401GO and Rightfoot announce partnership to offer student loan repayment benefits integrated with 401k retirement plans

401GO, a retirement plan provider, partners with Rightfoot to make it easier for small businesses to offer student loan benefits with 401K retirement plans.

“401GO is thrilled to partner with Rightfoot and excited with the possibilities to offer a truly integrated benefit that helps employees make student loans repayments and get on track for retirement savings. We are especially keen to launch an offering in the spirit of the Abbott Labs determination that allows employers to provide a matching contribution to a 401(k) account for the employees making good on their student loan debt obligations.” states 401GO CEO, Jared Porter.

Danielle Pensack, co-founder and CEO of Rightfoot states, “This partnership is special as it represents the first ever solution for small businesses to take advantage of an integrated 401k and student debt benefit. While this type of offering is new, it has historically only been available to firms with over 10,000 employees. Together, our technology drives innovation in financial wellness for small employers.

The offering is expected to be available in late 2020 and anyone looking for more information is invited to contact 401GO for additional details.

About Rightfoot

Rightfoot pioneered and built the industry's first student debt repayment APIs. They are the pipes, or technology infrastructure, that streamline student debt repayment across a fragmented market of public and private loan servicers. Rightfoot’s RESTful APIs make it easy for any developer to add student debt repayment as a feature of their application. They facilitate both individual and tax-free employer contributions.

About 401GO

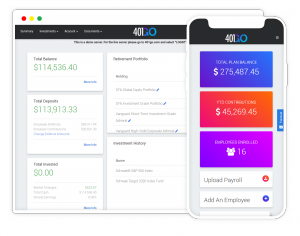

Founded in 2018, 401GO has the mission to make 401(k) plans accessible to all businesses. Whether it's a new startup 401(k) plan or an existing 401(k) plan, they make setup and administration easy and straightforward. To help ensure everyone is ready for retirement they have low costs and suitable 401(k) investments. No hidden costs, such as setup, document, or filing fees. Their pricing is a simple per participant fee of $9 per month—and that’s it.

401GO and Rightfoot are unaffiliated entities.

Daniel Beck

401GO, Inc.

+1 8012142125

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.