Recent Law Changes Make Small Employer-Sponsored Group Health Insurance Obsolete

Congress has made Small Employer-Sponsored Group Health Insurance Obsolete!

Recent changes in the law have significantly impacted small employers with group health insurance plans. Unfortunately, many of these employers are unaware that their current plans unintentionally prevent their employees and their dependents from accessing valuable tax credits amounting to tens of thousands of dollars. Thankfully, there's a much better solution available - ACA tax credits. These credits provide significant relief, helping both small business owners and employees reduce their insurance costs considerably. Personal portable health insurance becomes a more beneficial option for everyone. Additionally, the elimination of the family glitch simplifies the process, ensuring comprehensive coverage for all.

[Example 1]

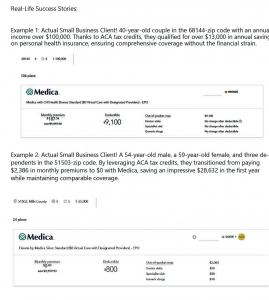

Actual Small Business Client, a 40-year-old couple living in the 68144-zip code, earning over $100,000 annually. Surprisingly, even with their higher income, they qualify for more than $13,000 in annual tax credits, allowing them to purchase personal, portable health insurance. This transformative solution not only grants them comprehensive coverage tailored to their needs but also eases the financial strain associated with traditional premiums. Now, the family's monthly insurance premiums for a Medica plan are only $187, making healthcare more accessible and affordable for them.

[Example 2]

Actual Small Business Client is a prime example of the benefits of ACA tax credits. The client, a 54-year-old male, a 59-year-old female, and three dependents residing in the 51503-zip code, faced exorbitant monthly premiums of $2,386 under their old BCBS Iowa plan. However, by leveraging ACA tax credits and switching to a new individual plan with Medica, their monthly premiums have been reduced to $0. They receive generous monthly ACA tax credits of $3,167 covering 100% of the family coast leading to astounding first-year client savings of $28,632 - all while maintaining comparable coverage.

With ACA tax credits, small employers no longer bear the weight of high health insurance premiums, allowing the economy to thrive. Clients who have utilized these credits saved a substantial amount while maintaining comparable coverage. Small employers can now celebrate as they can step back from managing health insurance and focus on more critical tasks. HR departments can dedicate efforts to employee development, talent acquisition, and fostering a positive work environment, thanks to ACA tax credits. This newfound flexibility and affordability empower businesses to invest in growth and innovation. Employees gain empowerment by choosing health insurance plans that suit their needs, leading to greater financial freedom and workforce mobility. ACA tax credits not only alleviate financial burdens but also open up new possibilities for businesses and employees, creating a path towards a healthier and more prosperous future.

Employers wanting more information on available tax credits can shop and explore examples at the following website: https://www.healthsherpa.com/?_agent_id=lee-benham. This free quote platform offers a user-friendly experience, allowing employers to get estimated ACA tax credits. Discover the benefits of ACA tax credits by calling Lee Benham (402) 312-4555 today and take a step towards building a healthier and more prosperous future for your business and employees.

https://www.healthinsurance.org/obamacare/beware-obamacares-subsidy-cliff/

https://www.healthaffairs.org/content/forefront/irs-revises-family-glitch-rule-ahead-2023-open-enrollment-period

https://www.kff.org/faqs/faqs-health-insurance-marketplace-and-the-aca/my-family-and-i-are-offered-health-benefits-through-my-job-but-we-cant-afford-to-enroll-my-employer-pays-100-of-the-premium-for-workers-but-contributes-nothing-toward-the-cost-of-adding-my/

Lee Benham

Anthem Insurance Services

+1 402-312-4555

email us here

Visit us on social media:

Facebook

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.