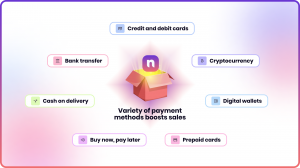

How a variety of provided payment methods boosts sales

Payment methods are a crucial aspect of any business, as they impact sales, customer satisfaction, and overall revenue.

Reaching a Broader Customer Base

Offering a variety of payment methods is an excellent way to reach a broader customer base. Customers have different preferences when it comes to payment methods, and by offering multiple options, businesses can cater to these preferences. For example, some customers may prefer to pay with a credit card, while others may prefer to use digital wallets or direct bank transfers. By offering multiple payment methods, businesses can attract and retain more customers.

Increased Customer Satisfaction

Providing a variety of payment methods can also increase customer satisfaction. Customers appreciate having the option to pay in a way that is convenient for them. Offering a range of payment methods also shows that the business is customer-focused and willing to accommodate their needs. Customers who are satisfied with their payment experience are more likely to return to the business and recommend it to others.

Improved Cash Flow

Offering a variety of payment methods can also improve cash flow for businesses. By providing more payment options, businesses can reduce the risk of payment delays or missed payments. For example, customers who prefer to pay with direct bank transfers can complete transactions more quickly, reducing the time it takes for businesses to receive payment. This can improve cash flow and help businesses to manage their finances more efficiently.

Competitive Advantage

Businesses that offer a variety of payment methods can gain a competitive advantage. Customers are more likely to choose a business that offers a convenient payment method that suits their needs. By offering more payment options than competitors, businesses can differentiate themselves and attract more customers. This can lead to increased sales, improved customer loyalty, and higher revenue.

Open Banking is a great addition to the range of payment methods. As Open Banking continues to evolve and mature, there are many opportunities for fintech developers to create innovative tools and services that can help consumers manage their finances more effectively. For example, by leveraging the financial data available through Open Banking, developers could create budgeting tools, financial management solutions, and cashflow analysis tools that can help consumers make better financial decisions and manage their money more effectively.

While the main focus of Open Banking has been on helping consumers make payments using direct bank transfers, there is certainly potential for the technology to be used for much more. As more banks and financial institutions embrace Open Banking, there will be a growing pool of data that developers can access and use to create new and innovative financial services.

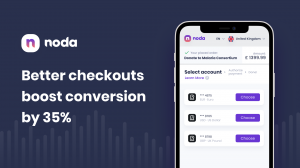

Noda's platform allows users to link their bank accounts, credit cards, and other financial accounts to a single dashboard. Users can then track their spending, create budgets, and receive personalised financial advice based on their spending habits. Noda's platform also enables users to make payments and transfers directly from their bank accounts, without the need for traditional payment methods.

In conclusion, providing a variety of payment methods is an excellent way to boost sales for businesses. Offering multiple payment options can help businesses reach a broader customer base, increase customer satisfaction, improve cash flow, and gain a competitive advantage. To maximise the benefits of multiple payment options, businesses should conduct market research to understand customer preferences and implement a range of payment methods that cater to these preferences.

Dana Lihotina

Noda

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.