As Market Indices Reach Record Levels, Investors Appear to be Taking a More Cautionary Stance on Stocks

Unresolved Global Geopolitical and Trade Issues Continue to Weigh on the Mind of Investors

CHICAGO, IL, USA, August 1, 2019 /EINPresswire.com/ -- Investors appear to be pulling back their exposure to equities following another frothy month in U.S. financial markets in which all three leading market indices reached record highs, according to new research in Spectrem Group’s August edition of its High Net Worth Insights Journal,With the Dow, NASDAQ, and S&P 500 indices standing at all-time highs, investors appear to be reallocating capital in anticipation of a market correction. An anticipated quarter point reduction in interest rates – while it may boost stock prices further – has not shifted a more bearish sentiment emerging among investors, who say they plan to hold on to their wallets and avoid expensive new investments at market peaks.

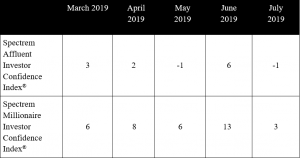

The Spectrem Millionaire Investor Confidence Index (SMICI®), which gained 7 points in June, dropped 10 points in July to 3, its lowest mark since January. The Spectrem Affluent Investor Confidence Index (SAICI®) dropped 7 points to -1 in July, eliminating the 7-point gain reported in June.

The monthly Spectrem Investor Confidence indices track changes in investment sentiment among the 17 MM households in America with more than $500,000 of investable assets (SAICI), and those with $1 MM or more (SMICI). June’s survey was fielded on July 15-22, 2019.

Stock market conditions and global trade relations remained relatively unchanged between June and July. Negotiations with China are continuing without visible progress and tensions between the United States, North Korea and Iran remain high.

Interest in individual stock investing among all investors surveyed dropped to 25.6 percent in July after climbing above 30 percent for the first time in 2019 the previous month. The Millionaire investors, who are more likely to invest in individual stocks, dropped their interest down to 31.2 percent, a 6 percent decrease from June, while interest among non-Millionaires fell below 20 percent to 19.7 percent.

Interest in stock mutual fund, individual bond, and bond mutual fund investing also fell among all investors, on average, but investing in cash products rose among Millionaires to 31.3 percent from 22.1 percent the previous month. That is the highest level of cash investing interest among Millionaires since August of 2012, almost seven years ago.

Those not investing, which is the percentage of investors who are not going to add to their allocations in the coming month, remained the same overall but rose among Millionaires, and working investors, notably. More than one-third of Millionaires (34.4 percent) declared no intention to add to allocations in the coming month.

Spectrem’s Household Outlook, which measures investor sentiment based on four key household financial components, dropped minimally from June to 24.70. But the Outlook for the economy, which is the most volatile of the four components that make up the Outlook, dropped to 1.20 and ran into negative territory among male investors, whose Outlook for the economy dipped 18 points to -1.32.

“While stock indices have reached their highest levels ever, the housing market is stagnant, the global trade situation has not improved and the American political scene remains turbulent,’’ said Spectrem President George H. Walper, Jr. “Sophisticated investors appear ready to take some cash off the table and hold their collective breath to see if there is a troubling shoe on the horizon waiting to drop.”

Charts, including a deeper analysis of the index and its methodology, are available upon request. Additional insights include:

• Spectrem Investor Confidence Index August 2019

• Too Good to Be True

About Spectrem Group: Spectrem Group (www.spectrem.com) strategically analyzes its ongoing primary research with investors to assist financial providers and advisors in understanding the Voice of the Investor.

George H. Walper, Jr.

Spectrem Group

(224) 544-5350

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.