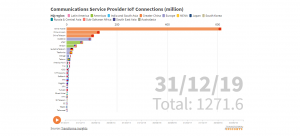

Global top tier of operators accounts for 1.27 billion cellular IoT connections, with China dominant

Technology analyst firm Transforma Insights unveils ranking of IoT connections for the top 33 carrier groups worldwide.

LONDON, UK, September 3, 2020 /EINPresswire.com/ -- The biggest 33 communications service provider groups worldwide accounted for 1.27 billion cellular IoT connections at the end of 2019, up from 948 million at the end of 2018, an increase of 34%, according to new research from Transforma Insights. The lion’s share of connections is accounted for by Chinese operators, which have 857 million connections, up from 605 at the end of 2018 (42% growth). The other 30 non-Chinese operators that are tracked collectively saw annual growth of 21%, from 343 million to 415 million.Notably, Transforma Insights has reviewed and revised down the numbers of connections for the Chinese operators compared to their published figures, which were collectively over 1.2 billion at the end of 2019. Commenting on the Transforma Insights approach, report author Matt Hatton said: “There’s little disputing the dominance of the Chinese operators, but the sheer scale of reported figures naturally set alarm bells ringing for our analysts. Based on some further digging we think the real figures for what we would define as IoT connections are about 30% lower than the official stated numbers for IoT connections.”

Another notable trend is the wide divergence in average-revenue-per-connection for the operators around the world. Based on limited available public data the highest was Telia with over USD4 per month. The Chinese operators reported only a small fraction of that. Based on China Mobile’s stated connections and revenue figures the average-revenue-per-connection was less than USD0.15 per month.

The findings of the research are published in the report ‘Top 33 operator groups account for 1.27 billion cellular IoT connections with Chinese operators dominant’ (link here) which was released today, including numbers of connections for 33 operator groups: America Movil, AT&T, Bharti Airtel, China Mobile, China Telecom, China Unicom, Deutsche Telekom, EE, Etisalat, KDDI, KPN, KT, LGU+, Megafon, MTN, MTS, NTT Docomo, Ooredoo, Orange, Rogers, SK Telecom, Softbank, Swisscom, Telefonica, Telekom Austria, Telenor, Telia, Telkomsel, Telstra, TIM, Turkcell, Verizon, Vodafone.

The research also forms part of the background for the soon-to-be-published ‘Communications Service Provider IoT Peer Benchmarking Report’ which provides detailed analysis of the strategies of ten major connectivity providers: Aeris Communications, AT&T, China Mobile, Deutsche Telekom, Kore Wireless, Orange, Telefonica, Telenor, Telia, Verizon, Vodafone. According to Hatton: “The analysis of numbers of connections and revenue for the wider group of 33 operators is interesting, but the critical thing for anyone procuring IoT connectivity is which is the right supplier for your needs either vertical, geographical or technical. The best way to determine that is to dig deep into the strategies and capabilities of the carriers, as we have done with a top tier of ten in our CSP IoT Peer Benchmarking Report, which will be published shortly.”

About Transforma Insights

Transforma Insights is a leading research firm focused on the world of Digital Transformation (DX). Led by seasoned technology industry analysts we provide advice, recommendations and decision support tools for organisations seeking to understand how new technologies will change the markets in which they operate.

For more information about Transforma Insights, please see our website transformainsights.com or contact us at enquiries@transformainsights.com. Follow us on Twitter: @transformatweet.

Matt Hatton

Transforma Insights

+44 7787 577886

email us here

Visit us on social media:

Twitter

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.