Aada Holding Private Sale for AADA Token on Cardano Blockchain

Aada is the first pooled lending protocol on Cardano

LONDON, ENGLAND, June 15, 2021 /EINPresswire.com/ -- Aada Finance is launching a private sale. A public sale will follow. During the private sale, tokens will be sold at a reduced price. Aada is a decentralized finance lending protocol built on top of powerful and safe Cardano smart contracts using Haskell. Aada is the first Pooled Lending protocol on Cardano. The Cardano Defi ecosystem is expected to grow exponentially, while Aada and its lending protocol are expected to be at the center of Defi.Cardano continues to demonstrate substantial gains and rapid expansion within the Decentralized Finance (Defi) landscape. Its broad community of supporters is highly dedicated to Cardano's scientific, evidence-based approach to smart contracts. Cardano promises to redefine the future of Defi, ushering in a completely new approach to doing business.

"Cardano ERC20 converter will bring massive asset amounts into cheaper-to-transact Cardano blockchain. Converter will allow issuing organizations and their users to handle ERC20 token migration to Cardano," said a spokesperson for Aada. "Users can convert their Ethereum tokens in just a few clicks, and when moved across, these tokens will be 'translated' into a special native token on Cardano that has the same value and works just like an ERC20. Additionally, if the user wishes to do so later, they can move their tokens back to the source network by burning them on Cardano. Two-way convertibility is baked in."

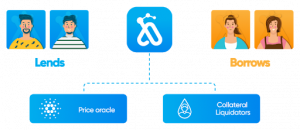

Aada is a decentralized non-custodial liquidity market protocol where users can act as depositors or borrowers. Depositors receive a passive income by providing liquidity to the market, while borrowers can borrow with over-collateralization (perpetually) or under collateralization (one-block liquidity). Cardano's Proof of Stake (PoS) speed and Plutus smart contracts will open wider acceptance and open more advanced features. In addition, the system introduces a trustless protocol that facilitates token swaps, non-fungible token (NFT) trading, and broader reorientation of the crypto world towards Cardano.

"Using pooled funding mechanisms, we can make lending easier and more available. The difference between Pooled and P2P lending is that lenders do pool their assets into one pool together where borrowers can easily borrow from the pool rather than searching for an individual lender," said a spokesperson for Aada. "Aada is expected to be the first of its kind Defi lending protocol once Cardano mainnet smart contract is possible. With extremely lower transaction fees, Aada expects early and active user adoption. Also, the Aada team will participate in Defi academy that will help to build a stronger and unified community."

Funds deposited into Aada are allocated to a smart contract. Funds can be withdrawn at any time. In addition, Aada is expected to generate tokenized lender positions, aka 'aaToken.' These can be moved to any wallet or smart contract on Cardano.

To use the Aada service, users deposit desired assets and amounts to use the service. Following the deposit, users will receive a passive income dependent on market borrowing demand. Depositing assets also allows users to borrow money by using the assets deposited as collateral. Any interest made on deposited money helps to offset the interest rate paid on borrowed money.

AADA is used as the Aada governance's center of gravity. AADA will be used to vote on the outcome of Aada improvements. AADA token can also be staked within the protocol to provide security/insurance to the protocol and depositors. Stakers will be rewarded with Aada collected fees and tokens from the incentives pool.

For more information about Aada, visit Aada.finance.

Token distribution:

Total supply minted: 100 000 000 AADA

Team tokens: 15%

AADA DeFi Academy: 5%

Staking and governance incentivization: 30%

Treasury/private sale: 20%

Public distribution: 30%

Media Relations

PR Services

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.