Spectrem Investor Confidence Indices Increase Sharply in June Amid Rising Markets and Trade Negotiations with China

Interest in Individual Stock Investing Returns

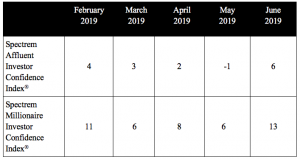

CHICAGO, IL, USA, July 1, 2019 /EINPresswire.com/ -- With stock markets surging and one reaching a record high, wealthy U.S. investors reported a return of confidence in June, according to Spectrem Group’s High Net Worth Insights Journal. A mere hint by the Federal Reserve of a possible interest rate cut later this year, and rising hopes for progress in the next round of trade negotiations between the United States and China helped fuel the rebound in confidence.The Spectrem Millionaire Investor Confidence Index (SMICI®) climbed 7 points from 6 to 13, its highest mark since August, and the Spectrem Affluent Investor Confidence Index (SAICI®) had an identical 7-point increase from -1 to 6, reaching its highest level since September.

The monthly Spectrem Investor Confidence indices track changes in investment sentiment among the 17 MM households in America with more than $500,000 of investable assets (SAICI), and those with $1 MM or more (SMICI). June’s survey was fielded June 13-20, 2019.

Interest in stock investing across all investors surveyed rose to 31.2 percent in June, its first time above 30 in 2019. Among Millionaires, that percentage reached 37.8 percent, 4 percent higher than in May. Among non-Millionaires, interest in individual stock investing jumped more than 8 percentage points to 24.4 percent.

Throughout much of the spring, Millionaire investors were focused on more conservative investment vehicles such as individual bonds, bond mutual funds and cash products. During June, interest in those more conservative investments declined among both Millionaires and non-Millionaires.

Those not investing, which is the percentage of investors who are not going to add to their allocations in the coming month, actually rose among Millionaires by approximately 5 percent to 33.1 percent while it fell among non-Millionaires by a corresponding 5 percent margin to 48.8 percent.

Spectrem’s Household Outlook, which measures investor sentiment based on four key household financial components, improved slightly from May to 25.20. Sentiment rose for three of the four components measured, but the Outlook for the economy bounced between an improved Outlook among Millionaires and a similar drop in Outlook among non-Millionaires.

“Rising stock prices in June, including an all-time high for the S&P 500 Index, indicate that investors continue to see positives ahead for the U.S. economy,’’ said Spectrem President George H. Walper, Jr. “Although recent economic growth has slowed from the first quarter, there are no near-term indicators on the horizon that might indicate a fallback in the market. The outcome of negotiations with China at the upcoming G-20 summit will likely play a significant role in investor sentiment for the next few months”.

Charts, including a deeper analysis of the index and its methodology, are available upon request. Additional insights include:

• Investors Believe All Over Again

• July 2019 Index Webinar

About Spectrem Group: Spectrem Group (www.spectrem.com) strategically analyzes its ongoing primary research with investors to assist financial providers and advisors in understanding the Voice of the Investor.

# # #

George H. Walper, Jr.

Spectrem Group

+1 (224) 544-5350

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.