SVB Bankruptcy Caused Stablecoin Unanchoring, MetaTdex Proposed Web 3.0-Based Financial Liquidity Solutions

On March 10, the Silicon Valley Bank (SVB) was shut down by regulators, becoming the largest bank collapse event since the 2008 financial crisis. Affected by that, the stock market and crypto market are also subjected to downward pressure on prices. How can the financial industry deal with the liquidity crisis in the future?

Fed's Interest Rate Hike Stimulated the SVB Liquidity Crisis

In June 2020, the Federal Reserve promised to keep interest rates at zero, ushering in a global financing boom for technology companies. At that time, SVB absorbed plenty of cash and deposits accumulated by technology startups. Between June 2020 and December 2021, the deposits in SVB rose from $76 billion to over $190 billion.

After a large inflow of capital from the liability side, SVBS allocated $16 billion in US Treasuries and $100 billion in MBS assets given that there was only a 0.1% annualized interest in its reserve accounts. Since SVB's asset purchases were concentrated in the low interest rate period of 2020 - 2021, the average yield of AFS and HTM assets was as low as about 1.5%.

Starting from March 2022, the pressure generated from SVB's aggressive allocation of long-term assets began to emerge under a high interest rate environment formed by the Fed's substantial interest rate hike. The market prices of SVB-held financial assets such as bonds continued to fall. Moreover, startups with deposits in the bank were subject to financing difficulties and surging withdrawal demands.

SVB had to sell the vast majority of its available-for-sale (AFS) financial assets in exchange for liquidity to cover those withdrawals. The $21 billion bond sales directly resulted in an actual loss of $1.8 billion. At the same time, SVB planned to raise $2.25 billion in equity financing such as the sale of common and preferred shares. These movements not only made for SVB's capital adequacy ratio, but also changed its asset-liability strategy to cope with the high interest rate environment.

However, bond purchase and equity financing are usually seen as panic asset sales and violent dilution of equities. SVB's $91 billion bond portfolio has matured and is now worth just $76 billion in market value, equating to an unrealized loss of $15 billion. Rising costs on the liability side, ever-increasing withdrawal pressure and sharply reduced asset value have led to the hasty financing and final stock price collapse of SVB. After plunging more than 60% on March 9, the stock price of SVB Financial Group fell another 68% to around $34 on March 10 before trading was suspended.

On March 10, the California Department of Financial Protection and Innovation (DFPI) closed SVB on the grounds of "insufficient liquidity and insolvency", and designated the Federal Deposit Insurance Corporation (FDIC) as the receiver.

Affected by the SVB Bankruptcy, USDC and some Other Stablecoins Unanchored

After the collapse of SVB, the entire banking industry and even the crypto market suffered price decline. The four major U.S. banks shrank by over $52 billion in market value. The price of USDC stablecoin also quickly fell to $0.8767 with a depreciation of over 12%.

USDC's sudden price plummet triggered a collective price tumble of mainstream stablecoins. Although many crypto institutions such as Binance, Tether and Paxos stated that they had no risk exposure to SVB, multiple stablecoins were still affected. On March 11, BTC price rapidly fell below $20,000, and the prices of mainstream cryptos such as ETH and BNB also fell simultaneously. On the contrary, TT and some other cryptos that were not highly correlated with USDC returned to the normal price curve soon after a slight fluctuation.

Circle, the issuer of USDC, tweeted that $3.3 billion of its approximately $40 billion USDC reserves is in SVB. As one of Circle’s six banking partners, SVB manages about 25 percent of USDC cash reserves. Circle is now waiting to see how the FDIC's takeover of SVB will affect its depositors. Besides, Circle and USDC will continue to operate as normal.

After USDC and some other stablecoins were unanchored, leading crypto service providers responded immediately. MetaTdex promptly tweeted to remind the community to beware of the stablecoin risks; Binance announced the suspension of the automatic conversion from USDC to BUSD; Coinbase paused the conversion service from USDC to U.S. dollars over the weekend and restored the service after banks opened on Monday; Robinhood also claimed to temporarily cease related transactions and deposits.

USDC reserves mainly include 77% of short-term U.S. Treasuries ($32.4 billion) and 23% of cash ($9.7 billion). The cash reserves are deposited in various institutions, with $3.3 billion in SVB.

Circle is determined to make up for the shortage of USDC reserves and stop USDC losses in time. When USDC continued to be unanchored for dozens of hours, Circle stated that if the $3.3 billion USDC reserves cannot be completely returned, the issuer would not only provide support for USDC and use company resources to make up for the shortage, but also introduce external capital if necessary. According to Coinmarketcap, USDC, DAI, FRAX, and USDD prices have all rebounded to $0.99 on March 15.

Web3.0's Mutual Assistance Potential for the Financial Industry Under the SVB Liquidity Crisis

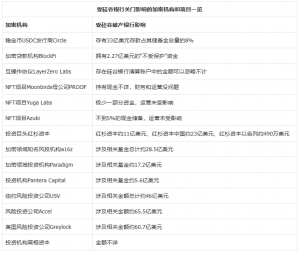

In addition to Circle, there are many other Web 3.0 companies that have business dealings with SVB, including BlockFi, Azuki, Yuga Labs, Sequoia Capital, a16z, and more.

After the crisis, SVB received support from more than 100 VCs and investors including General Catalyst and Sequoia Capital. On March 12, they signed a joint statement encouraging their portfolio companies to resume banking relationships with SVB after the bank was acquired and injected with certain funds, aiming to reduce the impact of SVB collapse and avoid the possible extinction of a technology company.

In response to the liquidity crisis, MetaTdex proposed the Web 3.0 strategy of meta-asse bridge that focused on the equity financing module. In the eyes of MetaTdex, there is no value to be created from SVB's two major liquidity crisis solutions of selling U.S. Treasuries and stocks. In terms of its stock financing strategy, it is difficult for new and old users to take positions when the SVB liquidity run occurs. Therefore, the entry of new $2.25 billion stocks into the securities market will only cause a bigger stock market bubble and panic emotion.

In the ecosystem of meta-asset bridge, MetaTdex introduces global shareholders and funds for listed companies (stocks) via the financial model of crypto-stock interoperability. To put it simply, the stock is mapped to the stock token (1:1) and forms a trading pair between token and stock token, allowing global users to buy the stock on MetaTdex decentralized exchange.

Just imagine, if SVB enters the ecosystem of MetaTdex's meta-asset bridge and the $2.25 billion new stocks are taken over by global investors, will the selling pressure be much less? MetaTdex builds a huge buffer zone for SVB stocks, preventing the stock price from plummeting.

More importantly, the incentive measures of MetaTdex Crypto-Stock ( a stock value added product) will urge stockholders to hoard stocks, resulting in a reduction in stock market circulation. Users can obtain stock incentives by pledging stock tokens in MetaTdex Crypto-Stock, and the main source of incentives is the private placement of listed company capital stocks. But in the traditional stock holding method, only dividends can be obtained and there is no opportunity to get stocks of private placement.

In a nutshell, the meta-asset bridge launched by MetaTdex is the base of stock user import for listed companies, which can provide listed companies with access to the global investor pool. The meta-asset bridge brings user flows and assets to listed companies, as well as reduces the circulation of stocks on stock exchanges. Furthermore, MetaTdex's stock incentives are capable of greatly increasing the motivation of investors to hold stocks for a long time. Currently, MetaTdex is seeking listing opportunities in Hong Kong, hoping to start the practice of meta-asset bridge via its own stock.

The stock market’s collateral reaction to the SVB collapse is still going on, and it’s unclear what will happen in the future. However, MetaTdex's meta-asset bridge provides a novel idea for improving stock liquidity. Through the expansion of the shareholder pool to eliminate the stock market bubble, Web 3.0 enterprises may play a greater role in the mutual assistance of the traditional financial industry in the future.

MIKE LIU

MetaTdex

email us here

Visit us on social media:

Twitter

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.