Travis County homeowners are being asked to pay over $1,700 in excess property taxes in 2023

Median assessments for Travis County residential property are 11.8% higher than the median sales prices in January and February 2023.

HOUSTON, TEXAS, UNITED STATES, April 19, 2023/EINPresswire.com/ -- Background – All property in Texas is subject to taxation on January 1, unless except. The median time-adjusted home price in Travis County for January 2023 is $500,000. However, based on a study by O’Connor reviewing over 17,000 Travis County sales in 2022 and 2023, the appraisal district has valued houses at a median of $563,156.It is true that Travis County home prices were over $500,000 at the start of 2022 and hit a peak median sales price of $643,500 in May 2022. However, only the sale price / values for January 1, 2023, are relevant. Of course, the appraisal districts do not set property taxes. However, their assessed values are a key component in calculating property taxes.

The median assessment of $563,156 is 11.8% higher than the median sales prices in January and February 2023 ($500,000). The excess assessment can and should be appealed, unless you enjoy agreeing to pay extra property taxes.

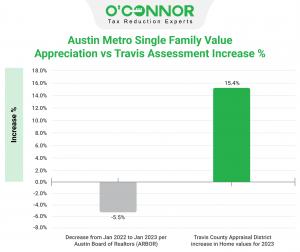

Hence there is a 20% gap between market trends and tax assessments. Market trends are down ~5% during the 12 months ending January 2023. However, the tax assessor has increased tax assessments by over 15% during the same period.

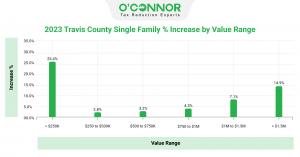

Homeowners of property valued at less than $250K saw by far the greatest percent increase among value ranges of single-family homes, with an increase of over 25%. The value range with the next highest percent increase was properties over $1.5 million where the increase was 14.9%.

When analyzed by living area, the larger the home, the higher the assessment increase was for Travis County single-family homeowners. Homes with more than 8,000 square feet saw increases of over 16%.

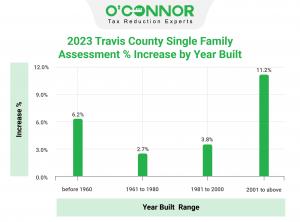

Newer homes built after 2001 have the highest jump in assessment at 11.2%, but homeowners of older properties were the next hardest hit with an increase of more than 6%.

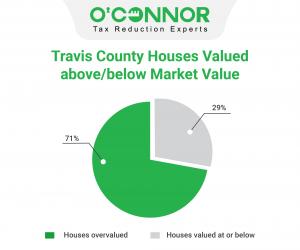

71%, or well over two thirds of all houses in Travis County are overvalued.

Both commercial or residential property owners in Travis county can expect to see significant increases in their property taxes unless they exercise their right to appeal and record levels of property tax protest are expected to follow. The deadline to file a property tax protest is May 15th.

About O'Connor:

O’Connor is among the largest property tax consulting firms in the United States, providing residential property tax reduction services in Texas, Illinois, and Georgia, as well as commercial property tax reduction services across the United States. O’Connor’s team of professionals possess the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs more than 600 professionals worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™ . There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Visit O’Connor at www.poconnor.com or call 713-290-9700.

Patrick O'Connor, President

O'Connor

+1 713-375-4128

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

YouTube

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.