Globalization Is A Key Factor For Asset Servicing Market Growth And Expansion

The Business Research Company’s Asset Servicing Global Market Report 2021 - COVID-19 Growth And Change

LONDON, GREATER LONDON, UK, October 11, 2021 /EINPresswire.com/ -- Globalization acts as a major driver for the growth of the asset servicing industry. According to a study on global asset servicing, nearly 60% of assets services in Assets Under Administration (AUA)/Assets Under Contract (AUC) predict that globalization is likely to be a strong driver for the asset servicing market’s growth over the coming years. The players dealing in assets servicing industry are majorly focusing on APAC markets and other growing economies. Moreover, according to the BNP Paribas Securities Services article published in January 2020, India was expected to experience impressive growth in assets management and servicing industry owing to the increasing working population, the rising buying power of the populace, and expected growth in the GDP of the country. Thus, globalization creates a large avenue for the expansion and growth of the asset servicing market over the coming years.

Major players covered in the asset global servicing industry are National Australia Bank Limited, CACEIS, BNY Mellon, HSBC, JP Morgan, Citi, The Bank of New York Mellon Corporation (BNY Mellon), State Street Corporation, UBS, Clearstream (Deutsche Börse Group), Northern Trust Corporation, BNP Paribas Securities Services, SimCrop A/S, Broadridge Financial Solutions, Inc., Pictet Group.

Read More On The Global Asset Servicing Market Report:

https://www.thebusinessresearchcompany.com/report/asset-servicing-market-global-report-2020-30-covid-19-growth-and-change

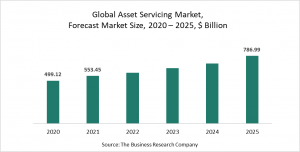

The global asset servicing market size is expected grow from $499.12 billion in 2020 to $553.45 billion in 2021 at a compound annual growth rate (CAGR) of 10.9%. The growth is mainly due to the companies resuming their operations and adapting to the new normal while recovering from the COVID-19 impact, which had earlier led to restrictive containment measures involving social distancing, remote working, and the closure of commercial activities that resulted in operational challenges. The market is expected to reach $786.99 billion in 2025 at a CAGR of 9%.

TBRC’s global asset servicing market report is segmented by service into fund services, custody and accounting, outsourcing services, securities lending, by end user into capital markets, wealth management firms, by enterprise size into large enterprises, medium and small enterprises.

Asset Servicing Global Market Report 2021 - By Service (Fund Services, Custody and Accounting, Outsourcing Services, Securities Lending), By End User (Capital Markets, Wealth Management Firms), By Enterprise Size (Large Enterprises, Medium and Small Enterprises), COVID-19 Growth And Change is one of a series of new reports from The Business Research Company that provides asset servicing market overview, forecast asset servicing market size and growth for the whole market, asset servicing market segments, and geographies, asset servicing market trends, asset servicing market drivers, restraints, leading competitors’ revenues, profiles, and market shares.

Request For A Sample Of The Global Asset Servicing Market Report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=3257&type=smp

Here Is A List Of Similar Reports By The Business Research Company:

Wealth Management Market - By Type Of Asset Class (Equity, Fixed Incomes, Alternative Assets And Others) Major Players, Market Size, Opportunities And Strategies – Global Forecast To 2030

https://www.thebusinessresearchcompany.com/report/wealth-management-market

Asset Management Market - By Type Of Asset Class (Equity, Fixed Income, Alternative Assets And Others), By Type Service Element (Asset Services, Custody Services), By Type Client (Mass Affluent, HNWI, Pension Funds, Insurance Companies, Sovereign Wealth Funds (SWF)), And By Region, Opportunities And Strategies – Global Forecast To 2030

https://www.thebusinessresearchcompany.com/report/asset-management-market

Custody Service Global Market Report 2021 - By Service (Core Custody Services, Ancillary Services, Core Depository Services, Other Administrative Services), By Type (Equity, Fixed Income, Alternative Assets), COVID-19 Growth And Change

https://www.thebusinessresearchcompany.com/report/custody-service-global-market-report

Interested to know more about The Business Research Company?

The Business Research Company is a market research and intelligence firm that excels in company, market, and consumer research. It has over 200 research professionals at its offices in India, the UK and the US, as well a network of trained researchers globally. It has specialist consultants in a wide range of industries including manufacturing, healthcare, financial services and technology.

Read more about us at https://www.thebusinessresearchcompany.com/about-the-business-research-company.aspx

Or get a quick glimpse of our services here: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Call us now for personal assistance with your purchase:

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

The Business Research Company

Email: info@tbrc.info

Follow us on LinkedIn: https://bit.ly/3b7850r

Follow us on Twitter: https://bit.ly/3b1rmjS

Check out our Blog: http://blog.tbrc.info/

Oliver Guirdham

The Business Research Company

+44 20 7193 0708

info@tbrc.info

Visit us on social media:

Facebook

Twitter

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.