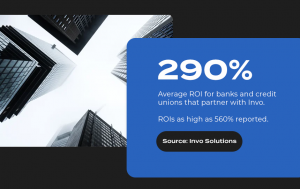

Invo Solutions reports estimated average ROI gains of 290% for clients

A recently published article by Invo Solutions reveals impressive Return On Investment (ROI) estimates for clients.

"At Invo, we are committed to holding up our end of the bargain," Martin said in the article. "Our clients invest in us, and we don't take that lightly. We want to deliver results and I think the data speaks for itself. Our clients average nearly $130,000 in annual full-time equivalent (FTE) savings through our product suite."

According to Martin, this dramatic ROI comes through "decreased wait times, centralized staffing, and increasing revenue through tools such as co-browsing." Among other data points, the post identifies an average 4-to-1 desk-to-agent ratio among Invo Solutions' clients, along with average wait times more than 90% lower than the national average. These numbers alleviate pain points in the industry, like a stagnant workforce, which Martin addressed as well.

"One thing I heard over and over in 2023 was how difficult it was for banks and credit unions to hire," Martin writes. "Our products are designed for these exact circumstances. Better yet, our products have proven not only to help understaffed branches maintain their level of service but to improve the customer experience without adding staff."

Invo Solutions offers many products to banks and credit unions, both digitally and in the branch. The post identified several of them, including the first-ever in-branch video banking solution Invo deployed over ten years ago. SMS text is one channel that Invo Solutions is dedicating significant resources towards in the coming years.

"We are not, and never will be, stagnant," Martin said. "In 2022, we identified SMS text as a significant need and are now working hard to provide every community bank and credit union with a texting platform that is powerful and budget-friendly."

Since 2012, Invo Solutions has created some of the industry's most dynamic digital tools, from video banking to two-way SMS text, co-browsing, and appointment scheduling. However, Martin identifies Invo's willingness to work with community banks and credit unions as what distinguishes them from other providers.

"We want to be known as the vendor that answers the phone," Martin writes, commenting on how tedious picking a technology vendor can be. "One frustration many financial institutions have with picking a vendor is how difficult it is to get the ball rolling. We want to be the vendor that hears your needs and is willing to work around your budget and circumstances."

To learn about Invo Solutions, visit their website or schedule a meeting today.

ABOUT INVO SOLUTIONS: Invo Solutions was founded in 2012 to develop the industry’s first video banking experience. Their staff combined for more than 75 years of industry experience and developed Invo within a financial institution to solve a unique problem in the industry. The customer engagement platform created by Invo Solutions continues to bridge the gap between physical and digital channels, creating even more ways for customers to reach their financial institutions.

Hope Solomon

Invo Solutions

+1 417-459-1360

email us here

Visit us on social media:

Facebook

LinkedIn

YouTube

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.