HULT Private Capital Sees a Return to Commercial Real Estate Investment

Commercial real estate markets record returns to pre-Covid highs throughout EMEA, the Americas and Asia Pacific regions

According to HULT's Mark Johnson, this push for new acquisitions has been a confluence of several factors. “First, half of the world's population has been vaccinated, a massive undertaking that is now starting to see results. The Delta variant infections are starting to be controlled, with infections beginning to subside in most industrialized countries. Barring any continuing supply chain issues, the global GDP is on track to return to pre-pandemic levels by the year's end. There is ample liquidity combined with low bond yields and increasing inflation, which is causing investors, who have become wealthy during the pandemic through equity markets, to redeploy their capital in commercial real estate in the third quarter. This increase is putting 2021 on a pace to reach a new volume record for annual investment.”

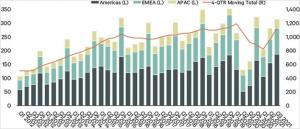

The global 95% investment volume increase puts Q3 at $315 billion in total. All three regions, the Americas, EMEA, and the Asia Pacific, have reported intense investment activity, all on par with their 2019 levels. Global volume on a year-over-year basis to date, has exceeded the 2020 volume by 44% and just exceeding 2019 volume by 3%.

According to HULT Private Capital, investor interest in multifamily projects in the US, Germany, and Sweden have significantly driven Q3 volume growth. In the UK and across most other regions, industrial and logistical property acquisitions remain popular. They have seen a slump in office and rental investment volumes that are still in a recovery phase, but the resilience in value of high-quality assets, as well as increasing bookings for viewings, give the suggestion of improving market conditions in that sector as well.

EMEA

According to HULT Private Capital, the economic reopening and reduction in Covid infections in the UK and the rest of Europe have restored investor confidence returning the UK and other EMEA countries to pre-pandemic trends. According to CBRE data, in the third quarter, year-over-year, the region's total volume grew by 56% in Q3 to $94 billion. Also, seeing year-to-date investment volume increasing 10% over the first three quarters of last year, and nearly par (-2%) with 2019 record volume.

The year-on-year volume race for Q3 was led by Sweden (186%), the Netherlands (126%), Germany (96%), and the UK (68%), primarily driven by the fast-growing multifamily sector. According to HULT Private Capital, there was intense movement in the UK's industrial sector that has attracted significant capital from foreign investors. The multifamily and industrial sectors' volume shares were 27% and 19%, respectively. Both were beneficiaries of a pandemic boost, with capital moving towards these two outperforming sectors. An increase in the supply of multifamily homes is expected to be seen in the UK and other markets, furthering investment growth across the region, following Germany, Sweden, and the Netherlands with an already increased multifamily supply. Due to e-commerce growth, the appetite of investors and user demand for industrial properties stayed strong through the pandemic.

An increase in Q3 hotel investment and very few destress sales implies that the worst is over for that sector.

Across The Pond

The Americas have seen investment volume show remarkable strength in Q3 of 2021. This has been led by the US's multifamily sector. There has been a surge of investment of 152% year-over-year for Q3 and 74% year to date. When excluding entity-level transactions, year-over-year, the investment volume grew by 141%. When compared to the pre-pandemic trend, the accelerated growth seen in the US Sun Belt, 18 southern states from Florida to California, offset a shortage of high-value office transactions in gateway markets this year. However, a comeback in trophy-level office sales, like the recent announcement of Google's planned Manhattan Purchase, is highly anticipated and critical for a full commercial real estate investment recovery.

The America's multifamily sector as a share of total volume, in Q3, rose to 39%, much above its 2015-2019 average of 28%. Phoenix, Atlanta, and Dallas led the Sun Belt markets, and all boomed in their population and employment growth leading to significant capital inflows over the past year.

In the meantime, after an exceptional performance of two years, the Americas industrial sector has shown an easing back, with its share of total volume dropping to 23%.

Asia Pacific

Investment volume grew in the Asia Pacific region year-on-year by 24% to $34 billion in Q3, with year-to-date volume at $102 billion, up 41% over the same time in 2020 and equal with 2019. The ongoing issues with supply chains and inflation in commodities have dampened the region's economic outlook and likely a similar effect on investment there.

Exceptions are Q3 growth in Hong Kong (354%), Australia (121%), and Japan's (89%) year-over-year increases. The $2.5 billion sale and leaseback of Dentsu's headquarters was a common trend of corporations moving owned real estate of their balance sheets. Additional major office markets such as Seoul, Melbourne, Shanghai, and Hong Kong performed well in Q3.

Asian hotel investment has still not picked up, waiting for further travel restrictions to be lifted. This, the retail and multifamily sectors have a potential upside for Q4 and 2022 as capital seeks counter-cyclical opportunities in a tight yield environment.

Total Global Outlook

Worldwide commercial real estate investment is set for a strong Q4, likely setting a new record for 2021. HULT Private Capital sees the momentum staying in multifamily and industrial investment, with retail and hotel investment expecting a rebound with increased international mobility. The hotly anticipated office recovery is already taking place in suburban markets, and urban markets are expected to follow in 2022. HULT Private Capital sees a 2021 annual global investment volume increase of approximately 28%, with more moderate growth of 8% in 2022.

For more information surrounding HULT’s services, visit www.hultprivatecapital.com or contact us on info@hultprivatecapital.com

The Press Team

HULT Private Capital

+44 2081235164

email us here

Visit us on social media:

Twitter

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.