Art+Tech & NFT Startups Report 2022 by FUELARTS is released

A new specialized in-depth study on Art+Tech & NFT startups' Ecosystem

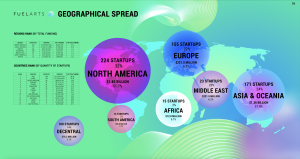

This report is a unique study on Art+Tech & NFT Ecosystem, revealing data on startups’ geographical distribution, stages of startups’ development, and investment attractiveness over the past 30 years. FUELARTS’ analytics presents data on the type of investors in the ecosystem and shares key problems and solutions in the field. Also, for the first time, the activity of female-founded startups is analyzed.

In particular, the report answers the following questions:

• Was 2021 the most successful year for startups in terms of investments?

• What type of investors were more active in Art+Tech in 2021 and why?

• Who led the TOP in terms of investments last year - a startup from the physical art market or the NFT one?

• How do art startups created by female founders correlate with their vitality and financial success?

FUELARTS was the first one to research investments made into Art+Tech startups and later included its findings in Deloitte Art & Finance report in 2019. This year they did a full-fledged industry report focused on the Art+Tech & NFT startups and it’s unique because no one before:

o didn’t single out Art+Tech startups into separate groups among other startups;

o didn’t calculate investments in them separately from all startups;

o didn’t propose splitting Art+Tech startups into startups from the physical and digital markets.

How to make the Art+Tech market more comprehensible for startups and transparent for investors – this is the mission of the report and FUELARTS company. Unlike the traditional Art Market, this data, including names of the investors, in most cases becomes public — this is a vital step towards the success of a startup in gaining more credibility and further funding.

Why do no more than 10% of business ideas go from the idea stage to the bootstrap stage? What are the main problems that Art+Tech startups face? What is the selection process of startups for Venture Capital fund? What fears do investors have about NFT? — these and other questions this report is focused on, are based on public data recorded on the official resources of analytical companies — Crunchbase and PitchBook — and FUELARTS’ database.

Download your copy here - https://fuelarts.com/report

Some Key Findings:

● In 2021 alone, 146 Art+Tech startups received funding, including 24 startups in the "physical" Art Market and 122 companies in Digital Art Market and NFT.

● The total funding for 146 Art+Tech startups amounted to $1.098 billion in 2021, which compounds 46.8% of the total funding received by these startups since their launch.

● Startups in the "physical" Art Market received $440 million (40.1% of the total funding), while startups, developing the Digital Art Market and NFT - $658 million (59.9%).

● In the Digital Art Market segment, online marketplaces received the highest number of investments in 2021, which amounted to $754.5 million for 33 companies. Startups in the game industry received $191.5 million for 27 companies. Considerable investments also received startups in content production ($120.3 million, 42 companies), asset management ($87.1 million, 9 companies), data analytics ($4.0 million, 8 companies) and visualization services ($2.6 million, 3 companies).

● Among the countries with the incorporation of digital startups and NFT (that received investments in 2021), the United States leads with 41 companies. The second place takes Singapore (8 companies), while the UAE and Canada share third place (4 companies each).

● Art+Tech and NFT startups (founded in 2021) received a total funding of $306.5 million, which amounted to 46.6% of the total funding of all companies in this sector created in different years.

● Art+Tech and NFT startups that received the highest investments in 2021 are in Seed stage (71 companies), followed by 29 companies in Pre-Seed stage and 13 companies in Series A.

● Startups with the highest total funding are in Series A (13 companies, $191 million), Seed stage (71 companies, $149 million) and Series B (three companies, $138 million).

● 28 companies from the Art+Tech and NFT Market, which came to the market in 2021, do not disclose any information regarding their financing sources. Thus, the investment "transparency" of this market has amounted to 77%.

● 108 Art+Tech & NFT startups were or co-founded by female entrepreneurs which amount to 15% of the total number (702 startups). 40 startups have women as mono founders, the rest on average have 2 female founders.

● Female-founded startups include 66 companies (63%) in the "physical" Art Market and 40 companies (37%) in Digital Art Market & NFT.

● Despite the overwhelming prevalence of NFT startups in media, the largest investment of $240 million was received the Classic Art+Tech startup - Kuaikan Media (an online comic bookseller).

● Those Art+Tech startups that were launched during the growth of the classical Art Market, moved further on the investment ladder. While startups that emerged simultaneous to the growth of the technology market (crypto, blockchain) and that did not necessarily solve Art Market issues, got their last funding the year after they were launched.

● The cumulative funding for 108 Art+Tech & NFT female-founded startups amounted to $1.243 billion, which equals 34.7% of the total funding received by all startups since their

● The cumulative amount invested in TOP-5 Classic Art+Tech startups in each of 5 segments (18 in total) amounted to $1.40 billion, or 78% of the total investment made in 319 Classic Art+Tech startups.

● The cumulative amount invested in TOP-5 Digital & NFT startups in each of 6 segments (29 in total) equals $1.54 billion, or 86% of the total investment made in 383 Digital & NFT startups.

*FUELARTS – https://fuelarts.com/ - is the first dedicated accelerator (NYC) that uncovers the potential of Art+Tech & NFT startups. It provides startups not only with tailor-made educational programs and a supportive community to connect all Art+Tech ecosystem stakeholders but also bonds with private investor services and helps to acquire the necessary tools to prepare investment-attractive projects.

Anna Shvets

TAtchers' Art Management

ceo@tatchers.art

Visit us on social media:

Facebook

Twitter

LinkedIn

Other

The Report online release & discussion March 31st, 11 AM EST.

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.