Montgomery County Tax Assessments for Median Home Over Market Value; Potential Extra Property Tax of $394

Two-thirds of Montgomery County homes are over valued in 2023. If assessments are not appealed, this can lead to additional taxes for homeowners.

HOUSTON, TEXAS, UNITED STATES, May 4, 2023/EINPresswire.com/ -- The median Montgomery County home tax assessment for 2023 is $335,860 versus a median time adjusted sales price of $321,250. The difference is $14,610 or 4.5% higher. The extra property taxes for the median Montgomery home is estimated at $394, before property tax protests, exemptions and tax rate compression.Two-thirds of Montgomery County Homes Over-Valued in 2023

The deadline to file a property tax protest is May 15th. Given the high level of assessment, most owners who protest will receive property tax relief.

2023 is Historic Year for Property Taxes for Texas Homes

Never before since Texas became a state in 1845 have most houses been assessed over market value. Individual tax entities did their own assessments until about 1980 and were substantially below market value. Appraisal districts were introduced in ~1980 to accurately and equitably assess real and personal property. Historically Texas homes were assessed at 93 to 99% of market value. Rarely was the median or typical value for a county in excess of 100%. Never before have most counties valued homes at over 100% of market value. Only 3 of 18 counties have assessed the median home below the median time adjusted sales price, based on a review of sales and tax assessments in each county by O’Connor. Home sales from January 2022 to March 2023 were included and total 13,853 sales.

The single-family median sale price in Montgomery County peaked at $375,000 in June of 2022, but by January 2023, the median sale price had dropped to $321,250. Property assessments in Montgomery County were up across the board for all value ranges of residential property, with increases from 12.3% to 14.5%. Montgomery County single-family assessments increased the most for homeowners in property under 2,000 sq. ft. with an increase pf 14.5%.

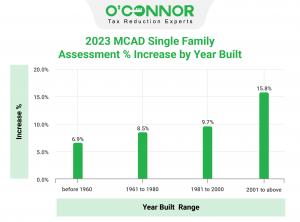

There is a 12% gap in the change in Montgomery County single-family value appreciation and the increase in Houston area home sales from January 2022 to January 2023. Residential property owners of homes built since 2001 face the most escalation in assessment value at 15.8%.

The property tax protest deadline is May 15th. Unless you protest the “proposed” or “noticed value” will be FINAL. In most years, about two-thirds of protests generate a lower value. The portion of protests that reduce the assessors value is expected to be higher in 2023 because: 1) never before have home values been over-stated across the state and 2) evidence simply will not support the 2023 estimated tax assessments in most cases.

About O'Connor:

O’Connor is among the largest property tax consulting firms in the United States, providing residential property tax reduction services in Texas, Illinois, and Georgia, as well as commercial property tax reduction services across the United States. O’Connor’s team of professionals possess the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs more than 600 professionals worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™ . There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O'Connor, President

O'Connor

+1 713-375-4128

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

YouTube

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.