Rising Stock Markets in November Spur Renewed Confidence Among Wealthy Investors

Spectrem Group Indices Rise Despite Continued Concerns over Impeachment Proceedings and the Lack of a Trade Agreement with China

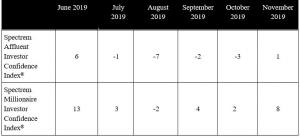

CHICAGO , IL, USA, December 2, 2019 /EINPresswire.com/ -- With all three major stock market indices reaching record highs in November, wealthy investors moved assets back into stocks, ignoring the ongoing barrage of political and geopolitical risks facing the U.S., according to the December edition of Spectrem’s High Net Worth Insights Journal.The monthly Spectrem Millionaire Investor Confidence Index (SMICI®), which tracks changes in investment sentiment among households with $1 MM or more in investable assets, was up by 6 points from 2 to 8 in November, the highest one-month improvement since May-June of 2019, when the SMICI climbed to 13. The Spectrem Affluent Investor Confidence Index (SAICI®), which measures investment sentiment among the 17 MM households in America with more than $500,000 in investable assets, also moved up 4 points to positive territory at 1, the first time since June the SAICI has reported a positive number.

Those index levels are not surprising considering the way the stock market performed through November. The Dow Jones Industrial Average climbed over 28,000 and the S&P 500 and NASDAQ regularly reported new closing highs during the month. The Spectrem Confidence Indices survey was conducted Nov. 20-25, 2019, at the height of stock market performance. Investor confidence and stock market numbers rose despite televised impeachment proceedings against President Donald Trump and little progress in trade negotiations with China.

The Spectrem Confidence indices are segmented by wealth, gender, political leanings and working status, and it was Millionaires, female and Democratic investors who reported the greatest increase in investing confidence in November.

Among Millionaire investors, individual stock investing interest increased from 29.1 percent to 34.4 percent. However, stock mutual fund investing fell among Millionaires, from 38.6 percent to 35.9 percent, and investing interest in bond and bond mutual funds also fell among Millionaires. Among Non-Millionaires, there was decreased investing interest in all products other than bond mutual funds.

Investors not investing, those investors who state intentions to maintain current investment levels and not increase investments, rose among Millionaires to 34.4 percent from 30.7 percent, and among non-Millionaires, those not investing rose from 46.3 percent to 50.8 percent. Considering the state of the stock market in November, those are noteworthy percentages, perhaps indicating yet again that investors are not convinced the bull market will continue.

Spectrem’s Household Outlook, which measures investor sentiment based on four key household financial components, improved for a third straight month to 22.30, well above the 8.0 mark it registered back in August. Most notable among the four components was the improved Outlook for the economy, which rose overall from -14.80 to 1.60, reaching positive territory among all investors for the first time since July. Although the Outlook for the economy among Millionaires improved by 7 points in November, it remains in negative territory for the wealthier investors for the fourth consecutive month.

“It was hard to ignore the strong performance of the stock markets in November,’’ said Spectrem President George H. Walper Jr. “Wealthy investors, when faced with clear evidence that the bull market has a way to run, began rotating back into stocks during the month. However, the Spectrem data appears to signal underlying investor concerns about the potential for a recession, the psychological impact of Trump’s impeachment proceedings and the inability to bring an extended trade impasse with China to a close.”

Charts, including a deeper analysis of the index and its methodology, are available upon request. Additional insights include:

• Bullish Stock Market

About Spectrem Group: Spectrem Group (www.spectrem.com) strategically analyzes its ongoing primary research with investors to assist financial providers and advisors in understanding the Voice of the Investor.

# # #

George H. Walper, Jr.

Spectrem Group

(224) 544-5350

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.