Video Services Far Down "Cut List" Yet Significantly Impacted by Inflation

The rising cost of consumer goods, services, and housing spurred many U.S. households to reduce SVOD and pay-TV expenses.

FORT COLLINS, CO, USA, August 23, 2022 /EINPresswire.com/ -- One-fourth of U.S. households downgraded or cancelled a subscription streaming video (SVOD) or pay-TV service due to the rising costs of consumer goods, services, and housing. This according to new research from Aluma Insights, a research consultancy focused on the home video value chain and consumer video behaviors.

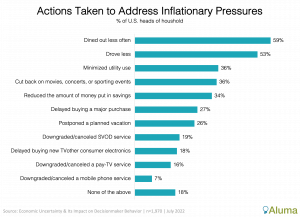

The simplest actions used to counter inflation are also the most common. In response to the increased cost of living, 59% of U.S. heads-of-household dined out less often, while 53% reduced time spent driving. More than one-third minimized their use of home utilities (e.g., electric, gas, water), as did one-third their out-of-home entertainment experiences. Only 7% of decision-makers reduced mobile phone expenses, further validating its utility-like status. Even in the toughest of times, mobile phone service would likely be the last expense to give way.

One-in-five U.S. households downgraded or cancelled an SVOD service, as did one-in-six a pay-TV service. Decision-makers 25-44 years of age had the highest rates for both (28% for SVOD, 19% for pay-TV), while those 65 and older had the lowest rate (8% for SVOD, 11% for pay TV). Households making less than $30,000 a year were, of all income segments, most likely to have reduced both SVOD and pay-TV expenses (27% and 23% respectively).

“Domestic TV and video subscription growth was slowing before the recent wave of inflation,” said Michael Greeson, principal analyst at Aluma. “But the rising costs of consumer goods, services, and housing added fuel to the fire, placing even more pressure on consumers to reduce these expenses.”

This data is drawn from a July 2022 survey of 1,970 U.S. heads of household and is the basis for a new 4-report series from Aluma, each discussing the impact of economic uncertainty and inflation have and will have on consumer TV, video, mobile, and consumer electronic purchases among key demographic segments. For more information about this project, you can reach us at info@alumainsights.com.

About Aluma

Aluma works with companies vested in the connected consumer and home video space. Via expansive consumer research and business acumen, Aluma delivers a robust research subscription at an affordable price. We invite you to rediscover what a cost-effective research program can be.

For more information, please contact us at info@alumainsights.com or visit our website, alumainsights.com.

Michael Greeson

Aluma Insights

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.