Spectrem Investor Confidence Indices Record Little Movement in April Despite Stock Markets Rising to Record Levels

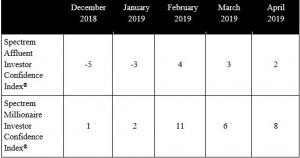

Index range: -31 to -51, Bearish; -11 to -30, Mildly Bearish; 10 to -10, Neutral; 11 to 30, Mildly Bullish; 31 to 51, Bullish.

Investors Pull Back from Both Stocks and Bonds

CHICAGO, IL, USA, May 1, 2019 /EINPresswire.com/ -- While the NASDAQ and S&P 500 indices climbed to record levels in April, retail investors remained on the sidelines, according to Spectrem Group’s High Net Worth Insights Newsletter. Many investors indicated they had no plans to add to their investments in the near term. The Spectrem Millionaire Investor Confidence Index (SMICI®) edged up 2 points in April to 8, and the Spectrem Affluent Investor Confidence Index (SAICI®) dropped one point to 2, but neither group of investors expressed an active interest in increasing their investment allocations.The monthly Spectrem Investor Confidence indices track changes in investment sentiment among the 17 MM households in America with more than $500,000 of investable assets (SAICI), and those with $1 MM or more (SMICI). April’s survey was fielded April 17-23, as the stock market indices were reaching record levels and potential negative investor sentiment from the release of the Mueller report had waned.

Millionaire investors reported decreased interest in all investment products, except individual stocks, which saw a rise to 36.4 percent of investors. Investing in stock mutual funds fell by more than 14 percent to 27.9 percent of Millionaires, while investing in individual bonds fell from 11.1 percent to 3.9 percent, a decrease of nearly two-thirds of investors.

Results were similar among non-Millionaires, who expressed declining interest in all investment products, except bond mutual funds, which grew by one percent to 9.9 percent. In a rare occurrence, non-Millionaires indicated greater interest in investing in bonds, both individual and in mutual funds, than Millionaires.

Investors with no plans to add to their investments in the coming month rose to 34.9 percent among Millionaires and reached above 50 percent of non-Millionaires to 50.4 percent.

Spectrem’s Household Outlook, which measures investor sentiment based on four key household financial components, was flat across all four metrics. The overall Outlook dropped less than half a point to 21.20, and none of the components saw a rise or fall of more than one point from the Outlook in March, indicating uncertainty among investors as to whether the current state of the economy is beneficial to them.

“Economists often caution that the stock market is not a reflection of the economy, and investors appear to agree,’’ said Spectrem President George H. Walper, Jr. “In the face of decidedly mixed signals on the direction of the U.S. economy, investors appear to be concerned about ongoing political and economic risks and what they might mean for their portfolios. The end result is a continued “wait and see’’ attitude among retail investors.”

Charts, including a deeper analysis of the index and its methodology, are available upon request. Additional insights include:

• It’s Not Just the Economy

• May 2019 Index Webinar

About Spectrem Group: Spectrem Group (www.spectrem.com) strategically analyzes its ongoing primary research with investors to assist financial providers and advisors in understanding the Voice of the Investor.

###

George H. Walper, Jr.

Spectrem Group

(224) 544-5350

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.