Research: Faster capital deployment linked to lower returns

New research from eFront shows an inverse correlation between the pace of capital deployment and fund performance

PARIS, FRANCE, December 19, 2018 /EINPresswire.com/ -- Limited partners in private equity funds should be wary of putting managers under pressure to deploy capital – that is the conclusion of new research published today by eFront, the world’s leading alternative investment management software and solutions provider.eFront’s research shows that there is an inverse correlation between the level of capital deployed during the first year of a fund’s investment period, and its eventual performance.

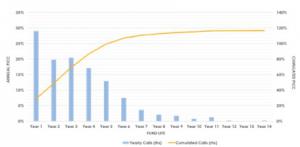

Looking at US LBO funds of vintage years 2000 to 2010, on average, funds deploy more capital in the first year (29%) than during each of the following ones. Years 2 and 3 are roughly at par (20%) and the amounts decline consistently thereafter (Figure 1). At first glance, the recent increase in pressure from fund investors to deploy capital would not imply a radical change of behaviour from fund managers.

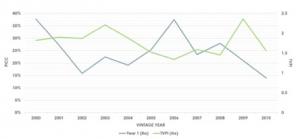

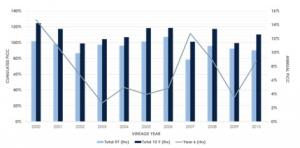

However, a deeper look shows that the amount deployed in Year 1 fluctuates, from 14% (vintage year 2010) to 38% (2000). Surprisingly, the capital deployment in Year 1 does not seem to be connected with macroeconomic conditions: the coefficient of correlation with US GDP growth is only 0.19. However, there is an inverse correlation, of -0.32, between the amount of capital deployed in Year 1 and the overall performance of funds (Figure 2). This correlation increases as funds mature, with older funds (2000-07) showing a stronger inverse correlation of -0.46.

This analysis raises some important conclusions on drawdowns, demonstrating that under pressure from investors, fund managers might have less freedom to select the best opportunities over time. Even though fund managers usually have a pipeline of potential investment opportunities when they raise new funds, there is no certainty about when these opportunities will materialise. Putting pressure on fund managers to deploy capital could thus lead them to execute investments they would have normally decided to pass on.

Interestingly, Figure 1 shows that a significant amount of capital is called after the usual end of the investment period of LBO funds. In Year 6, 7% of the committed capital is called on average. The most obvious reason associated with an extension of an investment period is that fund managers struggled to deploy capital during the usual five years.

Surprisingly, funds of 2000, 2001 and 2010, which deployed respectively 102%, 98%, and 90% after five years still called 15%, 11% and 9% of the committed capital in Year 6. In theory, at this point, the remaining capital to be drawn to pay the management fees during the divestment years would be insufficient. The logical conclusion is that fund managers decided to use the provision of their fund regulations, allowing them to recycle early distributions operated during the investment period to effectively invest up to 100% of the committed capital. This is clearly the case for 2000, 2001, 2008 and 2010.

Another explanation is that some fund managers might execute buy-and-build strategies. Fund regulations in effect prevent new investments after the investment period, but usually, allow reinvestments in existing portfolio companies, including to support acquisitions.

Tarek Chouman, CEO of eFront, commented:

“This analysis debunks some common assumptions about drawdowns. One of them is that fund investors have put an increased pressure on fund managers to deploy more capital faster. Given the fact that most of the fund regulations cap the capital deployed in any given year at 25-30% of the committed capital, it is difficult to see how much further fund managers can go in that respect. What is also clear from the analysis is that having the freedom to deploy or not is an important tool to invest for fund managers.”

Sam Barton

Hydra Strategy

+44 7380 961549

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.