SMACOM's stock selection ability tested when prices plummet: Explore measures to utilize the score

Testing shows that an investment strategy based on the News Sentiment Score can outperform sole reliance on the Tokyo Stock Price Index (TOPIX).

TOKYO, JAPAN, April 4, 2022 /EINPresswire.com/ -- The News Sentiment Score, one of the measurements outputted by SMACOM, indicates whether sentiment about an individual stock is bullish or bearish based on information in articles distributed by the Nikkei Group. Back-testing has verified that an investment strategy based on the News Sentiment Score outperformed sole reliance on the Tokyo Stock Price Index (TOPIX), which indicates the price movement of the Tokyo market as a whole.*For more information on the News Sentiment Score, see our previous article: (https://www.nikkei.co.jp/nikkeiinfo/en/global_services/nikkei-ftri/smacoms-unique-news-sentiment-score.html)

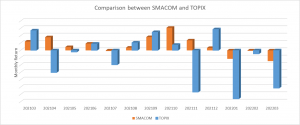

The graph 1 shows a monthly comparison of the returns obtained by following a trading strategy using SMACOM's News Sentiment Score with those resulting from continuously holding the TOPIX component stocks over the most recent one-year period. The approach that relies on the News Sentiment Score employs a long-short strategy, using a portfolio with a score of 80 points or higher designated "long," and a portfolio with a score of 20 points or lower designated "short," measured five days later.

TOPIX fell sharply in November 2021, when coronavirus cases resulting from the spread of the Omicron variant were first reported in South Africa. In contrast, the News Sentiment Score strategy, which works as described above, maintained a positive return, and the excess return versus TOPIX could be estimated at around 7%. In January 2022, Japanese stock market prices fell sharply due to the U.S. Federal Reserve's observed accelerated monetary tightening. Given such unfavorable conditions, we estimated that the excess return (vs. TOPIX) would be about 5%. After February 2022, when Russia's invasion of Ukraine began, we predicted that the News Sentiment Score strategy would deliver an excess return of over 4% (vs. TOPIX) as of March 9, 2022.

Even when an event affecting the entire market occurs, not all listed stock prices move in the same direction. We can achieve a positive return by shorting stocks that are expected to react negatively while simultaneously buying stocks that are predicted to experience positive price movements. In the event of bad news that affects the market as a whole, the outcome depends on how accurately one can identify positive stocks.

Stock selection using SMACOM is not only effective in achieving higher returns relative to TOPIX, but also in reducing risk. The graph 2 shows the standard deviation for returns and risks in the most recent one-year period based on back-test results. It indicates that a strategy using the SMACOM News Sentiment Score may be more effective at minimizing risk than one relying on TOPIX.

Nikkei FTRI is currently offering a free trial of SMACOM / the News Sentiment Score. If you are interested, please contact us by clicking below.

https://www.ftri.co.jp/eng/index.html#company

* The News Sentiment Score displayed via SMACOM is outputted based on QUICK news analysis, and its use on SMACOM is subject to approval by QUICK.

<Related Stories>

SMACOM's unique "Securities Report Sentiment Score"

SMACOM's unique "News Sentiment Score"

Providing services for the new SMACOM information distribution platform

Public Relations Office

Nikkei Inc.

pr@nex.nikkei.co.jp

Visit us on social media:

Facebook

Twitter

LinkedIn

Other

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.