CalHFA releases 20% Down Payment Assistance for California First Time Home Buyers and Funds are Running Out

Big News For California First Time Home Buyers. CalHFA has just announced the new “Dream For All” Shared Appreciation Loan.

CalHFA has just announced the new “Dream For All” Shared Appreciation Loan.

What is it?

It’s a second mortgage that can be used to cover up to 20% of the down payment as well as closing costs. In a time of rising mortgage interest rates, this also carries a 0% interest rate for the life of the loan.

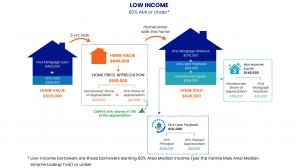

One may ask, “What is the Catch?” It is a “Shared Appreciation Loan”. This means at the time of pay off when the homeowner decides to refinance or sell, the home CalHFA requires the original balance of the loan to be paid off to paid off as well as 20% of the appreciation.

As an example, let’s say one purchases a home for $500,000. They have a first mortgage of $400,000 and a CalHFA Dream For All 2nd Mortgage of $100,00.

The house appreciates 100,000.

You will pay back $100,000 plus 20% of the appreciation or in this example, $20,000 for a grand total of $120,000 and then the homeowner keeps $80,000 appreciation in the home.

“All in all, this is a fantastic opportunity for California First Time Homebuyers” explains Garrick Werdmuller, President and CEO of Fresh Home Loan Inc. “Sure there is an equity share but a 20% down payment assistance loan is a pretty unique opportunity. We have actually helped borrowers get into larger homes than originally qualified for with a lower payment!” Werdmuller goes on. "If you are planning to use the program I would apply fast, their is only so much money allotted to the program and it is going fast!" (To apply visit: https://freshhomeloan.com/apply-now/)

“One thing that is truly unique about this loan is it can be used to cover closing costs as well. We had a home buyer that chose to buy a house with and 85% loan to value first mortgage and use the Dream For All 2nd mortgage to cover the down payment and closing costs and he is buying a home and his out of pocket costs are around $1600.” Werdmuller illustrates.

The program requires one to be a first-time home buyer and it requires the applicant to take a Homebuyer Education and Counseling Course which can be done in person or online.

To know for sure if someone is a first-time homebuyer, one should understand that a first-time homebuyer is defined as someone who has not owned and occupied their own home in the last three years. That means if someone has never owned a home, they are a first-time homebuyer. It also means that if they owned your home three or more years ago, but sold it, they are right back to being a first-time homebuyer again and can take advantage of all of the benefits of CalHFA's first-time homebuyer programs.

The program allows for single family residences, town homes, and condominiums. It does not allow for 2–4-unit properties. Accessory units may be eligible.

Here are some FAQ’s:

1. What is the Dream For All Shared Appreciation Loan?

The Dream For All Shared Appreciation Loan (Shared Appreciation Loan) is a shared appreciation loan program that provides loans for down payment to qualified homebuyers. Upon sale or transfer of the home, the homebuyer repays the original down payment loan, plus a share of the appreciation in the value of the home. Those repayments are then used to fund future homebuyer down payments.

2. What is the maximum loan amount for the Shared Appreciation Loan?

The maximum loan amount is up to 20% of the sales price or appraised value, whichever is less.

3. What are the income limits for the Shared Appreciation Loan?

Income cannot exceed CalHFA income limits. • Use Fannie Mae’s HomeReady® Lookup tool to determine if the income is less than or equal to the HomeReady 80% Area Median Income (AMI). Lower Income (LI) borrowers are eligible for CalHFA’s LI interest rate and a reduced amount of shared appreciation repayment.

4. Are borrowers required to make monthly payments on the Shared Appreciation Loan?

No, payments are deferred for the life of the first mortgage.

To apply today visit: https://freshhomeloan.com/apply-now/

You may also contact Garrick Werdmuller directly at:

Garrick Werdmuller

President CEO

Fresh Home Loan Inc

510.282.5456 call/text

www.FreshHomeLoan.com

NMLS 242952

All loan approvals are conditional and not guaranteed and subject to lender review of all information. Loan is conditionally approved when lender has issued approval in writing, but until all conditions are met, loan cannot be funded. Specified rates and [products may not be available to all borrowers. Rates subject to change according to market conditions and agreed upon lock times set by borrower. Fresh Home Loan Inc. is an Equal Opportunity Mortgage Broker in California. This licensee is performing acts for which a real estate license is required. Fresh Home Loan, Inc. is licensed by the California Department of Real Estate #02137513 NMLS # 2124104

#homebuyers #realestate #realtor #realestateagent #firsttimehomebuyer #househunting #homesellers #mortgage #home #homebuying #dreamhome #realtorlife #newhome #homeownership #homebuyer #homesweethome #forsale #buyersagent #property #homesforsale #realtors #realestateinvesting #homeforsale #mortgagebroker #realestatelife #investment #firsttimehomebuyers #homeowners #realtorsofinstagram #bhfyp

Garrick Werdmuller

Fresh Home Loan Inc

+1 510-282-5456

garrick@freshhomeloan.com

Visit us on social media:

Facebook

LinkedIn

YouTube

Other

CalHFA has just announced the new “Dream For All” Shared Appreciation Loan. 100% Financing 20% Loan

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.