TOPIX Review: Companies with Tradable Share Market Capitalizations of Around JPY10 bn to Be Tested

In the coming review of TOPIX, stocks with a tradable share market capitalization of less than JPY10 bn will undergo a slow reduction in inclusion weighting.

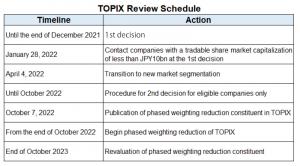

TOKYO, JAPAN, April 13, 2022 /EINPresswire.com/ -- [Nikkei QUICK News]This April, the Tokyo Stock Exchange (TSE) will proceed with a review of TOPIX. Stocks with a tradable share market capitalization of less than JPY10 bn will be subject to a gradual reduction in inclusion weighting. For some companies, this presents a difficult challenge and could be a downside factor for their stock prices.The results of the selection process for companies were announced in January, and the new classification of companies will become effective on April 4. It has been decided that 1,841 companies, or 84% of the TSE 1st Section, will be in the top-tier "Prime Market." For the remaining 344 companies in the same section, it has been decided that they will move to the "Standard Market," based on their business environment and management strategies. In accordance with the TOPIX review, companies that are currently listed on the TSE 1st Section will continue to be included in the index, even if it has been decided that they will move to the Standard Market.

Companies without Appropriate Market Capitalization Are Subject to Ratio Reduction

In addition, stocks with tradable share market capitalizations of less than JPY10 bn each will become "phased weighting reduction constituents" under the current TOPIX review. The TOPIX component ratios of such constituents will decrease in a series of 10 steps every quarter, starting at the end of October 2022 and finishing at the end of January 2025. If the tradable share market capitalization of a company exceeds JPY10 bn at least once in two rounds of decision, the company will maintain its place in the index without having its composition ratio lowered. The 1st decision was completed by December 2021.

The 2nd decision will take place in October 2022. For example, for a company with a fiscal year that ends in March, this decision will be made using the number of tradable shares of the company as of the end of March 2022 and its average share price from January to March 2022. For companies “on the borderline,” this is a crucial time.

The TSE's Information Services Department notes that there have been "more than a dozen inquiries" from companies since January concerning the TOPIX review. There has been a great deal of confirmation concerning the TOPIX review rules, and the TSE has been offering explanations on matters such as the procedures for this review.

Actions to Maintain Continued Index Inclusion, such as Stock Splits and Share Buybacks

Companies are also implementing measures that appear to be aimed at maintaining and improving their tradable share market capitalization. Cross Cat (2307), which engages in contract software development and has a low market capitalization of about JPY20 bn, revised its earnings forecast upward and increased its year-end dividend from January to March. It also announced a stock split and share buyback measures.

Some companies plan to expand or establish new shareholder benefits. BOOKOFF GROUP HOLDINGS (9278) enlarged its special benefit program for shareholders with 100 or more shares on March 15. Kibun Foods (2933) also introduced a new shareholder benefit program in February.

Makoto Sengoku, senior equity market analyst at Tokai Tokyo Research Institute, expressed his view that "in order to increase tradable share market capitalization, small-to-medium-sized companies will continue to establish or expand special benefit programs for their shareholders."

Ex-TOPIX Constituents Also Face Downward Pressure on Stock Prices

Stocks currently included in TOPIX are likely to be subjected to selling pressure if they find themselves excluded from the index. Shingo Ide, chief equity strategist at NLI Research Institute, pointed out that "since last year, active investors have been selling some stocks expected to be excluded from TOPIX. If the stocks were to be removed from TOPIX, passive funds would conduct further selling, which would continue to put downward pressure on stock prices."

Even if a company becomes a "phased weighting reduction constituent," it still has the potential to revive. In October 2023, tradable share market capitalization will be reevaluated, and if the relevant criteria are met by a given company, it will be able to regain its weighting. Although it is expected that certain companies will undertake a variety of actions, Atsushi Kamio, chief researcher at the Daiwa Institute of Research, points out that "in practice, it is quite difficult to raise tradable share market capitalization during a period of declining weightings."

For many companies, the ability to survive in TOPIX will present a major challenge that will determine the trend of their stock prices. Although the TSE's market restructuring as a whole has often been said to be "without substance," it is necessary to continue to closely monitor the activity of companies in the future.

<Related Stories>

AERIS: Technology for Better Financial Statement Forecasting

SMACOM's unique "Securities Report Sentiment Score"

SMACOM's stock selection ability tested when prices plummet

Public Relations Office

Nikkei Inc.

pr@nex.nikkei.co.jp

Visit us on social media:

Facebook

Twitter

LinkedIn

Other

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.