India’s Market For Nitrogen Is The World’s Fastest-Growing Major Industrial Gas Segment

LONDON, GREATER LONDON, UK, November 22, 2018 /EINPresswire.com/ -- India’s market for nitrogen is growing at 11.2% a year, having recently accelerated from 7.5%, Industrial Gas Global Market Opportunities And Strategies To 2021, a report from The Business Research Company. That places it ahead of the world’s second-fastest growing, Russia’s market, also for nitrogen, which was achieving 12.2% but has now slowed to 10.4%. China’s market for nitrogen is growing at a relatively leisurely 7.3% a year. In comparison with both China and the global average, in fact, all four of India’s major industrial gas segments – hydrogen, oxygen and carbon dioxide as well as nitrogen – are ahead in terms of annual growth.

The report Industrial Gas Global Market Opportunities And Strategies To 2021 also shows that the global industrial gas market grew from $66.08 billion in 2013 to $73.52 billion in 2017 at a compound annual growth rate of 2.7%, held back by negative growth for most gases in the huge North American market. Demand for industrial gases in the emerging economies generally is increasing rapidly mainly due to rising manufacturing activity. For instance, oxygen and nitrogen, produced by the industrial gas industry to meet the demand from the iron and steel smelting industries of China and India, have helped drive the Asia Pacific market for these gases at over 6% a year for oxygen and nearly 7% for nitrogen, well ahead of the global average.

By end user segments, India’s and China’s markets for industrial gases are distributed similarly, though China’s are much larger. Manufacturing, metallurgy and chemicals together absorb around 70% of industrial gases in both countries, in contrast to developed countries. Even in those like Germany, which still has a large manufacturing base, under 60% of all industrial gas sales are to heavy industry. Perhaps the most conspicuous contrast between the developed and developing economies, however, reflected in the chart, is in the proportion of industrial gas sales which go to healthcare – 5% and 4% in India and China, 15% and 20% in Germany and the UK.

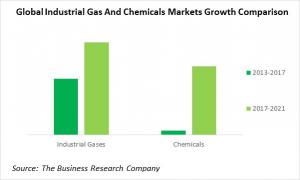

Industrial gases are themselves a segment of the larger chemicals market. The gas segment has been growing much faster than the wider market, a trend that is expected to continue despite acceleration of the chemicals market growth.

Industrial Gas Global Market Opportunities And Strategies To 2021 from The Business Research Company is one of a new series of industry report. It provides an industrial gases industry analysis, an industrial gases market overview, analysis and forecasts of industrial gas market size and industry statistics, industrial gas market growth rates, market trends, market drivers, market restraints, market revenues, industrial gas market share and company profile of the leading competitors. In over 300 industry reports, covering over 2400 market segments and 56 geographies, the market reports draw on 150,000 datasets. Extensive secondary research is augmented with exclusive insights and quotations from industry leaders obtained through interviews. Market analysis and forecasts are provided by a highly experienced and expert team of analysts and modelers. A range of strategies for the industrial gas market are explained and opportunities identified.

Where To Learn More

Read the Industrial Gas Global Market Opportunities And Strategies To 2021 from The Business Research Company for information on the following:

Markets Covered: Industrial gas market, nitrogen, hydrogen, oxygen, carbon dioxide, other industrial gases markets, chemicals market

Industrial Gas Companies Covered: L'Air Liquide S.A, The Linde Group, Praxair Inc., Air Products and Chemicals Inc., Taiyo Nippon Sanso Corporation

Regions: North America, Asia Pacific, Western Europe, South America, Eastern Europe, Middle East, Africa.

Countries: USA, China, Japan, Germany, Brazil, France, Italy, UK, Australia, India, Spain, Russia.

Time Series: Five years historic (2013-17) and forecast (2017-21).

Data: Industrial gas market size and growth for 7 regions and 12 countries; global regional and country industrial gases market size and growth segmented by type of gas – nitrogen, hydrogen, oxygen, carbon dioxide, other industrial gases; global, regional and country industrial gases market size and growth segmented by end user industry – manufacturing, metallurgy, chemicals, healthcare, food and beverages, other end users; global, regional and country industrial gases per capita consumption and market size as a percentage of GDP 2013-21; L'Air Liquide S.A, The Linde Group, Praxair Inc., Air Products and Chemicals Inc., Taiyo Nippon Sanso Corporation financial performance 2013-21; global chemicals market size and growth rate 2013-17 and 2017-21.

Other Information: PESTEL analysis, drivers and restraints, customer and operational insights, industrial gas market by country covering opportunities, industrial gas associations, investment and expansion plans, corporate tax structure and competitive landscape; Industrial gas market trends and strategies.

Opportunities In The Industrial Gas Market: The report reveals the global and regional segments where the industrial gases market will put on most $ sales up to 2022.

Strategies For Participants In The Industrial Gases Industry: The report explains over 15 strategies for industrial gases companies, based on industry trends and company analysis. These include investing in carbon capture and storage (CCS) technologies to produce environmentally sustainable carbon dioxide and Praxair’s strategy of acquiring companies in similar industries..

Sourcing and Referencing: Data and analysis throughout the report are sourced using end notes. Sources include primary as well as extensive secondary research.

Oliver Guirdham

The Business Research Company

+44 20 7193 0708

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.