Flatlining operational performance a worry for A/NZ Financial Services businesses

Latest OpsTracker data from ActiveOps shows operations leaders are not leveraging available capacity

ActiveOps (LSE:AOM)

A/NZ continues to be the top performing region. However, the flatlining in overall performance in the first quarter might be a signal that further gains will be a struggle to achieve.”

SIDNEY, AUSTRALIA, May 18, 2023/EINPresswire.com/ -- — Jane Lambert, Managing Director APAC at ActiveOps

-Australian and New Zealand-based financial service organisations struggle to make further productivity gains as capacity is being squandered

-Businesses need to direct their attention on unleashing capacity and getting the best from their team

-However, A/NZ remains the highest performing region compared to UK and Ireland and North America

According to the latest research from ActiveOps, a leading management process automation company, organisations in Australia and New Zealand have seen their operational performance flatline in the first three months of 2023, halting the gains the region enjoyed in the wake of the pandemic.

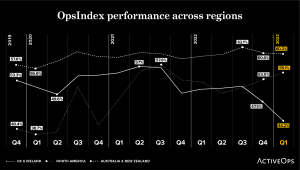

OpsTracker: The Performance Tracker for Operations in Financial Services Q2 report shows Australia and New Zealand’s overall OpsIndex score was stable at 60.3% in the opening quarter, though it remains higher than a year ago. The struggle to make further gains may cause some concern given there were already signs that capacity is being squandered and that operations leaders are unsure of how to get the most out of their teams. This is an area leaders will need to address over the coming months if they want to continue the upward trajectory of post-pandemic gains.

The OpsTracker report analyses insights from over 30,000 employees to identify the trends that are impacting operations at financial institutions across Australia and New Zealand, the UK and Ireland, and North America. This edition of the report reviews how operations teams have been navigating the current environment and what they can do to improve operational performance over the coming months.

ActiveOps’ OpsIndex score seeks to assess how well operations are being run across a range of metrics that matter most including: agility, control, effectiveness, efficiency, and focus. The relationship between how well organisations are faring across these metrics can give leaders unique insight, regardless of the types of applications or processes they implement—into which metrics they need to improve on or adapt to better run their operations.

As organisations attempt to revive a sense of normalcy in the wake of the COVID-19 pandemic, external events continue to disrupt the operating environment. Financial institutions went into the year already contending with the challenges caused by high inflation, rising interest rates and fears of recession. With the collapse of Silicon Valley Bank in March sparking a fresh crisis in the global banking market, the outlook has become even more uncertain. That is making it a challenge even for the best performing operations teams to plan effectively as the volume of inbound work becomes more volatile and forecasting becomes trickier.

Jane Lambert, Managing Director APAC at ActiveOps says: “The economic backdrop in Australia is more positive than some other regions as the Reserve Bank has paused interest rate rises, giving respite to homeowners and the International Monetary Fund expects Australia’s economy to expand 1.6% this year, avoiding the recession predicted for other advanced economies.”

Lambert continued: “This is translating into operational performance, as A/NZ continues to be the top performing region. However, the flatlining in overall performance in the first quarter might be a signal that further gains will be a struggle to achieve. Operations teams were already showing signs of wasted capacity and now productivity, as measured by work out per paid hour, is starting to dip. If that rebounds over the coming quarter, it could be attributed to a seasonal drop over the summer period but if work out per paid hour continues to decline, the problem may be deeper seeded and will be something to watch in the months ahead. For now, financial services companies in A/NZ need to continue to focus their attention on unleashing capacity and getting the best from their employees.”

To read a copy of the full report please go to: www.activeops.com/opstracker.

[END]

OpsTracker Methodology

The Quarterly ’Performance Tracker for Operations’ is based on the OpsIndex benchmarking data set from ActiveOps. OpsIndex analyses live operations data with valid measurement and comparison of performance across operations teams. OpsIndex measures operations using five dimensions—agility, control, effectiveness, efficiency, and focus. In addition, work out per paid hour looks at how much work is completed per hour of employee spend—including paid sick days and holidays.

For this report, data from over 30 financial services businesses with over 30,000 employees was analysed. We looked at the OpsIndex performance in Q1 2023 compared to the previous quarter and Q1 2022. The data covered organisations in Australia & New Zealand, the UK & Ireland, and North America.

About ActiveOps

We help operations teams do more with what they have. Operations teams in banks, insurance and healthcare businesses are constantly under pressure to reduce costs, drive up efficiency, all while trying to maintain a great customer experience.

This is easier said than done. Many have invested in all sorts of technology and process principles to help drive efficiency, but still find themselves struggling to meet SLAs and operational targets.

That’s where we come in – through our software and approach we help operations teams find capacity and enable them to use it much better.

The result – our clients typically see customer turnaround times increase significantly, including double-digit improvements in productivity with work in progress materially down. They can also leverage the capacity created to invest in non-core activity, as well as reduce levels of new recruitment.

Ultimately, our clients talk about how they are now in control of workload, rather than feeling reactive to it. That’s our aim and purpose.

For more information about ActiveOps, visit our website or follow our social channels on LinkedIn, Twitter and YouTube.

For additional information please contact:

Ellie Williams

Palermo PR

+61 409 533 337

ellie@palermopr.com.au

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.