Spectrem Group’s Investor Confidence Indices Fall to Lowest Point in Past Year

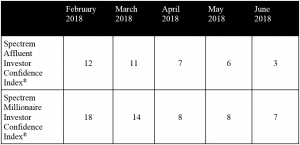

Index range: -31 to -51, Bearish; -11 to -30, Mildly Bearish; 10 to -10, Neutral; 11 to 30, Mildly Bullish; 31 to 51, Bullish

Investors Rattled by Ongoing Trade Battles

CHICAGO, USA, July 2, 2018 /EINPresswire.com/ -- Growing concerns about the threat of a full-blown trade war took their toll on U.S. investor sentiment in June, according to Spectrem Group’s High Net Worth Insights newsletter. This caution is reflected in the Spectrem Affluent Investor Confidence Index (SAICI®) and the Spectrem Millionaire Investor Confidence Index (SMICI®), both of which reached their lowest point in one year in June, now standing at 3 and 7, respectively.The monthly Spectrem Investor Confidence indices track changes in investment sentiment among the 17 MM households in America with more than $500,000 of investable assets (SAICI), and those with $1 MM or more (SMICI). This month’s survey was fielded between June 15-20, 2018, as the European Union and China announced retaliatory tariffs in response to those imposed by President Donald Trump.

The indices reveal the general direction of investor confidence, but more specifically indicate how investors are reacting to ongoing political uncertainty. Stock investing was down among both Millionaires and non-Millionaires, decreasing nearly 4 percentage points among Millionaires to 30.2 percent. Investors also expressed greater interest in safer investments such as stock mutual funds and bond mutual funds, while Millionaires significantly increased their cash position to 24.5 percent, an increase of more than 4 percent from May.

Non-Millionaires expressed growing concerns about investing, with nearly half (47.8 percent) indicating they did not plan to increase their investment in the coming month, the highest level since July 2017.

While the Spectrem indices reveal a general lack of enthusiasm among investors, the Spectrem Household Outlook showed how differently Millionaires and non-Millionaires perceive current events. The Spectrem Household Outlook is a monthly measure of long-term confidence among investors across four financial factors impacting households. During June, the overall Outlook fell, but only because of poor sentiment among non-Millionaires, especially concerning the economy. Following a large favorable jump in May to 24.10, the economy was rated at -0.90 among non-Millionaires in June. Millionaires, on the other hand, improved their outlook by more than five points in June to 30.04, the highest level since March.

“Investors carefully watch government decisions, and recent actions have caused them to wonder where the U.S. is headed,” said Spectrem President George H. Walper, Jr. “While the stock market regularly seems to recover by the end of the day’s trading, midday numbers have frequently been down by hundreds of points. Each day presents new uncertainties about the direction of American trade with foreign nations. Until markets have greater clarity on the issue of trade barriers, investors will respond to that uncertainty by pulling back.”

Charts, including a deeper analysis of the Index and its methodology, are available upon request. Additional insights include:

• Uncertainty, Confusion Keep Index Down

About Spectrem Group: Spectrem Group (www.spectrem.com) strategically analyzes its ongoing primary research with investors to assist financial providers and advisors in understanding the Voice of the Investor.

# # #

George H. Walper, Jr.

Spectrem Group

(224) 544-5350

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.