Aluma: Netflix, Hulu, and Disney+ Most Essential to Streaming Subscribers

Being indispensable has its advantages.

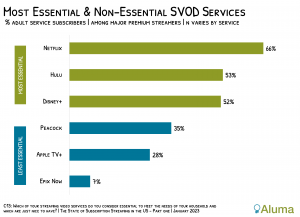

FORT COLLINS, COLORADO, US, March 14, 2023 /EINPresswire.com/ -- New research from Aluma Insights finds two-thirds of Netflix buyers view the service as indispensable to meeting household video needs. Hulu and Disney+ were the only other top-16 services in which more than half of subscribers considered the service essential instead of just nice to have. Conversely, Epix Now, Apple TV+, and Peacock were found to be the least essential services.

“This is a one way of comparing a service’s utility with that of its competitors,” noted Michael Greeson, veteran researcher and founder of Aluma Insights. “It says to some owners they've a bit more latitude when it comes to revenue optimization measures, such as cracking down on freeloading or increasing retail prices. It says to others there is great risk in significantly increasing prices or altering service terms.”

To this point, Disney CEO Bob Iger recently shared that December’s 38% increase in ad-free Disney+ prices caused minimal subscriber losses, suggesting the service is not yet fully valued. Aluma analysts agree, and expect both Disney+ and Hulu standalone prices will increase by around 15% during 2023.

The fact Netflix, Hulu, and Disney+ topped the essentials list, and Epix Now finished last, was unsurprising to Aluma analysts. However, finding Apple TV+ and Peacock among the bottom three services was unexpected. Apple TV+ is recognized for high-quality original content that resonates well with its subscribers. Then again, it has little depth in terms of third-party content and lower value than most other services, which may have reduced its stickiness.

Peacock is also susceptible to disruption, this despite a 28% increase in paid subscribers during 2022. Nearly three years after its introduction, the service still suffers from “failing to launch,” its content selection long anemic.

Even as it works to improve its library, however, Peacock’s owner Comcast is eliminating the service’s free ad-supported tier and is phasing out complimentary service for Xfinity subscribers, an audience the company estimates accounts for at least 70% of Peacock’s paid subscribers. “If 65% of Peacock subscribers consider the service dispensable, and Comcast is ending free service to 70% of Peacock’s subscribers, there is a real risk this strategy will backfire in 2023.”

A greater risk to less-essential services is plateauing monthly SVOD spending. Aluma found that in 2022 SVOD households spent on average $43.25 per month on the services, up significantly from 2020 but mostly stable compared with 2021.

However, between 2020 and 2022, the percentage of SVOD buyers open to spending more declined from 14% to 8%, while the percentage who planning to reduce these expenses increased from 17% to 25%.

“As buyers move closer to their SVOD spending limits, less essential services will have a difficult time optimizing revenue without enduring sizeable subscriber losses,” said Greeson.

About Aluma’s Original SVOD Research

Aluma recently surveyed nearly 2,000 US household decision-makers that pay for at least one SVOD service on a variety of topics, including the number of SVOD services paid for versus used, monthly spending, service value, proclivity to cancel, interest in inter-network SVOD bundles, TV viewing by service and device type, and much more.

About Aluma Insights

Aluma provides actionable insights to video creators, distributors, and OEMs looking to master the opportunities & challenges of the connected TV ecosystem.

To inquire further about Aluma’s consumer video research, please contact us at info@alumainsights.com.

Michael Greeson

Aluma Insights

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.