https://market.us/report/sodium-chlorate-market/free-sample/

Key Takeaways

• Market Size and Growth: The global Sodium Chlorate Market is projected to grow from USD 3.6 billion in 2023 to approximately USD 6.0 billion by 2033, at a CAGR of 5.2% during the forecast period.

• The crystalline form of sodium chlorate held a dominant market position, capturing more than a 63.4% share.

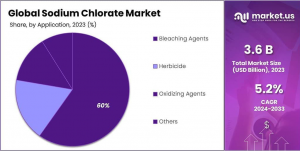

• Bleaching Agents: Dominates with over 60.3% market share in 2023, crucial for producing high-quality paper products by removing lignin.

• Paper & Pulp Industry: Leads with a market share of 73.3% in 2023, driven by sodium chlorate’s role in paper bleaching processes.

• Indirect Sales: Predominant with a market share of 63.4% in 2023, facilitated by distributors reaching diverse industries globally.

• Asia Pacific: Leads with a market share of 43.5%, expected to reach USD 1.6 billion by the forecast period end, driven by robust adoption in key sectors like pulp and paper.

Sodium Chlorate Top Trends

1. Sustainability Focus: The sodium chlorate industry is increasingly adopting sustainable production practices. There is a significant push towards using closed-loop electrolytic processes which reduce environmental impacts by optimizing energy use and minimizing waste. This trend is driven by stringent environmental regulations and a growing emphasis on eco-friendly manufacturing processes.

2. Technological Advancements: Manufacturers are integrating advanced technologies such as artificial intelligence (AI) and the Internet of Things (IoT) to enhance operational efficiencies and product quality. These innovations help in improving the precision and efficiency of sodium chlorate production processes.

3. Expansion in Emerging Markets: The demand for sodium chlorate is expanding in emerging markets, particularly in Asia-Pacific, due to the growth of local industries such as paper and pulp. Increased industrial activities in these regions are driving the need for more sodium chlorate, which is used extensively as a bleaching agent in paper manufacturing.

4. Diversification of Applications: Sodium chlorate's use is diversifying beyond the traditional pulp and paper sector. It is being increasingly used in other applications such as in the production of dyes and as an oxidizing agent in chemical syntheses. This trend is expanding the market and opening new avenues for growth.

5. Eco-friendly Bleaching Methods: There is a noticeable shift towards the use of eco-friendly bleaching methods in the pulp and paper industry. Sodium chlorate is crucial in the production of chlorine dioxide for elemental chlorine-free (ECF) bleaching, aligning with the industry’s move towards more sustainable practices.

To Get Moment Access, Buy Report Here: Score Up to 30% Off! https://market.us/purchase-report/?report_id=122504

Key Market Segments

By Form

In 2023, the Crystalline form of sodium chlorate dominated the market, capturing more than 63.4% of the share. Its popularity is driven by its high purity and stability, essential for applications like bleaching in the paper and pulp industry. The crystalline form is highly soluble in water, enhancing its efficiency and effectiveness in industrial processes.

On the other hand, the Amorphous form, though less common, serves niche applications that require finer granularity. It is primarily used in specialized chemical syntheses and certain industrial applications, where its unique physical properties offer distinct advantages. Despite its smaller market share, amorphous sodium chlorate plays a crucial role in high-precision processes.

By Application

In 2023, Bleaching Agents held a commanding market share of over 60.3%. This dominance can be attributed to sodium chlorate's essential role in the paper and pulp industry, where it is used for bleaching wood pulp to produce high-quality white paper. As global consumption of paper and textiles increases, the demand for effective bleaching agents remains strong.

Herbicides represented a significant application, capturing approximately 25.2% of the market. Sodium chlorate’s effectiveness as an herbicide is valued in both agricultural and non-agricultural settings. It disrupts the photosynthesis process in plants, leading to vegetation control in industrial sites and along transportation routes.

Oxidizing Agents accounted for around 10.1% of the market share. Sodium chlorate is an essential oxidizing agent in chemical reactions, facilitating processes like dye-making and the synthesis of chemicals. It is also critical in the manufacture of explosives, where it supplies the oxygen required to sustain combustion.

By End-Use

The Paper & Pulp Industry dominated the sodium chlorate market in 2023, holding over 73.3% of the share. Sodium chlorate is indispensable in this sector for producing high-quality white paper, as it helps break down lignin in wood, which is responsible for the darkness of raw paper. This process is crucial for a wide range of paper products, driving consistent demand within the industry.

The Chemical Industry is the second-largest end-user, accounting for approximately 12.8% of the market. In this sector, sodium chlorate’s strong oxidizing properties are vital for producing chemicals such as perchlorates and chlorites, which are used in a variety of applications, including safety matches, dyes, and explosives.

In the Mining Industry, sodium chlorate is utilized as an oxidant in the extraction of metals like uranium, holding about 8.4% of the market share. Its ability to release oxygen makes it an effective agent in breaking down ores, improving the efficiency of extraction processes.

By Distribution Channel

In 2023, Indirect Sales held a dominant position, with over 63.4% of the market share. This channel's strength lies in the network of distributors and resellers who help sodium chlorate manufacturers reach diverse industries such as paper, chemicals, and mining. Indirect sales provide broad market access and are particularly advantageous in reaching geographically dispersed customers.

Direct Sales, while smaller, accounted for about 36.6% of the market share. This distribution method is favored by large industrial consumers, such as paper mills and chemical plants, who require bulk quantities of sodium chlorate. Direct sales offer closer relationships between producers and key customers, often leading to more customized service and better supply chain management.

Key Market Segments List

By Form

• Crystalline

• Amorphous

By Application

• Bleaching Agents

• Herbicide

• Oxidizing Agents

• Others

By End-use

• Paper & Pulp Industry

• Chemical Industry

• Mining Industry

• Others

By Distribution Channel

• Direct Sales

• Indirect Sales

Regional Analysis

The Asia Pacific region led the global sodium chlorate market in 2023, holding a dominant share of 43.5%. This growth is driven by increasing demand across industries like pulp and paper, water treatment, and chemical manufacturing in countries such as China, India, Japan, and South Korea. The region’s emphasis on sustainability and adherence to stringent environmental regulations further supports its leading position.

In North America, the sodium chlorate market is steadily expanding, driven by increasing demand in the pulp and paper sector, herbicides, and specialty chemicals. The region benefits from a strong industrial infrastructure and advancements in chemical applications, contributing significantly to market growth.

Regulations On the Sodium Chlorate Market

1. Environmental Regulations: Sodium chlorate production is subject to strict environmental regulations due to its high toxicity and potential environmental hazards. Manufacturers must comply with emissions standards related to air and water quality, particularly concerning the release of chlorine and other byproducts during production. Compliance with local and international environmental protection laws is essential to prevent pollution and ensure sustainable operations.

2. Occupational Safety and Health Standards: Sodium chlorate is considered hazardous due to its oxidizing properties, which can pose risks to workers in manufacturing plants. Regulatory agencies, such as OSHA in the U.S., require safety protocols for handling, storage, and transportation. These include personal protective equipment (PPE), ventilation systems, and emergency response plans to minimize the risks of exposure to harmful chemicals.

3. Hazardous Chemical Classification: In many countries, sodium chlorate is classified as a hazardous substance under various national chemical safety laws. It requires proper labeling, handling, and storage by the Globally Harmonized System (GHS) of Classification and Labeling of Chemicals. This ensures that workers and end-users are aware of the risks associated with its use.

4. Transportation and Packaging Regulations: Due to its classification as an oxidizing agent, sodium chlorate is subject to strict transportation regulations. It must be transported using approved carriers and packaging that meets safety standards. These regulations aim to reduce the risk of accidental reactions during transit, especially in the case of spills or exposure to incompatible substances.

5. End-Use Restrictions: Certain regions impose restrictions on the use of sodium chlorate, especially in agricultural applications. For instance, its use in herbicides is regulated to ensure that it does not negatively affect non-target plants or wildlife. There may be specific guidelines for its application in non-agricultural settings to minimize environmental and health risks.

Key Players

• Arkema

• Chemtrade

• CHG

• China First Chemical Holdings

• ERCO

• Ercros

• Hunan Hengguang Chemical

• Inner Mongolia Lantai Industrial

• Kemira

• Lianyungang Xingang Chemical

• Nouryon

• Sanxiang Electrochemical

Conclusion

The global Sodium Chlorate Market continues to play a vital role in industries such as paper and pulp, chemicals, and agriculture. Its dominant use in bleaching processes, particularly for paper products, remains the key driver of demand. As industries evolve, there is a growing emphasis on sustainable and environmentally friendly production methods, which will likely shape the future of sodium chlorate manufacturing. Although challenges such as stringent regulatory requirements and rising environmental concerns exist, the market shows significant growth potential, especially with advancements in production technology and expanding applications across various sectors. As demand continues to rise, particularly in emerging markets, the sodium chlorate industry is poised for steady growth, with opportunities for innovation and adaptation to meet both industry needs and environmental standards.

Lawrence John

Prudour

+91 91308 55334

Lawrence@prudour.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.