Mintus predicts traditional art will outperform NFTs in 2023

LONDON, UNITED KINGDOM, January 31, 2023 /EINPresswire.com/ -- Mintus, the online art investment platform, today announces its 2023 forecast for art investment. The fund manager predicts that, as an asset class, physical art will outperform Non-Fungible Token (NFT) art this year.

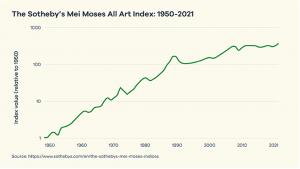

Mintus expects the war in Ukraine, high inflation, and declining economic growth this year will drive investors to seek more stable assets, such as physical art. To support its prediction, Mintus cites the Sotheby’s Mei Moses All Art Index: 1950-2021, a measure of the state of the broader art market, which shows an increase in overall demand at a compound annual growth rate of 8.5 per cent, despite adverse global events since 1950.1

In 2022, auction sales of Old Masters, Impressionist, Modern, Post-War and Contemporary Art by auction houses Sotheby’s, Christie’s, and Phillips, reached a record total of $7.5 billion (£6.2 billion), an increase of 15 per cent on 2021.2 By contrast, global markets for NFTs and other blockchain-based assets, such as cryptocurrencies, have been beset by strengthening economic headwinds and prominent scandals, such as the collapse of stablecoin TerraUSD in May, the bankruptcy of crypto-exchange FTX in November, and the July announcement of a 20 per cent reduction in headcount at NFT marketplace OpenSea.

As further proof, Mintus refers to the 87 per cent fall in monthly spending on NFTs between March and November 2022; the fall in the number of active NFT traders to just over a third of its peak in January 2022; and a fall of nearly 60 per cent in the number of new NFTs created on the Ethereum blockchain, according to research group Nansen.

Tamer Ozmen, Mintus CEO, said, “Even if the NFT market does make an unlikely resurgence, let’s face it: the days of choosing a Bored Ape over an Andy Warhol are probably long gone. Investors must remember that any ebbs and flows in the art market are features, not bugs, in the lifecycle of any long-term investment. The performance of all traditional asset classes in 2022 reflects that. Whilst the art market may have had a record-breaking year in 2022, the biggest takeaway was that high-quality, fresh-to-market artworks will fetch premium prices, no matter the wider economic climate.”

ENDS

Notes to Editors

Old Master Paintings Auction Market – 2022 In Review. Eilidh McClafferty. ArtTactic. https://arttactic.com/product/old-master-paintings-auction-market-2022-in-review/

About Mintus

Mintus is an online, art investment platform, regulated by the Financial Conduct Authority, offering a new way to buy shares and invest in exceptional, multi-million-pound contemporary artworks. Mintus opens up the annual $65bn art market to investors, allowing them to invest in the world’s greatest paintings at a fraction of their overall value. Paintings by Andy Warhol and George Condo are the first two works to be presented by Mintus. Mintus plans to offer $150m of inventory during the next 12 months, offering investors the opportunity to invest in other iconic individual paintings, and through curated portfolios of art.

Mintus expects the war in Ukraine, high inflation, and declining economic growth this year will drive investors to seek more stable assets, such as physical art. To support its prediction, Mintus cites the Sotheby’s Mei Moses All Art Index: 1950-2021, a measure of the state of the broader art market, which shows an increase in overall demand at a compound annual growth rate of 8.5 per cent, despite adverse global events since 1950.1

In 2022, auction sales of Old Masters, Impressionist, Modern, Post-War and Contemporary Art by auction houses Sotheby’s, Christie’s, and Phillips, reached a record total of $7.5 billion (£6.2 billion), an increase of 15 per cent on 2021.2 By contrast, global markets for NFTs and other blockchain-based assets, such as cryptocurrencies, have been beset by strengthening economic headwinds and prominent scandals, such as the collapse of stablecoin TerraUSD in May, the bankruptcy of crypto-exchange FTX in November, and the July announcement of a 20 per cent reduction in headcount at NFT marketplace OpenSea.

As further proof, Mintus refers to the 87 per cent fall in monthly spending on NFTs between March and November 2022; the fall in the number of active NFT traders to just over a third of its peak in January 2022; and a fall of nearly 60 per cent in the number of new NFTs created on the Ethereum blockchain, according to research group Nansen.

Tamer Ozmen, Mintus CEO, said, “Even if the NFT market does make an unlikely resurgence, let’s face it: the days of choosing a Bored Ape over an Andy Warhol are probably long gone. Investors must remember that any ebbs and flows in the art market are features, not bugs, in the lifecycle of any long-term investment. The performance of all traditional asset classes in 2022 reflects that. Whilst the art market may have had a record-breaking year in 2022, the biggest takeaway was that high-quality, fresh-to-market artworks will fetch premium prices, no matter the wider economic climate.”

ENDS

Notes to Editors

Old Master Paintings Auction Market – 2022 In Review. Eilidh McClafferty. ArtTactic. https://arttactic.com/product/old-master-paintings-auction-market-2022-in-review/

About Mintus

Mintus is an online, art investment platform, regulated by the Financial Conduct Authority, offering a new way to buy shares and invest in exceptional, multi-million-pound contemporary artworks. Mintus opens up the annual $65bn art market to investors, allowing them to invest in the world’s greatest paintings at a fraction of their overall value. Paintings by Andy Warhol and George Condo are the first two works to be presented by Mintus. Mintus plans to offer $150m of inventory during the next 12 months, offering investors the opportunity to invest in other iconic individual paintings, and through curated portfolios of art.

Ryan Forecast

Yellow Jersey PR

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.