Webb County Home Values are Slightly High in 2023

Webb County 2023 assessments are more consistent with recent property sales than many Texas counties, but still a bit high.

HOUSTON, TEXAS, UNITED STATES, May 9, 2023/EINPresswire.com/ -- Webb County homes are valued consistently with recent property sales. The median 2023 tax assessment is $205,688 versus a median time adjusted sales price of $201,450. The median level of assessment is 101.7% Stated differently, the typical home tax assessment exceeds the typical sales price by $4,238. The property taxes for $4,238 at 2.7% without exemptions would be $114.While it appears the Webb County Appraisal District is slightly high, the typical large Texas appraisal district that overshot market value, valued homes 8.7% higher than relevant home sales, based on an analysis by O’Connor of 1,640 Webb County home sales during January 2022 to March 2023.

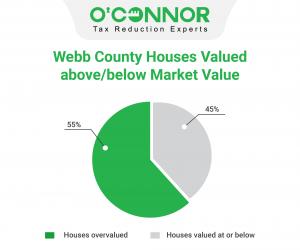

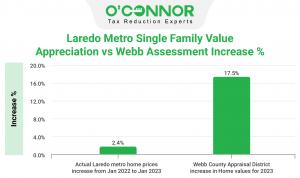

Tax assessments exceed market value for 55% of Webb County homes and are at or below market value for 45%, based on O’Connor’s analysis of Webb County homes sales and tax assessments. According to reports on home sale prices for the greater Laredo metro area, there is an increase of 2.4% from January 2022 to January 2023. However, when looking at home prices specifically in Webb County, these declined by 4.1% from January 2022 to January 2023. At the same time, Webb County home tax assessments rose by 17.5%. Webb County home prices increased during 2022 but were less volatile than many counties.

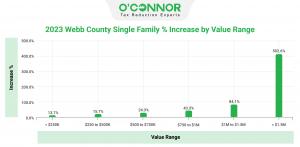

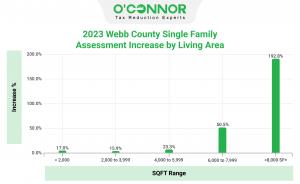

All Webb County homeowners have significant increases, but property valued over $1.5M has taken the brunt of the assessment increases, seeing an unbelievable surge of over 500%. Residential property owners with homes in the $1M to $1.5M range are also shocked with spikes of 84.1%. As one might expect, property in the higher value ranges is frequently larger in size. This is consistent with O’Connor’s findings that properties over 8,000 sq. ft. have taken the greatest jump in assessment value at 192.8% increase, with homes between 6,000 to 7,999 sq. ft. also seeing a 50.5% increase. Assessment increases are up across all age ranges of residential properties in Webb County, although homes built in 2001 and later have the greatest growth in assessed value.

Webb County property owners don’t have to accept this. If your assessment has increased, it is your right to appeal. Don’t pay more than your fair share. Record levels of property tax protest are expected to follow. The deadline to file a property tax protest is May 15th.

About O'Connor:

O’Connor is among the largest property tax consulting firms in the United States, providing residential property tax reduction services in Texas, Illinois, and Georgia, as well as commercial property tax reduction services across the United States. O’Connor’s team of professionals possess the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs more than 600 professionals worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™ . There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O'Connor, President

O'Connor

+1 713-375-4128

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

YouTube

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.