Secured Carbon Externally Verifies Local Carbon Emissions to Rate the Performance of Climate Projects

Secured Carbon delivers key validation innovation to unlock the annual $5 trillion flywheel of ESG climate investing.

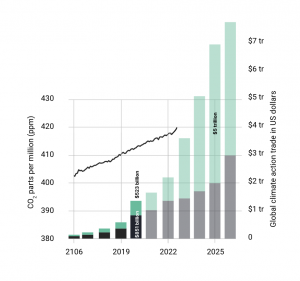

To slow the rate of carbon dioxide and temperature rise, recent estimates suggest an annual need of £4.2 trillion ($5 trillion) for carbon-reducing projects for the next 30 years. But until now, the lack of verified impact of carbon offsets and green bonds have hampered investment.

Current carbon accounting standards accept self-reported forecasts — but not the actual pollution emitted. These models are rarely verified externally due to technical challenges. But as the market grows, the financial incentive to cut corners or defraud investors increases and more discrepancies are being reported. For example, carbon credits from forest projects have later been found to be vastly overestimated or double-counted, and satellites have detected enormous rogue emissions from oil-and-gas fields.

“We have already seen a weakening of carbon offsets because of a lack of standards about acceptable environmentally rigorous schemes,” reports the Climate Bonds Initiative. “Poor quality offsets were, for many buyers, not readily distinguishable from high quality offsets. In such circumstances poorer quality offsets dominated for price or availability reasons, sparking a race to the bottom, or an abandoning of the sector.”

Despite record trade of £0.76 trillion ($0.9 trillion) in cap-and-trade carbon offsets and another £0.84 trillion ($1 trillion) in so-called green bonds, global carbon dioxide (CO2) concentration in May 2022 measured 421 parts per million (ppm). CO2 continues to rise unchecked at a rate of 2.33 ppm per year. It is nearly at 430 ppm – the concentration associated with a 1.5°C rise in global temperature. It has been another summer of historic global heat waves, wildfires, investor demand for environmental governance, and increasingly violent activist protests.

“When it comes to climate action, effective measurement, reporting and verification (MRV) of emissions and emissions reductions is critical to help countries understand GHG sources and trends, design mitigation strategies, enhance credibility and take other policy actions,” reports the World Resource Institute.

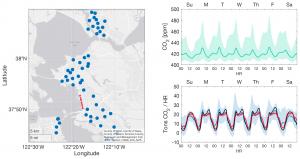

BEACO2N networks are set up in a square-mile mesh, or closer, throughout a city to detect local carbon dioxide levels. They can be used to verify the effectiveness of projects such as replacing gas-powered heating and cooling systems in apartment complexes, or changing traffic patterns. This precision enables effective carbon reduction decisions, and pinpointing rogue emissions.

Investors agree that they should be putting money towards the climate, but they don’t know where to put it as there is currently no way of accurately measuring the return on investment. Secured Carbon is committed to installing BEACO2N networks in the 300 largest and most polluting cities on the planet. “Cities account for over 70% of global CO2 emissions,” reports the World Bank, “most of which come from industrial and motorized transport systems that use huge quantities of fossil fuels and rely on far-flung infrastructure constructed with carbon-intensive materials.” BEACO2N will enable cities to attract major investors who seek to increase economic output while reducing carbon emissions.

Secured Carbon focuses on enabling countries, companies and cities such as Oakland and Glasgow to issue a new kind of Green Bond that closes the gap in ESG investments: external, measurement-based climate performance bonds. “Performance bonds are different from green or ESG bonds,” explains Michael Mainelli, executive chairman of Z/Yen Group. “A policy performance bond … is a bond where, in its simplest form, interest payments are linked to the actual greenhouse gas emissions of the issuing country against published targets. An investor in this bond receives an excess return if the issuing country’s emissions are above the government’s published target.”

“Secured Carbon is delivering a high-trust tool to facilitate the world's most important conversation and conundrum: how we integrate our financial lives with our environmental impact,” says John Pigott, CEO of ABE, a global and regulated token exchange. “A real-time, verifiable data feed that can audit the environmental impact of our activities will increase trust in the global financial ecosystem."

Tac Leung

Secured Carbon

+1 415-350-5300

email us here

Prof. Ron Cohen speaks on our mission to scale up the Berkeley Environmental Air-quality & CO2 Network (BEACO2N) in cities around the world.

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.