Are Japanese stocks overvalued or reasonable? Will the market surpass the bubble era in 2023? – QUICK Market Survey

When asked about the factors behind the Nikkei 255’s recovery to the 30,000 level, the most common response was "Continued monetary easing measures by the world's central banks" at 69%. Respondents choosing global factors such as significant fiscal spending and the start of vaccination stood out. While citing the recovery in corporate performance, the opinion was expressed that "It is indeed the external demand that is pushing up the corporate performance" (Investment Advisory).

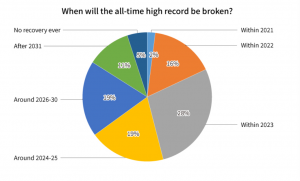

Views varied on when the market would break the record high value recorded during the bubble period (38,915 at the end of 1989). 28% of respondents expect this event to take place around 2023, whereas 19% expect the record to be broken around 2024-25 or 2026-30. Only 2% of respondents expected the market to reach its highest-ever level by the end of 2021. There is a strong sense of caution about a steady rise, with some saying, "Even if the market does reach a temporary high, sustainability will be an issue" (Securities firm). Meanwhile, others said, "If excess liquidity is recovered, the current stock market rally will not last long" (Bank).

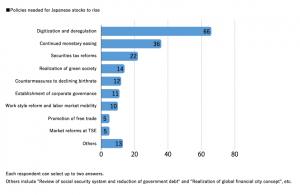

What policies are necessary for a sustained rise in Japanese stocks? "Promotion of digitization, and deregulation to improve productivity" was the most common response, followed by "Continued monetary easing." "Securities tax reforms to attract personal investments" received more support than "Realization of green society" and "Countermeasures to declining birthrate".

The average forecast for the Nikkei 225 at the end of March was 29,129. This is the eighth consecutive month of increases for the end-of-month forecast and the all-time high since the survey was first taken in April 1994. The survey targeted 214 participants, including investment managers at domestic institutional investors, and 124 responded. The survey was conducted during March 2 - 4, 2021.

QUICK Data Factory(QUICK Monthly Survey)

https://corporate.quick.co.jp/data-factory/en/product/data012/

Public Relations Office

Nikkei Inc.

pr@nex.nikkei.co.jp

Visit us on social media:

Twitter

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.