Concierge Auctions Study Finds Ultra-Luxury Market is Thriving Nationwide for U.S. Top Properties in 2021

Concierge Auctions’ Sixth Annual “Luxury Homes Index” Shows Average Price of Top Luxury Home Sales in the U.S. Now Above $20 million

NEW YORK, NEW YORK, UNITED STATES, February 23, 2022 /EINPresswire.com/ -- Concierge Auctions today released its sixth annual "Luxury Homes Index." In this 2022 edition Concierge Auctions’ research shows that the luxury real estate market is setting a new and impressive pace for the sale of top-grossing properties. The findings analyze the 10 highest property sales in 56 top luxury markets across the United States to determine the performance and behavior of top properties and buyers in the U.S. ultra-luxury market. New to the Luxury Homes Index this year is the Top 100 List, an analysis of the top-grossing luxury home sales in the United States’ top luxury markets, which reveal the most popular destinations for luxury home sales in 2021. The results are in, the luxury market is hotter than ever.

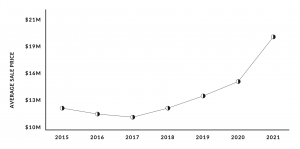

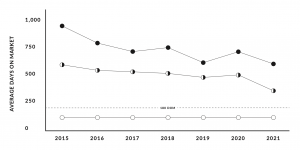

The country’s most luxurious real estate is selling at higher and higher ticket prices. The average achieved price of top sales increased 34% in 2021, from $15,145,856 in 2020 to $20,298,593 in 2021. In the U.S. market, that price does not deter buyers from signing on the dotted line—in fact homes sold faster in 2021 than during the home buying frenzy of 2020 spurred on by the onset of the pandemic. Average Days On Market for the 56 markets evaluated in 2021 was just 349 days, a 30% decrease from the 491 days in 2020. 2021 marks the first time in the Index’s history that luxury homes have averaged a sale timeline in under one year.

In this edition, Concierge Auctions’ research shows that the US real estate market remains strong and continues to heat up. Top sales in the hottest luxury markets across the US are achieving higher percentage of list prices on average. Over the past 5 years the top luxury sales in the 56 markets analyzed have grown 82.97% in average sale price, marking an exceptional national trend in luxury homes continuing to earn momentum in value. The average price of top luxury market sales increased over 34% in 2021 and showed a 65% increase over the past four years. Seller and buyer trends have shifted in the past year with properties moving fast, likely due to new location and property priorities inspired by COVID-19, with an analyzed overall 29.4% decrease in Days On Market.

With data compiled by Concierge Auctions’ Luxury Homes Index from 2015 to 2021 across 56 of the hottest luxury real estate markets, the company can now identify larger market trends. Concierge Auctions examined the 10 most expensive homes sold in each market to chart the overall health of the luxury tier. The research, drawn from MLS and public property record data, demonstrates that luxury buyers will spare no expense for their new home (or second or third home) and that competition in the luxury sector is driving faster sales.

“Overall, we are finding that the luxury home market is continuing on a historic upswing,” stated Concierge Auctions CEO, Laura Brady “2021 saw record-setting prices in luxury homes across the U.S., continuing the 2020 real estate boom for luxury homebuyers and sellers in 2021. Those sales are averaging record lows for Days On Market, and we anticipate a continued trend of higher prices and low Days on Market for 2022.”

Top 100

New this year — Concierge Auctions reported its Top 100 Sales in 56 of the hottest luxury markets in the U.S. South Florida and New York are by far the most popular and highest grossing markets in the United States by top sales price achieved and by most number of properties breaking into the country’s Top 100 Sales of 2021.

The top five grossing sales of 2021 were in Florida and New York and topped out at over $122 million:

$122,695,954 - 535 N County Rd, Palm Beach, FL 33480

$109,625,000 - 1840 S Ocean Blvd, Palm Beach, FL 33480

$105,000,000 - Julie Pond, Water Mill, NY at

$94,173,000 - 2000 S Ocean Blvd, Boca Raton, FL

$85,000,000 - 75 + 69 West End Road, East Hampton Village, NY

The markets with the most homes on the Top 100 list include:

Palm Beach, FL - 10 homes

New York City - 10 homes

The Hamptons, NY - 10 homes

Boca Raton, Delray Beach and Highland Beach - 10 homes

Miami, FL – eight homes

Days On Market

In 2020 the overall Days on Market average for all top properties was 491 days in 2020 versus only 349 days in 2021. This marks the first time in over five years that top priced homes in the U.S. are selling in under one year on average. Overall, the average days on market for top luxury properties across all markets have decreased showing an urgency in the buyer pool for high caliber properties.

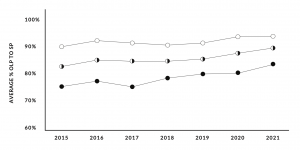

In 2021, properties that sold within 180 days achieved 93.47% of their Original List Price. By contrast, those that took longer than 180 days to sell achieved just 84.14%. Concierge Auctions’ platform provides a list-to-auction timeline of 30 to 60 days. This 9.32% difference in price achieved is a direct correlation with time spent on the market. That 9% is a substantial gain, or loss, when dealing with multi-million-dollar properties and does not include carrying costs, property taxes, or other expenditures of both time and money.

For properties listed for 180 days or more, average Days On Market fell from 696 days on average in 2020 to 614 days on market in 2021. For properties listed for less than 180 days, average Days on Market stayed steady from 80 average days on market in 2020 to 83 average days on market in 2021.

“Through this data, it’s clear there’s a significant increased urgency in today’s market,” stated Chad Roffers, President. “Whether due to individuals relocating due to the pandemic, purchasing their second, third or fourth home or for income potential, our auction model only fuels interest and attracts the ideal buyer. Auctions are unique in real estate because the format creates urgency for sale by nature — there is a specific timeframe provided in which a property will sell, and a playing field where each bid is just one step above the last we play into the healthy competition the market is already showing.”

The lowest Days On Market for an individual property among the country’s top grossing luxury real estate sales took place in Holmby/Bel Air, CA and Lake Tahoe, NV, both on the market for just six days. New Hampshire (104 days on market), Duval + St. Johns, FL (133 days on market) and Palo Alto, CA (143 days on market) came in at the lowest average days on market in 2021 per destination. The highest number of average Days on Market were in Dallas, TX (880 days on market), Vero Beach (779 days on market), FL and Westchester County, NY (687 days on market). Though these average days on market are an average increase for each location, the overarching trend across the U.S. is a decrease in average Days on Market overall.

The luxury market has made strides in 2021, closing the gap in average Days on Market between the luxury market and the general real estate market, though top luxury homes continue to take longer to sell.

The 10 markets with highest Days On Market (longest time to sell from most to least):

1. Dallas, TX

2. Vero Beach, FL

3. Park City, UT

4. Westchester County, NY

5. Miami, FL

6. Orange County, CA

7. Beverly Hills, CA

8. Fairfield County, CT

9. Nantucket, CT

10. Holmby Hills/Bel Air, CA

The 10 lowest Days On Market were in (fastest time to sell from least to most):

1. New Hampshire

2. Duval + St. Johns, FL

3 Palo Alto, CA

4 Brentwood, CA

5 Santa Barbara, CA

6 Pacific Palisades, CA

7 Lake Tahoe, CA

8 Philadelphia, PA

9 Morristown/Essex, NJ

10 Chicago, IL

Sale Price

The average price of top sales across all 56 luxury markets evaluated in 2020 was $15,145,856. In 2021 that average jumped over $5 million to $20,298,593. This is a 34% increase year over year and a 51% increase from the pre-pandemic luxury market top sales average of $13,364,312 in 2019. The luxury real estate market was hot in 2020 due to pandemic purchasing and location flexibility, but 2021 raised the bar and set a new record high for average sale prices in the luxury market.

Boca Raton, Aspen, and Lake Tahoe are new to the top sales price list this year, showing momentum for mountain market luxury home prices and a continuation of hot listings in South Florida.

Top Southern U.S. destinations continue to prove that their markets are even hotter than their climate. South Florida prices are trending up and properties are selling fast. Six of the top 10 highest priced residential property sales in the U.S. in 2021 took place in South Florida including the highest grossing property sale in Palm Beach at $122+ million.

All top 10 markets for highest sale price average grew exponentially in achieved sales price with the exception of New York City, which decreased a steep $15+ million from 2020 to 2021 at $49,917,000. In 2020, New York City’s average sales price was $65,561,281 which was already a slight increase from a $65,371,204 average in 2019. This may be in part due to the slowdown in luxury residential development caused by the onset of the pandemic in 2020 and may mark a relative scarcity in new luxury property in New York City in the year to come. However, 10 of the top 100 sales of 2021 were in New York City, making the city one of the top players in highest ranking national luxury sales of the past year. The ultra-wealthy have not been deterred from buying up the biggest real estate tickets in New York City, but the city’s highest ticket items are now competing with markets in South Florida and California for top luxury buyers. Data shows that the New York City market has remained among the most competitive markets in the U.S. with listings consistently selling at 75% of the list price or more.

The Southern U.S. has more than doubled its average sale price for top listings in the region (including Florida and Texas) coming in at an exponential 117.42% growth in average sale price from 2015 to 2021. The Western U.S. (including mountain markets like Seattle, Lake Tahoe, and hot markets across California) increased 79.14% in average sale price since 2015, showing a significant trend in the luxury market gaining momentum at top dollar price points. The Northeastern U.S. (including New York, Massachusetts and Connecticut) also increased in average sale price but at a lower rate of 42% growth since 2015. The lower growth rate of sale price in the Northeastern U.S. in comparison to Southern and Western markets showed there are new markets growing even faster in luxury price points than metro hotspots like the once unmatched New York and Boston.

“Many of us anticipated that 2021 would be a year of growth for luxury real estate,” says Chad Roffers, Chairman, Concierge Auctions. “COVID-19 has bolstered the luxury marketplace. There is a decidedly specific shift and a larger group of buyers attracted to warmer climates like South Florida and scenic mountain markets like Lake Tahoe. As catalysts for market movement in the luxury auction space, we’ve seen mountain markets gaining in popularity over the past few years and we watched as South Florida became a true tier one market for luxury living. Now more so than ever, sellers and buyers are getting closer to the same price point which is helping to generate top tier interest in the entire country’s luxury market. That also means the luxury market is getting more crowded and competition is driving the highest caliber of properties to historically high sales.”

The top 10 markets with the highest sales prices:

Palm Beach, FL

Hamptons, NY

Boca Raton, FL

New York, NY

Holmby/Bel Air, CA

Beverly Hills, CA

Miami, FL

Aspen, CO

Lake Tahoe (CA/NV)

Brentwood, CA

The 10 markets with the lowest sales prices:

Philadelphia, PA

Morristown + Essex, NJ

Boston, MA

Denver, CO

New Hampshire

Atlanta , GA

Westlake Village, CA

Chicago, IL

Houston, TX

Duval & St Johns Counties, FL

“From this data, we are confident that the US real estate market remains strong and will only continue to heat up. In 2021 alone, Concierge Auctions set world record-setting sales of over $3.4 billion in global bids,” stated Brady. “We have our eyes set on another flourishing year with continued expansion into the $10 million to $100 million plus market and activity spanning more than 30 countries. 2021 was truly a monumental year for luxury real estate and we are looking forward to another historic year ahead.”

To receive the complete Concierge Auctions "2021 Luxury Homes Index" call 212.984.3896 or visit LuxuryHomesIndex.com.

* Fewer than 10 sales were used for some markets because public data was incomplete. Total reflect 57 markets analyzed in 2018-2020; 40 in 2017; and 27 in 2015-2016.

About Concierge Auctions

About Concierge Auctions Concierge Auctions is the world’s largest luxury real estate auction marketplace, with a state-of-the-art digital marketing, property preview, and bidding platform. The firm matches sellers of one-of-a-kind homes with some of the most capable property connoisseurs on the planet. Sellers gain unmatched reach, speed, and certainty. Buyers receive curated opportunities. Agents earn their commission in 30 days. In November 2021, Concierge Auctions was acquired by Sotheby’s, the world’s premier destination for fine art and luxury goods, and Realogy Holdings Corp., the largest full-service residential real estate services company in the United States, holding a joint 80 percent ownership stake. Concierge Auctions continues to operate independently, partnering with real estate agents affiliated with many of the industry's leading brokerages to host luxury auctions for clients. Since Concierge Auctions’ inception in 2008, it has generated billions of dollars in sales, broken world records for the highest-priced homes ever sold at auction and conducted auctions in 46 U.S. states and 31 countries. The firm owns one of the most comprehensive and intelligent databases of high-net-worth real estate buyers and sellers in the industry, and it has committed to build more than 300 homes through its Key For Key® giving program in partnership with Giveback Homes™, which guarantees that for every property the company sells, a new home is funded for a family in need. For more information, visit ConciergeAuctions.com.

Emily Roberts

Concierge Auctions

+1 212-202-2940

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.