Nikkei 225 Total Return hitting a record high

The Nikkei 225 Total Return Index, which focuses on stocks paying out dividends, has hit an all-time high. Awareness of shareholder returns is increasing.

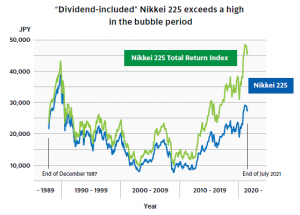

TOKYO, JAPAN, October 25, 2021 /EINPresswire.com/ -- Looking at the Nikkei 225, the difference between the price movements of the index of shares that do not offer dividends and the index of shares that pay out dividends becomes clear. The Nikkei 225 is at 70% of its highest price level ever, which was 38,915 yen at the end of 1989. However, the dividend-included index reached its highest price ever in February 2021, surpassing all previous highs during the 31 years since the end of the bubble period. In addition to the strong stock market, the compound interest effect of dividend reinvestment is having an impact.The total return index is also calculated for the world's major stock indexes, and institutional investors often compare investment results using the dividend-included index.

Since 2013, when Abenomics began, the performance of the Nikkei 225 Total Return Index has exceeded the Nikkei 225, and the divergence between the two measurements has widened. The background is that a growing number of companies are placing importance on dividends due to increasing awareness of shareholder returns.

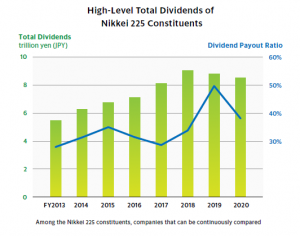

According to Nikkei NEEDS*, the dividend payout ratio of the Nikkei 225 constituents that can be continuously compared was 38% in FY2020, an increase of 10 points from FY2013. Over the same period, net profi¬t increased by only 15%, while total dividends increased by 55%.

For more details, please visit our guidebook(Download free).

URL:https://go.nkbb.jp/l/543892/2021-09-24/fylx94

*About Nikkei NEEDS

The Nikkei Economic Electronic Databank System (NEEDS) provides over 50 years of high quality corporate financial, equity, fixed income and macroeconomic data. The service is subscribed to by over 95% of Japanese financial Institutions, including all top ten securities companies and all six of the major banks in Japan – a true indication of the caliber of the services provided by NEEDS.

Public Relations Office

Nikkei Inc.

pr@nex.nikkei.co.jp

Visit us on social media:

Twitter

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.