Variable life Insurance Market Booming Worldwide with Major: Allianz, Ping An Insurance, Zurich Insurance

Stay up to date with Variable life Insurance Market research offered by HTF MI. Check how key trends and emerging drivers are shaping this industry growth.”

Key Players in This Report Include:

Allianz (Germany), AXA SA (France), Generali (Italy), Ping An Insurance (China), Aflac (United States), Prudential PLC (United Kingdom), Munich Re (Germany), Zurich Insurance (Switzerland), Nippon Life Insurance (Japan), Japan Post Holdings (Japan) are some of the key players that are part of study coverage. Additionally, the players who are also part of the research coverage are Berkshire Hathaway (United States), Metlife (United States), Manulife Financial (Canada), Chubb (Switzerland), AIG (United States).

Download Sample Report PDF (Including Full TOC, Table & Figures) https://www.htfmarketintelligence.com/sample-report/global-variable-life-insurance-market?utm_source=Saroj_EINnews&utm_id=Saroj

Definition:

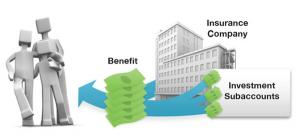

Variable life insurance is a type of permanent insurance coverage that includes an investing component. Unlike standard life insurance policies, where the cash value rises at a fixed interest rate, variable life insurance allows customers to invest premiums in a variety of investment options, most commonly mutual funds. Furthermore, the performance of the policy's cash value is determined by the profitability of chosen assets. If assets perform well, cash value increases dramatically, resulting in a greater death benefit and more funds for withdrawals or loans. However, if assets underperform, cash value falls, lowering the policy's overall value.

Market Drivers:

• increased financial awareness, customization, and flexibility

Market Opportunities:

• adoption of technology and product innovation

Major Highlights of the Variable life Insurance Market report released by HTF MI:

According to HTF Market Intelligence, the Global Variable life Insurance market to witness a CAGR of 6.1% during forecast period of 2024-2030. The market is segmented by Global Variable life Insurance Market Breakdown by Type (Variable Universal Life Insurance, Indexed Variable Life Insurance) by End User (Individuals, Businesses) by Distribution Channel (Tied Agents, Banks, Direct Sales, Brokers, Independent Financial Advisors, Online Platforms) and by Geography (North America, South America, Europe, Asia Pacific, MEA).

Global Variable life Insurance market report highlights information regarding the current and future industry trends, growth patterns, as well as it offers business strategies to help the stakeholders in making sound decisions that may help to ensure the profit trajectory over the forecast years.

Buy Now Latest Report Edition of Variable life Insurance market @ https://www.htfmarketintelligence.com/buy-now?format=3&report=11897

Geographically, the detailed analysis of consumption, revenue, market share, and growth rate of the following regions:

• The Middle East and Africa (South Africa, Saudi Arabia, UAE, Israel, Egypt, etc.)

• North America (United States, Mexico & Canada)

• South America (Brazil, Venezuela, Argentina, Ecuador, Peru, Colombia, etc.)

• Europe (Turkey, Spain, Turkey, Netherlands Denmark, Belgium, Switzerland, Germany, Russia UK, Italy, France, etc.)

• Asia-Pacific (Taiwan, Hong Kong, Singapore, Vietnam, China, Malaysia, Japan, Philippines, Korea, Thailand, India, Indonesia, and Australia).

Objectives of the Report:

• -To carefully analyze and forecast the size of the Variable life Insurance market by value and volume.

• -To estimate the market shares of major segments of the Variable life Insurance market.

• -To showcase the development of the Variable life Insurance market in different parts of the world.

• -To analyze and study micro-markets in terms of their contributions to the Variable life Insurance market, their prospects, and individual growth trends.

• -To offer precise and useful details about factors affecting the growth of the Variable life Insurance market.

• -To provide a meticulous assessment of crucial business strategies used by leading companies operating in the Variable life Insurance market, which include research and development, collaborations, agreements, partnerships, acquisitions, mergers, new developments, and product launches.

Have a question? Market an enquiry before purchase @ https://www.htfmarketintelligence.com/enquiry-before-buy/global-variable-life-insurance-market?utm_source=Saroj_EINnews&utm_id=Saroj

Points Covered in Table of Content of Global Variable life Insurance Market:

Chapter 01 – Variable life Insurance Executive Summary

Chapter 02 – Market Overview

Chapter 03 – Key Success Factors

Chapter 04 – Global Variable life Insurance Market – Pricing Analysis

Chapter 05 – Global Variable life Insurance Market Background

Chapter 06 — Global Variable life Insurance Market Segmentation

Chapter 07 – Key and Emerging Countries Analysis in Global Variable life Insurance Market

Chapter 08 – Global Variable life Insurance Market Structure Analysis

Chapter 09 – Global Variable life Insurance Market Competitive Analysis

Chapter 10 – Assumptions and Acronyms

Chapter 11 – Variable life Insurance Market Research Methodology

Get Discount (10-15%) on Immediate purchase 👉 https://www.htfmarketintelligence.com/request-discount/global-variable-life-insurance-market?utm_source=Saroj_EINnews&utm_id=Saroj

Key questions answered:

• How feasible is Variable life Insurance market for long-term investment?

• What are influencing factors driving the demand for Variable life Insurance near future?

• What is the impact analysis of various factors in the Global Variable life Insurance market growth?

• What are the recent trends in the regional market and how successful they are?

Thanks for reading this article; you can also get individual chapter-wise sections or region-wise report versions like America, LATAM, Europe, Nordic nations, Oceania, Southeast Asia, or Just Eastern Asia.

Nidhi Bhawsar

HTF Market Intelligence Consulting Private Limited

+1 5075562445

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.