Balancing Company Flexibility with Shareholder Expectations

KEY TAKEAWAYS

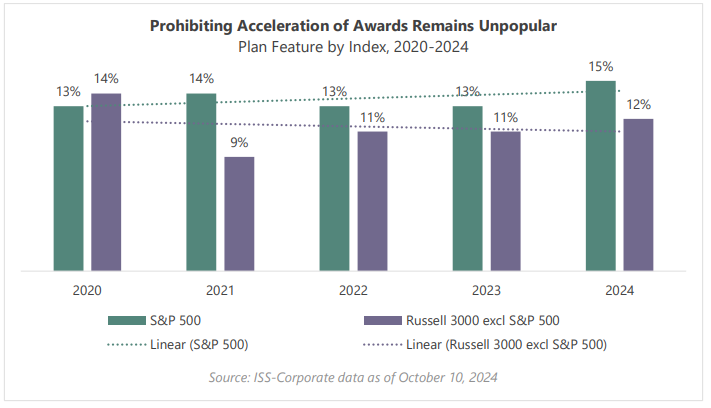

- No more than 15% of equity plans on the ballot over the past five years limit the plan administrator’s capacity to accelerate awards.

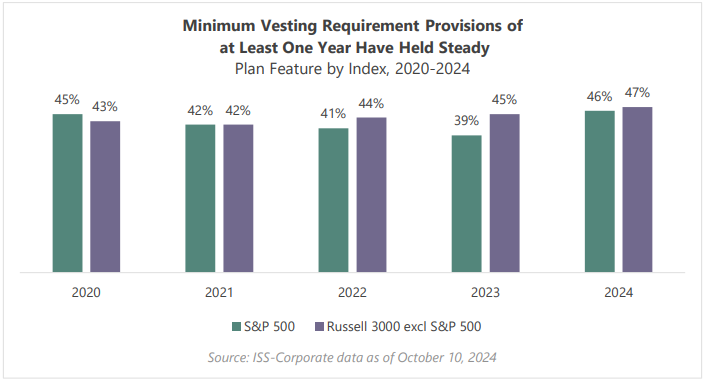

- Companies’ inclusion of Minimum Vesting Requirements within their plans has remained consistent. Over the past five years, four out of 10 equity plan proposals contain minimum vesting provisions.

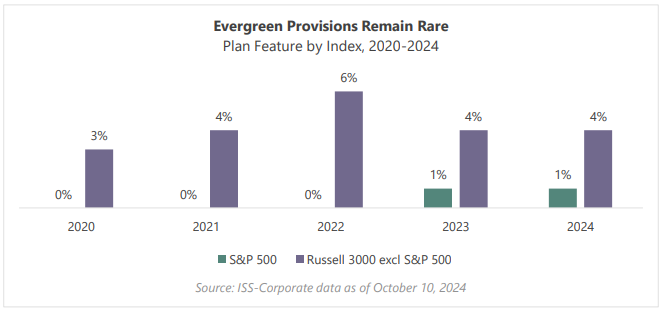

- Although considered a problematic practice, there was a 5% increase in plan proposals with evergreen provisions within the Russell 3000 index in 2023.

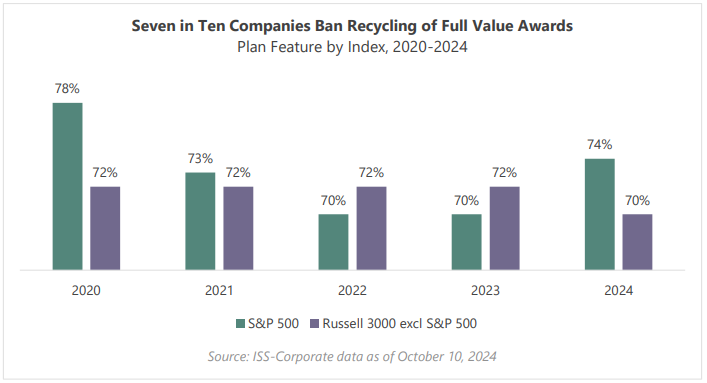

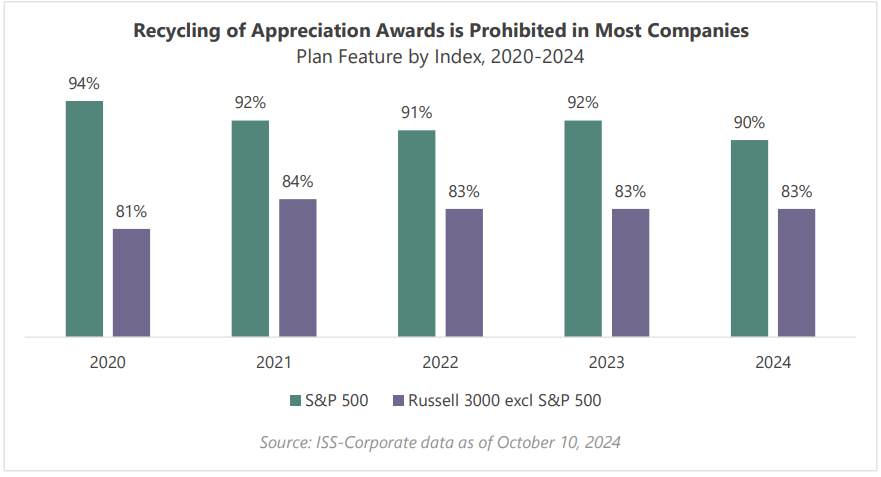

- The prevalence of S&P 500 companies prohibiting the liberal share recycling of full value awards has decreased from 78% in 2020 to 70% in 2023. The same trend was observed for the liberal share recycling of appreciation awards, which decreased from 94% in 2020 to 90% in 2024.

Equity plans serve as a vital mechanism for attracting executives and employees and retaining current talent. However, equity compensation results in a transfer of wealth from existing shareholders to employees and can dilute shareholders’ stake in a company. Amending or approving an equity plan requires shareholder approval, and investors may push back on poorly designed plans.

Equity plan design and its underlying governance features have evolved over time, reflecting investor preferences as well as the desire of compensation committees to have flexibility in administering these plans. This report delves into equity plan features and examines key trends observed over the past five years.

In particular, we examined the following features:

- Minimum Vesting Requirement (MVR)

- Payment of dividends and dividend equivalents on unvested awards

- Limits to the administrator’s capacity to accelerate awards

- Liberal share recycling

- Vesting conditions upon a change in control

- Repricing and cash buyouts

- Evergreen

Every year, an average of 23% of S&P 500 companies and 26% of Russell 3000 companies (excluding the S&P 500) seek shareholder approval for an equity plan. Multiple factors converge in the design of these equity plans, and companies often introduce or remove features to balance shareholder and company interests.

Minimum Vesting Requirement (MVR)

The Minimum Vesting Requirement (MVR) feature sets a waiting period before awards vest or the recipients are allowed to take ownership of the awards granted. Shareholders in general find this to be a good governance practice because it aligns the interests of the recipients with those of shareholders.

Despite modest growth in recent years, nearly half of companies mandate a minimum vesting requirement. Companies that refrain from including this feature argue that it would reduce their plan’s flexibility, particularly when designing new hire grants or make whole grants, when the company deems that vesting is not required.

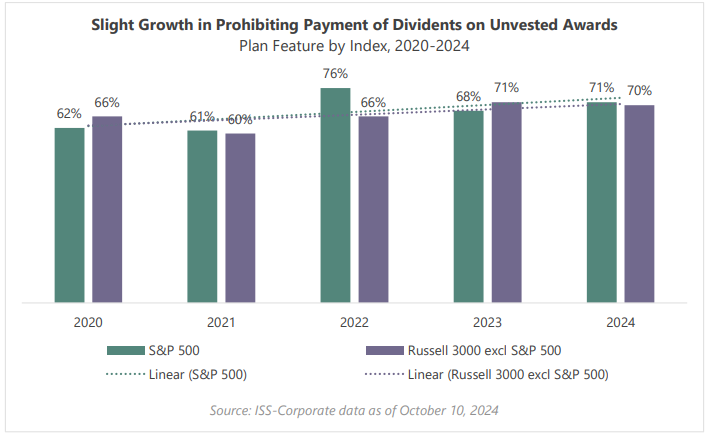

Payment of Dividends on Unvested Awards

Distributing dividends before an award vests may draw criticism from shareholders as a premature benefit for recipients. This practice increases risk, particularly if the underlying awards are forfeited after the dividends have already been paid.

As of 2024, about seven in 10 companies prohibit the payment of dividends on unvested awards. Notably, there was a spike to 76% among S&P 500 companies with equity plans on the ballot containing this provision in 2022. This uptick could be attributable to companies wanting to adopt shareholder-friendly plan features in the midst of market uncertainty following the COVID-19 pandemic.

Limits to the Administrator’s Capacity to Accelerate Awards

The authority to accelerate awards is usually held by plan administrators to allow for discretionary adjustments under specific circumstances (i.e., retirement or voluntary termination). Shareholders often prefer to have guardrails over the administrator’s power to modify the awards while companies prefer to retain this capacity to preserve flexibility.

Limiting the option to accelerate awards remains unpopular among most companies. As of 2024, only 15% of S&P 500 and 12% of the remaining Russell 3000 prohibit the acceleration of awards beyond cases of death or disability. Over the past five years, limiting the ability of the plan administrator to accelerate awards remained consistently below 20% among all companies. Although it is still the second least prevalent plan provision among companies, behind the evergreen clause, this year represents the largest annual increase in the adoption of this feature since 2021.

Liberal Share Recycling

Share recycling extends the share reserve by allowing shares to be utilized multiple times to deliver value to participants. However, adding “used” [1] shares back into to the share reserve is problematic for investors as it represents an increase in the economic cost of the plan and potential dilution.

Liberal share recycling can apply to both full value awards and/or appreciation awards (e.g., options). The number of companies prohibiting liberal share recycling for full value awards is on the decline from 78% in 2020 to 74% in 2024 for the S&P 500. The remainder of the Russell 3000 has been steadier over the same period and now stands at 70% of companies.

Generally, investors and proxy advisors take the view that recycling appreciation awards creates more economic cost than the recycling of full value awards. For this reason, companies more strictly prohibit share recycling on appreciation awards than on full value awards. Over the last five years, nine of every 10 equity plans among S&P 500 companies banned this feature for appreciation awards compared to seven in 10 companies in the same index prohibiting share recycling on full value awards.

Change in Control Vesting

Several outcomes may occur when control over the company changes, such as the automatic acceleration of vesting, assumption of the awards by the surviving entity, or acceleration if the awards are not assumed. Investors generally favor a double-trigger mechanism, whereby vesting occurs only after both the change in control and involuntary termination of the participants. Automatic acceleration of the equity awards without a corresponding termination can raise concerns among investors, as it allows executives to retain their positions and vested awards, which would be costly for the company and the shareholders. Some investors advocate transparent and specific disclosures that clearly outline how time-based and performance-based equities should be treated upon a change in control.

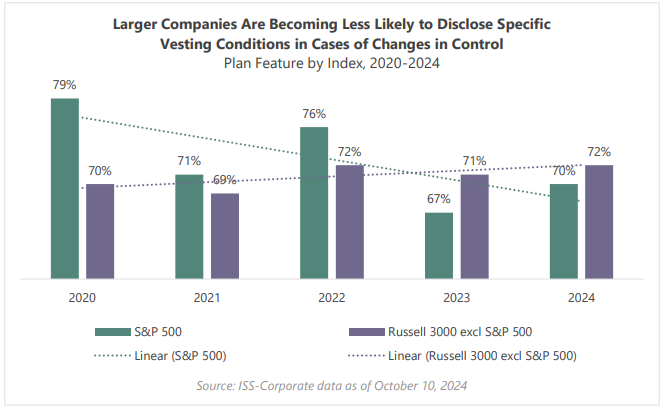

Over the past years, the disclosure of vesting in the event of a change in control has improved in terms of specificity and transparency. In 2024, 70% of S&P 500 and 72% of rest of the Russell 3000 with plans on ballot disclosed specific treatment for outstanding time-based and performance-based awards upon change in control.

A five-year lookback reveals a downward trend in such disclosures for S&P 500 companies while the remaining Russell 3000 companies are slightly more willing to include this feature in their equity plans.

Repricing and Cash Buyouts

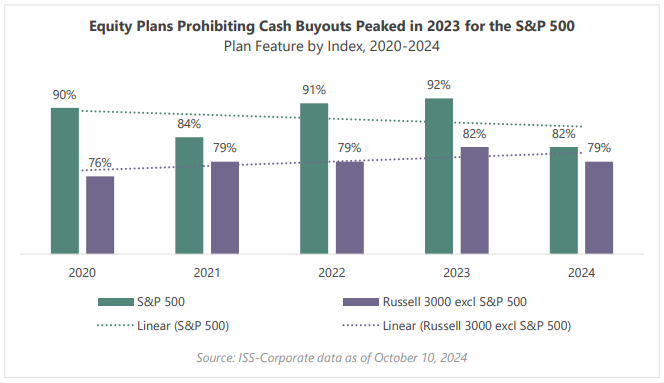

Some equity plans permit the administrator to adjust, exchange or repurchase outstanding underwater appreciation awards to provide value to the holder. Repricing occurs when companies adjust outstanding stock options to lower the exercise price or cancel underwater options to re-grant new awards. Companies can also exchange underwater stock options for cash (cash buyouts). These practices are considered problematic by investors as they bring along additional costs to the company and potentially create a misalignment between participants’ and shareholders’ interests. There is a notable year-over-year decrease in the prevalence of companies prohibiting repricing, from 95% in 2023 to 89% in 2024 for the S&P 500, although the five-year trend for repricing banning is flat across the remainder of the Russell 3000.

Evergreen

Evergreen features automatically allocate additional shares to the equity plan reserve after a given period. Investors generally oppose this practice as it dilutes the ownership percentage of shareholders. Although considered a problematic provision, or even a deal breaker by some proxy advisors, evergreens are slightly more present in equity plans on the ballot than they were just five years ago. Even after the increase, they are present in just 1% of equity plan proposals among S&P 500 companies. Companies should weigh whether it is beneficial to adopt an evergreen provision given that many investors oppose equity plans with excessive dilution. This can also be considered an overriding factor for proxy advisors, whereby including this provision could result into an automatic adverse vote recommendation on the proposal.

Next Steps: Identifying Suitable Plan Features

Over the years, companies of all sizes have sought to balance their desire to select shareholder-friendly equity plan features while also addressing other company interests. Companies should consider benchmarking their own practices against their peers and examining recent trends on the adoption, prevalence, and success of each feature. Furthermore, companies may find differences across industries and should aim to identify and adopt only the practices that are best suited to the business environment in which they operate.

If you are a current client of ISS-Corporate, please speak with your advisor to pull this data from the Equity Plan Benchmarking tool on the Compass platform.

1“Used” shares can be:

- shares tendered or withheld as payment for an option exercise

- shares tendered or withheld as payment for taxes

- shares repurchased by the company using stock option proceeds

- shares not issued in the net-settlement of stock appreciation awards(go back)

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.