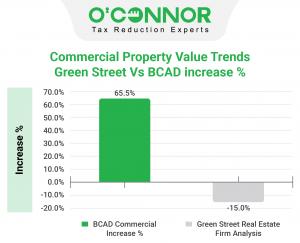

Brazoria County Assessments for Commercial Real Estate are up over 65%

Commercial property values are surging across the state of Texas, with Brazoria County leading the way.

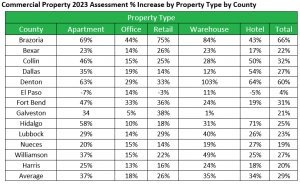

HOUSTON, TEXAS, UNITED STATES, May 5, 2023/EINPresswire.com/ -- Brazoria County Appraisal District (BCAD) proposed the highest increases in assessed value with an average increase of 65.5% for apartments, office, warehouse, retail, and hotel. The average increase for commercial is 29.4%, based on a study of 2023 property tax assessments by O’Connor for Brazoria, Bexar, Collin, Fort Bend, Hidalgo, Harris, Lubbock, Nueces, Williamson. Data will be provided for the top 30 counties as is becomes available and is analyzed.Brazoria County not only had the highest overall level of increase for commercial at 65.5%, but its level of increase is also double the average for nine counties. Furthermore, Brazoria County Appraisal District had the highest level of assessment increase for apartments (68.8%), office (43.7%), retail (75.1%), and warehouse (83.7%). Hidalgo County Appraisal District raised hotel property tax assessments by 70.6% but BCAD was second highest with hotel tax assessment increases of 42.7%.

There is a gap of over 80% between the estimated value of Brazoria County commercial property and the property assessments for 2023!

While the Brazoria County Appraisal District assessment increases for commercial properties are mammoth, they are inconsistent with the trends for commercial property values both in Brazoria County, Texas, and the U.S. Commercial real estate values plummeted in 2022 due primarily to large increases is capitalization rates. (Capitalization or cap rate move inversely with value. The higher the cap rate, the lower the value. The rates for 10-year treasuries rose from 1.76% to 3.55%. Cap rates increase when 10-year-treasuries increase.)

The volume of commercial real estate sales is off by 70 to 80% due to a chasm between the price buyers will pay and amount sellers will accept. Few commercial properties are selling other than distressed properties where the seller has no alternative.

Other factors affecting commercial property rates are higher insurance (especially in coastal areas), higher property taxes and generally higher costs due to inflation.

It is impossible to reconcile the massive increases in commercial property tax assessments in Brazoria County with the macroeconomic trends reducing real estate values.

Commercial property assessment values in Brazoria County are up over 100% for property built between 1961 and 1980.

Owners of Brazoria County commercial property of all value ranges are stunned with the increase in taxable value for 2023, but those with property valued between $1M and $5M, and those with property over $5M face the most extreme hikes of 67.7% and 66.1%, respectively.

Brazoria County owners of apartments built before 1960 are likely appalled to see assessed value increases of well over 200% or more than triple the previous values!

There is little humor in seeing that Brazoria County property owners of offices constructed between 1981 and 2000 received the most favorable assessments which ONLY increased by 32%.

Retail commercial owners in Brazoria County with property built between 1961 and 1980 are not amused to see assessed value increases over 137%.

Increased assessed value for commercial warehouse properties in Brazoria County are comically high for all ranges of years built, with the lowest at over 70% for properties constructed before 1960.

Brazoria County medical office assessed values went up by 30.3%, while regular office property rose by 47.2%.

Retail property assessments for 2023 are the most pronounced for Brazoria County neighborhood shopping centers with values up over 107%!

Mini warehouses are up in assessed value by almost 85%!

The protest deadline is May 15, 2023. Protest now to be certain you don’t miss the deadline. There are three steps to the appeal process: informal, formal or appraisal review board, and judicial. O’Connor expects record reduction in Brazoria County tax assessments for 2023.

If you are a commercial property owner in Brazoria County and your assessment has increased, you do not have to accept the new appraisal value, it is your right to appeal. Don’t pay more than your fair share. Record levels of property tax protest are expected to follow. The deadline to file a property tax protest is May 15th.

About O'Connor:

O’Connor is among the largest property tax consulting firms in the United States, providing residential property tax reduction services in Texas, Illinois, and Georgia, as well as commercial property tax reduction services across the United States. O’Connor’s team of professionals possess the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs more than 600 professionals worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™ . There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O'Connor, President

O'Connor

+1 713-375-4128

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

YouTube

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.