Capturing Automation In The Insurance Brokers Market

The Business Research Company’s Insurance Brokers Market 2022: Market Size, Trends, And Forecast To 2026

LONDON, GREATER LONDON, UK, October 24, 2022 /EINPresswire.com/ -- The reports have been updated with the most recent Ukraine-Russia War impact on market growth for all 27+ industries. The reports also provide possible solutions and opportunities for surviving this crisis.

Insurance brokers are increasingly adopting advanced technologies to automate the insurance process, reduce the cost of operations and improve efficiency. These technologies include artificial intelligence (AI) applications such as robot-advisors, robotic process automation and block chain, a distributed decentralized ledger and the underlying technology of bitcoin (a cryptocurrency), not managed by a central authority. These technologies help in the automation of risky and complex p2rocesses, providing scope for machine learning, avoiding repetitive and time taking processes, providing quick and error-free services, and for secure sending, receiving and storing of information. In February 2022, Digital insurance marketplace, RenewBuy, acquired Bengaluru-based fintech start-up, Artivatic.AI, to scale up business and improve technology solutions to better serve customers in insurance claim settlements, risk assessment and underwriting.

Read more on the Global Insurance Brokers Market Report

https://www.thebusinessresearchcompany.com/report/insurance-brokers-market

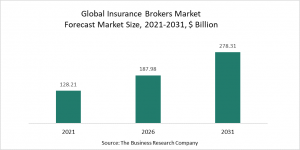

The global insurance brokers market size is expected to grow from $128.21 billion in 2021 to $187.98 billion in 2026 at a rate of 8.0%. The global insurance brokers market share is then expected to grow at a CAGR of 8.2% from 2026 and reach $278.31 billion in 2031.

The insurance brokers market is expected to be driven by increased incidence rates of chronic diseases and physical disabilities. The market is driven by the increased fear of chronic diseases, which forces parents of young children to opt for term life insurance. The increasing need of insurance will increase the need of insurance brokers. According to the United Nations, the proportion of total global deaths due to chronic diseases is expected to increase to 70% and the global burden of chronic diseases is expected to reach about 60% by 2030. According to a UN report on world population aging, by 2050, one in six people in the world will be over age 65 (16%), up from one in 11 in 2019 (9%). By 2050, one in four persons living in Europe and Northern America could be aged 65 or above. Growth of the aging population and rising chronic disease incidence will contribute to increased fear for the dependents, thereby increasing demand for life insurance and thereby insurance brokers driving the insurance brokers market.

Major players covered in the global insurance brokers industry are Marsh & McLennan Cos Inc., Aon PLC, Arthur J Gallagher & Co, Willis Towers Watson PLC, Acrisure LLC.

TBRC’s insurance brokers market report is segmented by type into life insurance, general insurance, health insurance, other types, by mode into offline, online, by end-user into corporate, individuals.

Insurance Brokers Market 2022 – By Type (Life Insurance, General Insurance, Health Insurance, Other Types), By Mode (Offline, Online), By End-User (Corporate, Individuals), And By Region, Opportunities And Strategies – Global Forecast To 2031 is one of a series of new reports from The Business Research Company that provides a insurance brokers market overview, forecast insurance brokers market size and growth for the whole market, insurance brokers market segments, geographies, insurance brokers market trends, insurance brokers market drivers, restraints, leading competitors’ revenues, profiles, and market shares.

Request for a Sample of the Global Insurance Brokers Market Report

https://www.thebusinessresearchcompany.com/sample.aspx?id=6469&type=smp

Not what you were looking for? Here is a list of similar reports by The Business Research Company:

Reinsurance Global Market Report 2022– Market Size, Trends, And Global Forecast 2022-2026

https://www.thebusinessresearchcompany.com/report/reinsurance-global-market-report

Insurance Agencies Market Report 2022– Market Size, Trends, And Global Forecast 2022-2026

https://www.thebusinessresearchcompany.com/report/insurance-agencies-global-market-report

Insurance (Providers, Brokers And Re-Insurers) Global Market Report 2022– Market Size, Trends, And Global Forecast 2022-2026

https://www.thebusinessresearchcompany.com/report/insurance-providers-brokers-and-re-insurers-global-market-report

About The Business Research Company?

The Business Research Company is a market research and intelligence firm that excels in company, market, and consumer research. It has over 200 research professionals at its offices in India, the UK and the US, as well a network of trained researchers globally. It has specialist consultants in a wide range of industries including manufacturing, healthcare, financial services and technology.

Read more about us at https://www.thebusinessresearchcompany.com/about-the-business-research-company.aspx

Call us now for personal assistance with your purchase:

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Check out our:

TBRC Blog: http://blog.tbrc.info/

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model

Healthcare Blog: https://healthcareresearchreports.com/

Oliver Guirdham

The Business Research Company

+44 20 7193 0708

info@tbrc.info

Visit us on social media:

Facebook

Twitter

LinkedIn

Market Research Products, Services, Solutions For Your Business - TBRC

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.