The Inversion of the Yield Curve and Stalled China Talks Turn U.S. Investors Pessimistic

Confidence Wanes as Fears of a Possible Recession Grow with Rising Bond Market Volatility

CHICAGO, IL, USA, September 3, 2019 /EINPresswire.com/ -- As yields on 10-year Treasury notes fell below two-year notes multiple times in August, U.S. investors began pulling back from stocks over concerns of a possible recession, according to new research in Spectrem Group’s September edition of its High Net Worth Insights Journal.On Aug. 14, the Dow Jones Industrial Average lost almost exactly 800 points in one day’s time after yields on short-term (2-year) Treasury notes exceeded those of 10-year notes for the third time in one week. Such an inverted yield curve has been a harbinger of most economic recessions in America for the last century, and also occurred earlier in the summer of 2019. The frequency of the inversions seemed to be enough to make investors express concern over the health of the economy, and they did so in the Spectrem Investor Confidence Indices survey.

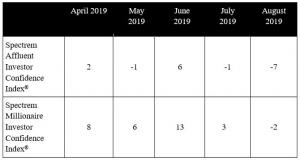

The monthly Spectrem Millionaire Investor Confidence Index (SMICI®), which tracks changes in investment sentiment among households with $1 MM or more in investable assets, fell five points to -2 in August, its first fall into negative territory since January of 2016. The Spectrem Affluent Investor Confidence Index (SAICI®), which measures investment sentiment among the 17 MM households in America with more than $500,000 in investable assets, fell from -1 to -7, reaching its lowest mark since August of 2013.

The August survey was fielded Aug. 16-21, 2019, as the stock market attempted to climb out of the mid-summer hole it found itself in.

Falling Treasury note yields combined with an escalating trade conflict with China have sowed an atmosphere of confusion and uncertainty among American investors. Still, the Spectrem Confidence Indices showed that investors want to invest and are shifting toward more conservative products that can maintain value over time.

Interest among all investors in individual stocks fell in August, while investing interest in stock mutual funds, individual bonds, bond mutual funds and cash all rose. Intentions among Millionaires to invest in bond mutual funds rose almost 6 percent to 16.8 percent, while interest in individual bonds among Millionaires rose 3.5 percent to 10.2. Interest in individual stock investing fell to 30.7 percent among Millionaires and 17.7 percent among non-Millionaires, which indicate only slight decreases.

Despite lower confidence, more investors expressed plans to add to their allocations. Only 29.2 percent of Millionaires said they were not investing further in the coming month, a decrease of more than 5 percent of non-participation from the previous month.

While the confidence indices fell to their lowest numbers in recent history, Spectrem’s Household Outlook was even more depressed in August. The Outlook, which measures investor sentiment based on four key household financial components, fell among all investors from 24.70 to 8.00, the largest single-month drop in five years. The Millionaire Outlook was halved, from 25.39 to 12.04, and the non-Millionaire Outlook fell to 3.10, its lowest level since January of 2016.

“When the yield curve for Treasury notes first inverted earlier this summer, reaction among investors was muted, and the stock market went on to reach record highs,’’ said Spectrem President George H. Walper, Jr. “But the frequency of the inversions in early August, combined with the stalled trade negotiations with China and growing prospects for a no-deal Brexit have created an atmosphere of heightened apprehension among American investors.”

Charts, including a deeper analysis of the index and its methodology, are available upon request. Additional insights include:

• Recession Fears Disrupt Index

• Spectrem Investor Confidence Index September 2019

Index range: -31 to -51, Bearish; -11 to -30, Mildly Bearish; 10 to -10, Neutral; 11 to 30, Mildly Bullish; 31 to 51, Bullish.

About Spectrem Group: Spectrem Group (www.spectrem.com) strategically analyzes its ongoing primary research with investors to assist financial providers and advisors in understanding the Voice of the Investor.

# # #

George H. Walper, Jr.

Spectrem Group

(224) 544-5350

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.