Collin County homeowners may pay extra $236 in property taxes in 2023.

The typical Collin County home that is overvalued by $8,759 will be subject to around $236 in excess property taxes based on a tax rate of 2.7%.

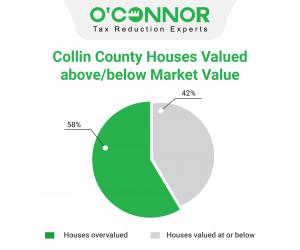

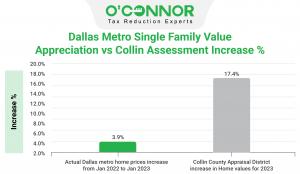

DALLAS, TEXAS, UNITED STATES, April 26, 2023/EINPresswire.com/ -- Collin County over-shot valuing houses at 100% of market value, with a typical level of 101.9% of market value. This means the typical Collin County home is over-valued by $8,759, or 1.9%, based on a study of Collin County home sales by O’Connor. The excess property taxes would be $236 per homeowner, before tax protests, exemptions, or tax rate compression.Collin Central Appraisal District raised home values by a whopping 17.4% versus the 3.9% level of increase reported by the North Texas Association of Realtors®. It is surprising only 58% of houses are over-valued given the disparity between the increase in tax assessments and the increase in value reported by area Realtors.

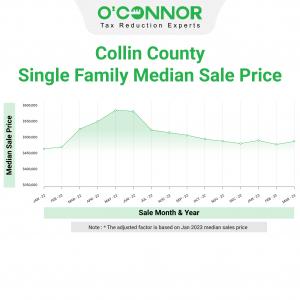

The median sale price of single-family homes in Collin County are slightly higher in January 2023 than in January 2022, but they have come down significantly since the peak in May/June of 2022.

Collin County homes under $250K received the highest assessment percent increase at over 27% when compared with all residential property value ranges.

Larger homes, specifically residential property over 8,000 sq. ft. increased in assessed value by over

22%, the most among all home sizes.

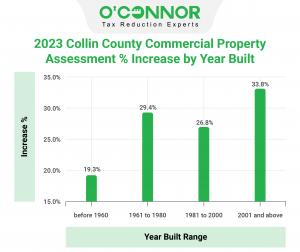

Collin County assessment increases are most pronounced for homes built in 2001 or more recently at an increase of 19.2%. The next highest increase is seen in homes constructed prior to 1960, where the increase is over 17%.

Property Owners in Collin County do not have to accept the new appraisal value, it is your right to appeal. Don’t pay more than your fair share. Record levels of property tax protest are expected to follow. The deadline to file a property tax protest is May 15th.

About O'Connor:

O’Connor is among the largest property tax consulting firms in the United States, providing residential property tax reduction services in Texas, Illinois, and Georgia, as well as commercial property tax reduction services across the United States. O’Connor’s team of professionals possess the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs more than 600 professionals worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™ . There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O'Connor, President

O'Connor

+1 713-375-4128

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

YouTube

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.